L to R – Mr. Arjun Sharma, Vice Chairman & Director, Nexus Select Mall Management Pvt. Ltd; Mr. Asheesh Mohta, Senior Managing Director, Blackstone; Mr. Dalip Sehgal, Executive Director & Chief Executive Officer, Nexus Select Mall Management Pvt. at the press conference on the announcement of Nexus Select Trust’s REIT Initial public Offer (IPO) – Photo By GPN

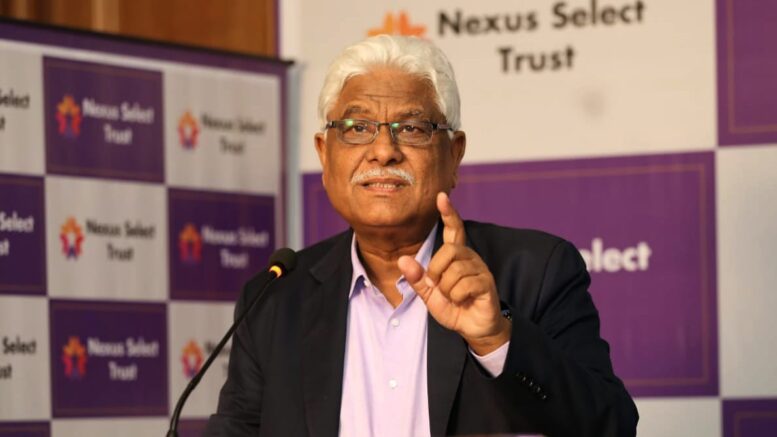

Mr. Asheesh Mohta, Senior Managing Director, Blackstone addressing the gathering on the announcement of Nexus Select Trust’s REIT Initial public Offer (IPO) – Photo By GPN

L to R – Mr. Raj Balakrishnan, MD & Co-head of Investment Banking, BofA Securities India Limited

Mr. Atul Mehra, MD & Co-CEO of Investment Banking, JM Financial Limited

Mr. Arjun Sharma, Vice Chairman & Director, Nexus Select Mall Management Pvt. Ltd

Mr. Asheesh Mohta, Senior Managing Director, Blackstone

Mr. Dalip Sehgal, Executive Director & Chief Executive Officer, Nexus Select Mall Management Pvt. Ltd

Mr. Rajesh Deo, Chief Financial Officer, Nexus Select Mall Management Pvt. Ltd

Mr. Narayanan Sadanandan, Advisor – Equity Capital Markets, SBI Capital Markets Limited

Mr. Nitin Idnani, Executive Director, Investment Banking, Axis Capital Limited at the press conference on the announcement of Nexus Select Trust’s REIT Initial public Offer (IPO) – Photo By GPN

- Anchor Investor Bidding Date – Monday, May 8, 2023

- Bid/Offer Opening Date – Tuesday, May 9, 2023

- Bid/Offer Closing Date – Thursday, May 11, 2023

- Bids can be made for a minimum of 150 Units and in multiples of 150 Units thereafter by Bidders other than Anchor Investors

MUMBAI, 3 MAY, 2023 (GPN): Global investment firm Blackstone – backed Nexus Select Trust is set to launch India’s first retail REIT (Real Estate Investment Trust) public offer on May 9, 2023. The company plans to raise ₹3,200 crore through initial public offering (IPO) route, which comprises fresh issue of units up to ₹1,400 crore and an offer for sale of up to ₹1,800 crore. The company, which filed the draft red herring prospectus with SEBI in November last year, had earlier planned to raise up to ₹4,000 crore from its proposed public offer.

The REIT is an investment instrument that was introduced in India a few years ago to attract investment in the real estate sector by monetising rent-yielding assets. It offers proportionate ownership of an income-generating real estate asset to retail investors.

The price band for Nexus Select Trust REIT, which will be available for subscription till May 11, is expected to be announced this week. The stock is likely to make its debut on the domestic exchanges – BSE and NSE – by May 15, sources close to the development said.

As per document filed with SEBI, the company has reserved up to 75% of the offer for qualified institutional buyers (QIB) and the remaining 25% for high networth individuals (HNI). Morgan Stanley, JP Morgan, Kotak Mahindra Capital, Axis Capital, and BoA ML are the bankers for the proposed public issue.

This would be the fourth REIT to make its debut on the Indian stock exchanges and the first in retail space as all three listed REITs – Embassy Office Parks REIT, Mindspace Business Parks REIT, and Brookfield India Real Estate Trust – are leased office assets.

Besides, this would be Blackstone’s third REIT listing on the domestic bourses after Embassy Office Parks and Mindspace Business Parks. The American private equity firm launched India’s first REIT Embassy Office Parks in April 2019 after raising about ₹4,750 crore through a public issue. Mindspace Business Parks was the second REIT that was listed in August 2022 following fundraising of ₹4,500 crore via the IPO route.

As per the offer document filed with SEBI, major sponsor Blackstone and some other smaller holders will partially sell their stakes in Nexus via the offer for sale (OFS) route. The net proceeds from the fresh issue will be utilised towards repayments of debts, acquisition of stake, redemption of debt securities in certain special purpose vehicles (SPV), as well as to meet general corporate purposes.

With an enterprise value of ₹23,000 crore, Nexus Select Trust has a portfolio of 17 operational shopping malls across 14 major cities with a total leasable area of 9.2 square feet (msf), two complementary hotel assets (354 keys), and three office assets (1.3 msf) as of December 31, 2022. The company’s business portfolio includes assets that are mixed-use in nature with complementary hotels and office spaces like Hyatt Regency Chandigarh and Oakwood Residence Whitefield Bangalore (together constituting 2.8% of its gross portfolio market value as of June 30, 2022), which are managed by global hotel operators, Hyatt and Oakwood.

The company’s retail portfolio includes Select Citywalk Mall in South Delhi, one of the most successful shopping malls in the country with the highest performing assets based on tenant sales per square foot, as per CBRE report. Spread across 0.51 msf, Select Citywalk Mall has around 3,000 stores in its malls with nearly 1,000 brands, including international brands such as Zara, Massimo Dutti and others. Last month, Apple opened a flagship retail store in the mall, which is second the outlet of the iPhone maker in India after a store in Mumbai at Reliance Industries’ Jio World Drive mall.

Post listing, Dalip Sehgal, who is the CEO of Nexus Malls, will head the REIT and Arjun Sharma, the promoter of the Select Group, will join the board of the REIT. The other key board members include Tuhin Parikh, Head of Blackstone India Real Estate, Michael Holland, ex-CEO of the Embassy REIT, Jayesh Merchant, ex-CFO of Asian Paints, and Sadashiv Rao, former director at IDFC.

Be the first to comment on "Nexus Select Trust ₹3,200 cr IPO Opens on 9 May sets price band at ₹95-100 for the India’s first retail REIT IPO backed by Blackstone"