Rajeev Jain, Managing Director, Bajaj Finance Limited (BFL)

Bajaj Finance Reports:

– Consolidated profit after tax of ₹ 3,158 crore in Q4 FY23 and ₹ 11,508 crore in FY23

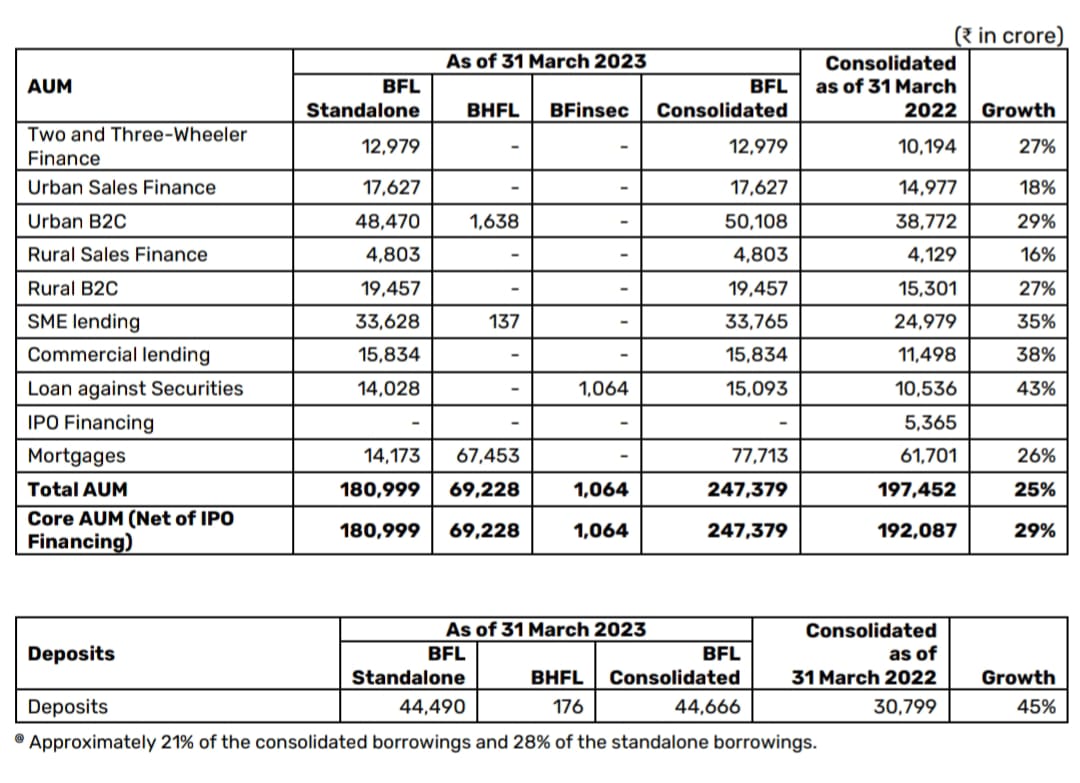

– Consolidated assets under management of ₹ 247,379 crore as of 31March 2023

– Highest ever new loans booked of 29.58 million in FY23

– Highest ever increase in customer franchise of 11.57 million in FY23

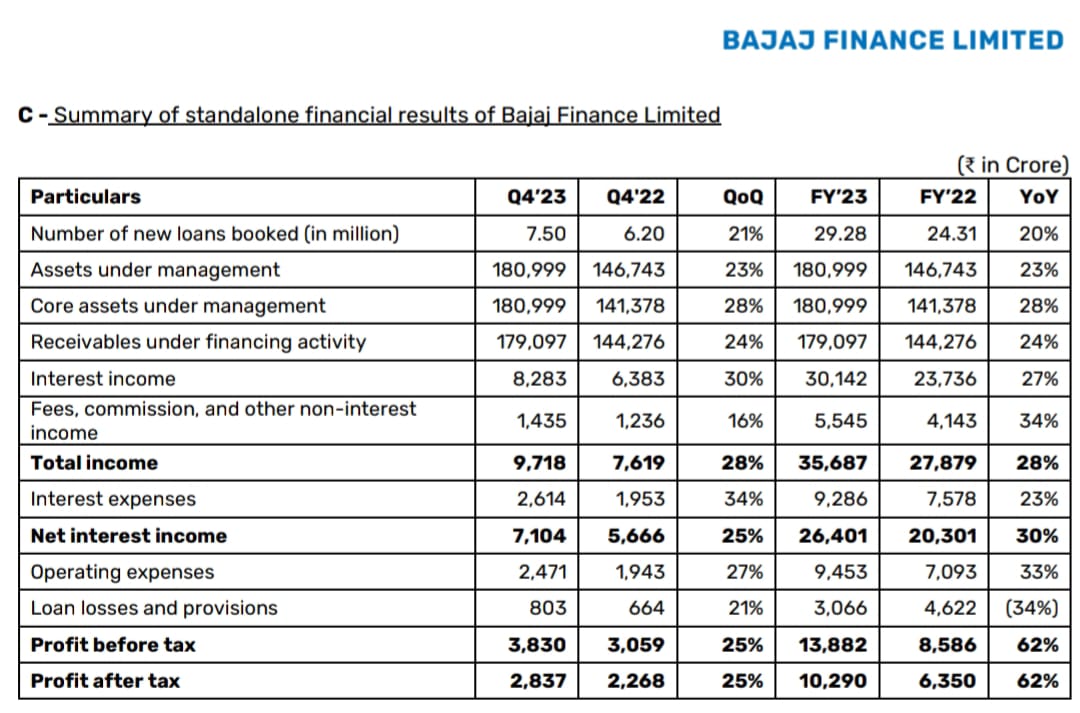

MUMBAI, 26th APRIL, 2023 (GPN): Bajaj Finance Ltd on Wednesday reported a 30 per cent YoY jump in profit at Rs 3,158 crore for the March quarter compared with Rs 2,420 crore in the same quarter last year. The NBFC said its net interest income (NII) for the quarter climbed 28 per cent per cent YoY to Rs 7,771 crore from Rs 6,061 crore in the corresponding quarter last year.

MUMBAI, 26th APRIL, 2023 (GPN): Bajaj Finance Ltd on Wednesday reported a 30 per cent YoY jump in profit at Rs 3,158 crore for the March quarter compared with Rs 2,420 crore in the same quarter last year. The NBFC said its net interest income (NII) for the quarter climbed 28 per cent per cent YoY to Rs 7,771 crore from Rs 6,061 crore in the corresponding quarter last year.

Bajaj Finance said it was a strong quarter across all financial and portfolio metrics. It delivered Rs 16,537 crore of core asset under management (AUM) growth in the March quarter and added 30.90 lakh new customers to the franchise during the quarter. All products and services are now live on Web and App digital platforms, it said adding that its app platform had 3.55 crore net users.

The NBFC said it added 19 new locations and 10,800 distribution points during the quarter. Geographic presence stood at 3,733 locations and over 1,54,000 active distribution points as of March 31.

