Shri Siddhartha Mohanty, Chairperson, LIC

PERFORMANCE UPDATE for Nine Months ended December 31st 2023 (9M FY24)

- PERFORMANCE UPDATE for Nine Months ended December 31st 2023 (9M FY24)

- Board approved an interim dividend of Rs. 4/- Per Share

- Value of New Business (VNB) increased by 8.40% to 5,938 Crore.

- Non Par APE increased by 49.08% to Rs 3,299 crore

- Non Par APE share within Individual business grows by 459 bps to 14.04%.

- VNB Margin (Net) increased by 200 bps to 16.6%

- AUM increased by 11.98% to Rs 49.66 lakh crore

- Improvement in 13th month persistency both on premium and policy basis

- Solvency Ratio increased to 1.93 from 1.85

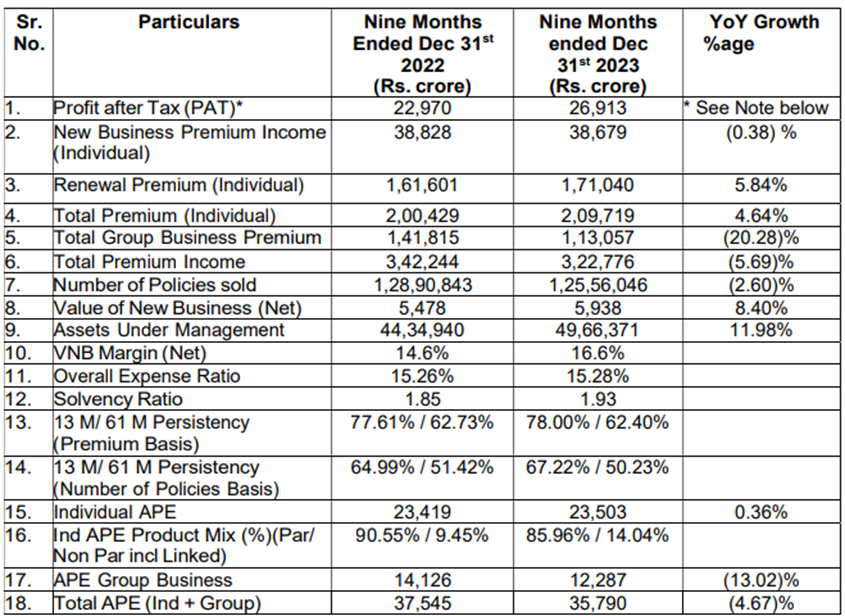

MUMBAI, FEBRUARY 8th, 2024 (GPN): The Board of Directors of Life Insurance Corporation of India (“LIC”) approved and adopted the standalone and consolidated financial results for the nine months ending December 31st, 2023. Below are the key highlights of our standalone results.

The Profit after Tax (PAT) for the nine months period ended December 31st, 2023 was Rs. 26,913 crore. The current period profit includes an amount of Rs.21,461 crore (Net of Tax), pertaining to the accretions on the available solvency margin, transferred from Non Par fund to shareholders account. The PAT for similar nine months period ended December 31st, 2022 was Rs. 22,970 crore is not comparable since it included an amount of Rs.4,542 crore (Net of Tax) pertaining to the accretions on the Available Solvency Margin for the last quarter of FY 2021-22 which was transferred from Non Par fund to shareholders account on September 30th 2022.

In terms of market share measured by First Year Premium Income (FYPI) (as per IRDAI), LIC continues to be the market leader by market share in Indian life insurance business with overall market share of 58.90%. For nine months ended December 31st 2023, LIC had a market share of 38.74 % in Individual business and 72.24% in the group business.

The Total Premium Income for nine months period ended December 31st 2023 was Rs. 3,22,776 crore as compared to Rs. 3,42,244 crore for the nine month period ended December 31st 2022 during the previous year. The Total Individual Business Premium for the nine months period ended December 31st 2023 increased to Rs. 2,09,719 crore from Rs. 2,00,429 crore for the comparable 2 period of previous year. The Group Business total premium income for nine months ended December 31st 2023 was Rs. 1,13,057 crores as compared to Rs 1,41,815 crore for nine months ended December 31st 2022.

A total of 1,25,56,046 policies were sold in the individual segment during the nine months period ended December 31st, 2023 as compared to 1,28,90,843 policies sold during the nine months ended December 31st, 2022.

