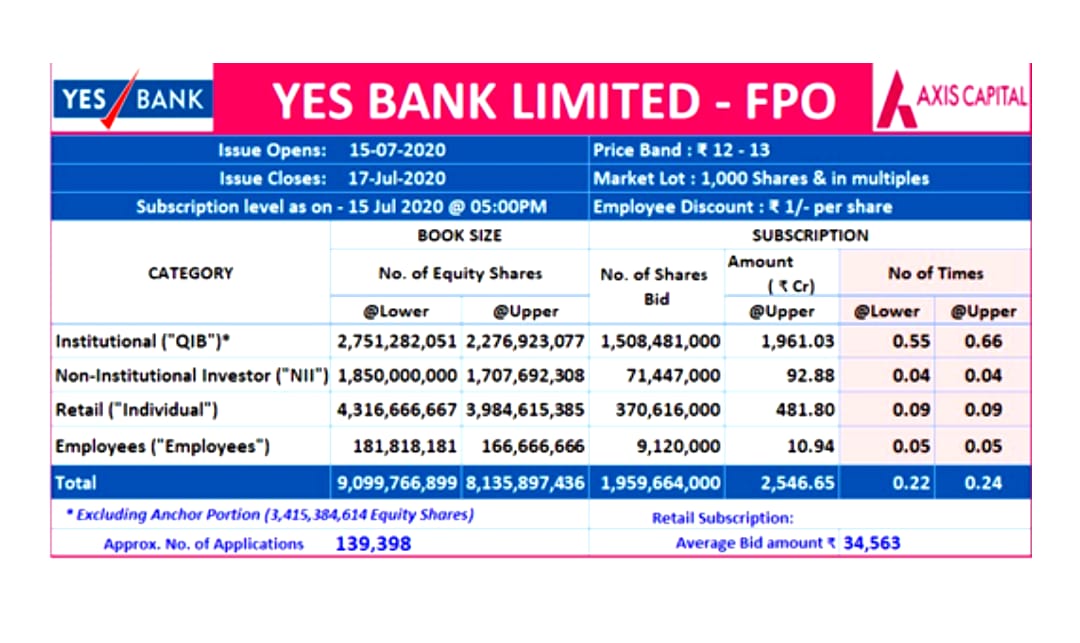

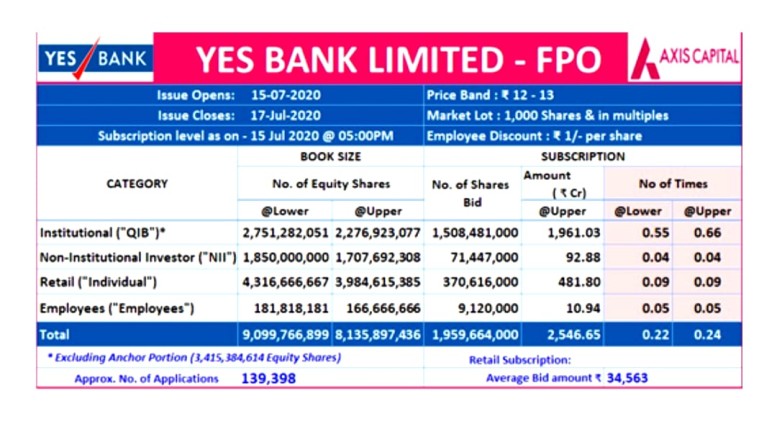

Retail book subscribed 9%

MUMBAI, JULY 15, 2020 (GPN): The full service commercial bank announced its Rs. 15K Cr fundraising plan via the Further Public Offering on July 13, 2020. As stated in the RHP, the funds are being raised to ensure adequate capital to support its growth and expansion, including enhancing its solvency, capital adequacy ratio, and evolving regulatory requirements.

On July 14, the bank raised Rs. 4,098 cr from 14 anchors at Rs 12 per share to US based alternative asset manager, Tilden Park Capital via Bay Tree India Holdings LLC; Singapore based fund management company, Amansa Capital and UK based Fund management company, Jupiter Funds, collectively these 3 FPIs came together to acquire 75% of the shares offered to the anchors. The other domestic institutions who invested as anchors include HDFC Life Insurance, Bajaj Allianz Life Insurance, ICICI Lombard General Insurance, Reliance General Insurance, RBL Bank Limited, Edelweiss Alternative Investment Opportunities Trust, Elara India Opportunities Fund, Hinduja Leyland Finance and ECL Finance.

From market sources it is understood that 95% of Anchor investors are long only funds.

While the QIB portion was subscribed 0.66 times, the Non Institutional portion was subscribed 0.04 times, Retail portion was subscribed 0.09 times and Employee portion was subscribed 0.05 times. Bids of 1,959,664,000 shares were received against the offered 9,099,766,899 shares.

The new generation private sector bank currently has a presence in 28 states and 8 union territories with a network of 1135 branches and 1423 ATMs and has 1 representative office in Abu Dhabi.

The new generation private sector bank currently has a presence in 28 states and 8 union territories with a network of 1135 branches and 1423 ATMs and has 1 representative office in Abu Dhabi.

Kotak Mahindra Capital Company Limited, SBI Capital Markets Limited, Axis Capital Limited, Citigroup Global Markets India Private Limited, DSP Merrill Lynch Limited, HSBC Securities and Capital Markets (India) Private Limited, ICICI Securities Limited and YES Securities (India) Limited are the appointed BRLMs to the issue. ENDS

Be the first to comment on "Yes Bank’s FPO subscribed 24% on Day 1"