Bajaj Finance’s board has recommended a dividend of Rs 30 per share for the financial year ended 31 March 2023. The said dividend, if declared, by the shareholders at the ensuing annual general meeting, will be credited on or about July 28 or July 29, Bajaj Finance said.

The NBFC said its cost of funds for the quarter stood at 7.39 per cent, up 25 bps over the December quarter.

Gross non-performing assets for the quarter came in at 0.94 per cent against 1.6 percent in the year-ago quarter. Net NPA stood at 0.34 per cent against 0.68 per cent YoY. Stage 3 assets stood at Rs 2,313 crore as of March 31 against Rs 3,133 crore as of March 31, 2022.

Bajaj Finance delivered an annualised return on asset (ROA) of 5.40 per cent for the quarter compared with 5.29 per cent in the year-ago quarter. Annualised return on equity (ROE) stood at 23.94 per cent against 22.80 per cent YoY. Capital adequacy came in at 24.97 per cent. Tier-1 capital stood at 23.20 per cent.

Opex to NII improved to 34.1 per cent against 34.5 per cent YoY. The NBFC continues to invest in teams and technology for business transformation, Investing in Social and Rewards platform in FY24.

In Q4, net deposit growth was Rs 1,682 crore. Deposits contributed to 21 per cent of consolidated borrowings as of March 31.

For the standalone entity, assets under management (AUM) grew 28 per cent YoY to Rs 1,80,999 crore as of March 31 from a core AUM of Rs 1,41,378 crore as of March 2022.

Bajaj Financial Securities Limited

➢ Customers acquired during Q4 FY23 and FY23 were approximately 41,800 and 234,100

respectively. Customer franchise as of 31 March 2023 was over 565,100.

➢ Margin trade financing (MTF) book stood at ₹ 1,064 crore as of 31 March 2023 as against ₹ 720

crore as of 31March 2022.

➢ Total Income for Q4 FY23 and FY23 was ₹ 58 crore and ₹ 204 crore respectively.

➢ Profit after tax for Q4 FY23 and FY23 was ₹ 3 crore and ₹ 8 crore respectively.Ends

Be the first to comment on "Bajaj Finance Ltd Net profit Zooms 30% to Rs 3,158 Cr in Q4FY23; declares Rs 30 dividend"