On an Annualized Premium Equivalent (APE) basis, the total premium was Rs 35,790 crore for the nine months period ended December 31st 2023. Of this 65.67% (Rs. 23,503 crore) was accounted for by the Individual Business and 34.33% (Rs.12,287 crore) by the Group Business. Within the Individual Business the share of Par products on APE basis was 85.96% (Rs.20,203 crore) and balance 14.04% (Rs. 3,299 crore) was due to Non Par products. The Non-Par APE has increased from Rs. 2,213 crore for the nine month period ended December 31st, 2022 to Rs. 3,299 crore for the nine month period ended December 31st 2023 registering a growth of 49.08%. Therefore, our Non Par share of Individual APE which was 9.45% for the nine month period ended December 31st 2022 has grown to 14.04% for the nine month period ended December 31st 2023.

The Value of New Business (VNB) for the nine months period ended December 31st, 2023 was Rs. 5,938 crore as compared to Rs. 5,478 crore for the nine months ended December 31st, 2022, registering a growth of 8.40%. The net VNB margin for the nine months period ended December 31st, 2023 was 16.6 % as compared to 14.6% for the nine months ended December 31st, 2022.

The Solvency Ratio as on December 31st 2023 improved to 1.93 as against 1.85 on December 31st, 2022.

For the nine months ended December 31st 2023, the persistency ratio on premium basis for the 13th month and 61st month were 78.00% and 62.40%, respectively. The comparable persistency ratios for the corresponding nine months ended December 31st 2022 were 77.61% and 62.73% respectively.

For the nine months period ended December 31st, 2023, the persistency ratio on number of policies basis for the 13th month and 61st month were 67.22 % and 50.23%, respectively. The comparable persistency ratios for the corresponding period ended December 31st, 2022 were 64.99% and 51.42% respectively. Therefore, for the 13th month, the persistency has improved both on premium and number of policies basis.

The Assets Under Management (AUM) increased to Rs. 49,66,371 crore as on December 31st 2023 as compared to Rs. 44,34,940 crore on December 31st, 2022 registering an increase of 11.98% year on year.

The Overall Expense Ratio for the nine months period ended December 31st, 2023 was 15.28% as compared to 15.26% for the period ended December 31st, 2022.

The Yield on Investments on policyholders funds excluding unrealized gains was 9.14% for nine months period ended December 31st, 2023 as against 8.58% for period ended December 31st, 2022.

The Net NPA in the policyholders fund was Rs. 8.01 crore as on December 31st, 2023 as compared to Rs. 10.94 crore as on December 31st, 2022.

Shri Siddhartha Mohanty, Chairperson, LIC said – “Our consistent and focused approach towards diversifying and changing our product mix is now yielding results at a faster pace. The same is evident in the rise in the share of Non Par business on APE basis to 14.04% of our total individual business for the first nine months of FY 2024. The fact that this is also accompanied by 200 bps increase in the VNB margin levels to 16.6% is an indicator that our strategic interventions are delivering in the manner that we envisaged. We want to make sure that every action of ours is value accretive to all stakeholders. We will relentlessly pursue our targeted product and channel mix with the support of all our employees, agency force and channel partners. We are committed to developing new products designed to meet the evolving needs of our customers. With our digital transformation project underway, we are confident of making significant improvements in our business processes.”

Key Operational and Financial metrics:

* The Corporation had changed its accounting policy in September 2022 regarding transfer of amount (Net of Tax) pertaining to the accretion on the Available Solvency Margin from Non-Participating Policyholder’s Account to Shareholder’s Account and accordingly transferred total amount of Rs. 27,240.75 crores (Net of Tax) during Financial Year 2022-23, which included transfer to Shareholder’s Account amounting Rs. 19,941.60 crores (Net of Tax) upto quarter ended 31.12.2022. The above amount of Rs. 19,941.60 crores was pertaining to quarter ended 31.03.2022, 30.06.2022, 30.09.2022 and 31.12.2022 for Rs. 4,542.31 crores, Rs.4,148.78 crores, Rs. 5,580.72 crores and Rs. 5,669.79 crores 4 respectively. An amount of Rs. 21,460.68 crores (Net of Tax) has been transferred during nine months ended 31.12.2023 (Rs. 7,692.34 crores for the quarter ended 31.12.2023, Rs. 6,276.80 crores for the quarter ended 30.09.2023 and Rs. 7,491.54 crores for the quarter ended 30.06.2023), due to which the Profit upto the period ended 31.12.2023 is not comparable with the corresponding figures upto the period ended 31.12.2022.

BSE Link: https://www.bseindia.

Result sheet BSE Link: https://www.bseindia.com/xml-

Be the first to comment on "LIC posts Q3FY24 Results, Profit Soars 49% YoY at Rs 9,442 Crore Declares Interim Dividend of Rs 4 Per Share"