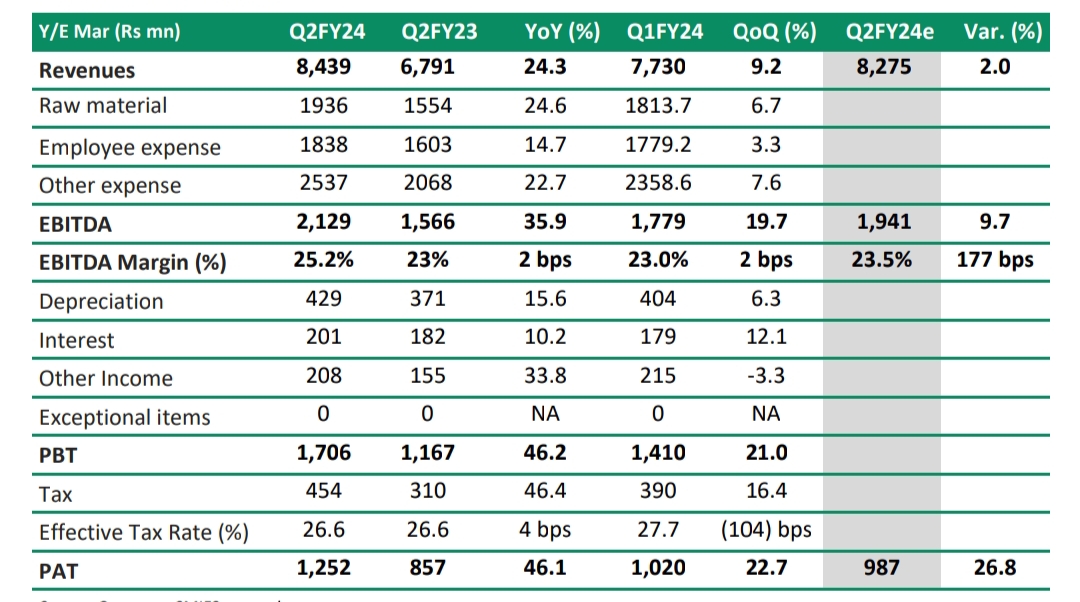

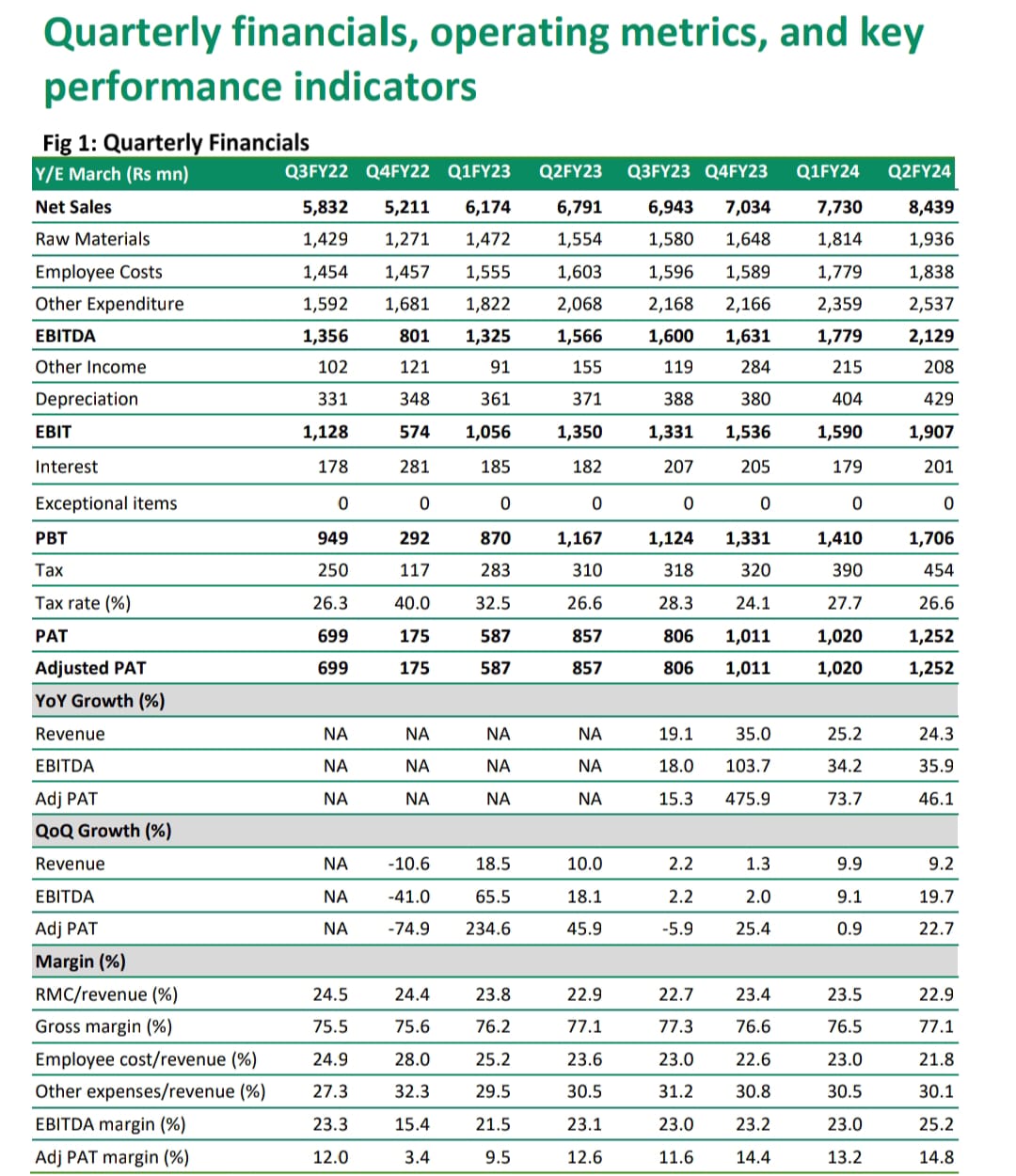

MUMBAI, 11 NOVEMBER, 2023 (GPN): Global Health Ltd (Medanta) reported a 46 percent year-on-year (YoY) rise in net profit at Rs 125 crore for the July-September period of the current financial year.

The company reported a net profit of Rs 86 crore in the year-ago period.

The hospital operator’s revenue for the quarter came in at Rs 844 crore, reflecting a 24 percent rise YoY from Rs 679 crore.

Its earnings before interest, taxes, depreciation, and amortization (EBITDA) was at Rs 213 crore against Rs 156 crore in the same quarter of the previous financial year.

The EBITDA margin for the July- September quarter was reported at 25.2 percent as against 23 percent for the same period a year ago.

Medanta experienced strong and sustained growth across all its clusters (GHL, Patna and Lucknow). ARPOB grew by 4.8% YoY to Rs. 61,003 in Q2 FY24 driven by increase in tariffs at

Gurgaon unit and growth in Lucknow and Patna.

Despite weak season in the quarter, the

company’s occupancy increased to 65% in Q2FY24 as compared to 59% in Q2FY23. Medanta plans to add 50 beds in Patna and 120-150 beds in Lucknow in FY24, it further plans to add

100 beds in Gurgaon unit. Management is further confident of operationalizing Noida facility in 2 years’ time leveraging its healthy balance sheet & operating cashflows.

Going ahead EBITDA margins would expand

1) due to benefits of payor mix in Lucknow, the company has 100% cash and insurance patients 2) Expansion of beds capacity as 1000-1500 beds will be added over a span of 2 years

