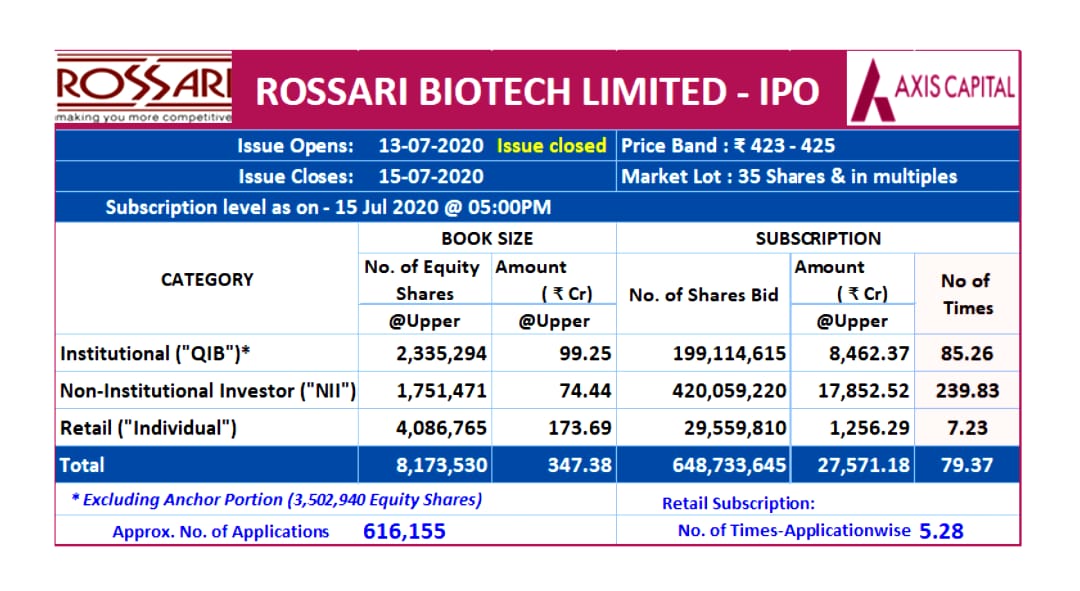

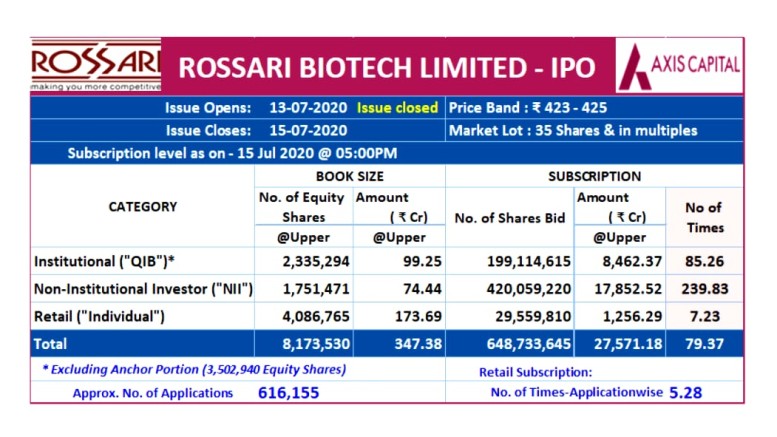

Overall the IPO has been subscribed 79.37 times

MUMBAI, JULY 15, 2020 (GPN): The specialty chemical manufacturer Rs. 496.49 cr IPO saw a stupendous response from all investor categories for its Initial Public Offering and has indeed broken the capital market lull of 4 months.

While QIB and HNI bids made their mark on the day 1 itself, the retail fell short of a full subscription on the very first day. On July 10, the company raised Rs.148.87 crs from marquee anchor investors such as Abu Dhabi Investment Authority, Malabar India Fund and Ashoka India Opportunities fund besides large domestic mutual fund houses like HDFC MF ,ICICI MF, SBI MF, SUNDARAM MF, AXIS MF under various or individual schemes.

Bids of 648,733,645 shares were received against the offering of 81,73,530 shares. The QIB portion was subscribed 85.26 times, NII was subscribed 239.83 times and retail portion was subscribed 7.23 times.

The price band for the IPO was fixed between Rs 423 – 425 per share and opened for bidding on 13 July. Despite the high valuation and customer concentration concerns cited by the brokerage houses, collectively they gave it a subscribe rating with a long term objective in mind citing there is proof of concept and a tremendous scope for growth organically and inorganically besides the company having a strong demand for existing product lines.

The price band for the IPO was fixed between Rs 423 – 425 per share and opened for bidding on 13 July. Despite the high valuation and customer concentration concerns cited by the brokerage houses, collectively they gave it a subscribe rating with a long term objective in mind citing there is proof of concept and a tremendous scope for growth organically and inorganically besides the company having a strong demand for existing product lines.

On this refreshing capital market development, well-known independent market analyst, Arun Kejriwal stated” “There was a huge pent up demand for a primary offering as none had come in the last four months. This was a fresh company from a sector which already enjoys premium valuations and this company in particular had the added flavor of personal health and hygiene attached to it. Sanitizers in covid-19 became the icing on the cake and the subscription is testimony to the market response. ”

The last specialty chemical’s IPO to come to market was Neogen Chemicals in April 2019. It also sought a good response from the market and found a subscription of 30.49X in the QIB Category, 113.88X in the NII Category and 15.86X in the Retail Category, totally 41.07X. The IPO came at a price of Rs. 215 per share on the higher side of the price band and is currently trading at Rs. 571 on BSE and Rs 570 on NSE. ENDS

Be the first to comment on "Rossari’s 496 cr IPO generates demand for Rs. 40K crore"