3) operating leverage playing out as Medanta has in-house doctors, and large facility of more than 500 beds in single location which will result in EBITDA CAGR growth of 27% from FY23-FY26E.

The management views- We upgrade our EV/EBITDA multiple by 10% to 23x

(21x earlier) due to strong margin expansion and significant volume growth at both mature and new hospitals. We value the stock at 23x EV/EBITDA on FY25E EBITDA and arrive at a target price of Rs 1018 per share, translating into an upside of 12% and hence, we retain Accumulate rating on the stock.

Strong revenue growth aided by ARPOB growth

Strong revenue growth aided by ARPOB growth

• Revenue increased 24.3% YoY and 9.2% QoQ to Rs 8,439 mn. This was mainly due to increase in inpatients admission which saw increase of 19.4% YoY to 42,000 in Q2FY24. Out-patient volume increased by 23.2% to 728,000.

• ARPOB (Rs. 61,003- growth of 4.8% YoY) and Occupancy levels (65% in Q2FY24 vs 59% in Q2FY23)

increased by 600 bps due to volume growth in Lucknow and Patna hospitals.

• EBITDA for the quarter saw robust growth of 36% YoY and 19.7% on sequential basis to Rs. 2,129

Mn, whereas EBITDA margin was at 25.2% which witnessed expansion of 216 bps YoY 221 bps on sequential basis.

• Mature hospitals revenue has seen 20% YoY growth to Rs. 6,064 Mn with 7.2% improvement in ARPOB from Rs. 58,896 in Q2FY23 to Rs. 63,132 in Q2FY24, whereas EBITDA margins has improved from 22.9% in Q2FY23 to 25.5% in Q2FY24. The developing hospitals reported revenue

growth of 40% to Rs. 2,643 Mn with ARPOB increase of 0.5% from Rs. 56,823 in Q2FY23 to Rs. 57,082 in Q2FY24.

ALSO READ:

Be the first to comment on "Medanta (Global Health Ltd) Q2 FY24: Net Profit Zooms 46% to Rs 125 crore"