L-R Mr. Ashwani Khare (Executive Director, ICICI Securities Limited), Mr. Devan Kampani (Deputy CEO, JM Financial Limited), Mr. Aman Rathee (Whole-Time Director, ASK Automotive Limited), Mr. Kuldip Singh Rathee (Chairman and Managing Director, ASK Automotive Limited), Mr. Prashant Rathee (Whole-Time Director, ASK Automotive Limited), Mr. Naresh Kumar (Chief Financial Officer, ASK Automotive Limited), Mr. Ashish Nigam (Executive Director – Investment Banking, Axis Capital Limited) and Mr. Pinkesh Soni (Senior Vice President, IIFL Securities Limited) at the IPO press conference of, ASK Automotive Ltd.- Photo By GPN

L to R: Mr. Aman Rathee (Wholetime Director, ASK Automotive Ltd.), Mr. Kuldip Singh Rathee (CMD, ASK Automotive Ltd.) and Mr. Prashant Rathee (Wholetime Director, ASK Automotive Ltd.) at the IPO press conference of, ASK Automotive Ltd – Also the products displayed in Pic – Photo By GPN

L to R: Mr. Devan Kampani (Dy. CEO, JM Financial Ltd.), Mr. Kuldip Singh Rathee (CMD, ASK Automotive Ltd.) and Mr. Naresh Kumar (CFO, ASK Automotive Ltd.) at the IPO press conference of, ASK Automotive Ltd.- Photo By GPN

Mr. Kuldip Singh Rathee (CMD, ASK Automotive Ltd.) at the IPO press conference of ASK Automotive Ltd.- Photo By GPN

NATIONAL/ MUMBAI, NOVEMBER 02, 2023 (GPN): Gurugram-based Leading Auto Ancillary Firm ASK Automotive Limited (“ASK”), announced on Thursday the Offer for subscription of Equity Shares in relation to its Initial Public Offer (IPO) to Open on Tuesday, November 07, 2023.

NATIONAL/ MUMBAI, NOVEMBER 02, 2023 (GPN): Gurugram-based Leading Auto Ancillary Firm ASK Automotive Limited (“ASK”), announced on Thursday the Offer for subscription of Equity Shares in relation to its Initial Public Offer (IPO) to Open on Tuesday, November 07, 2023.

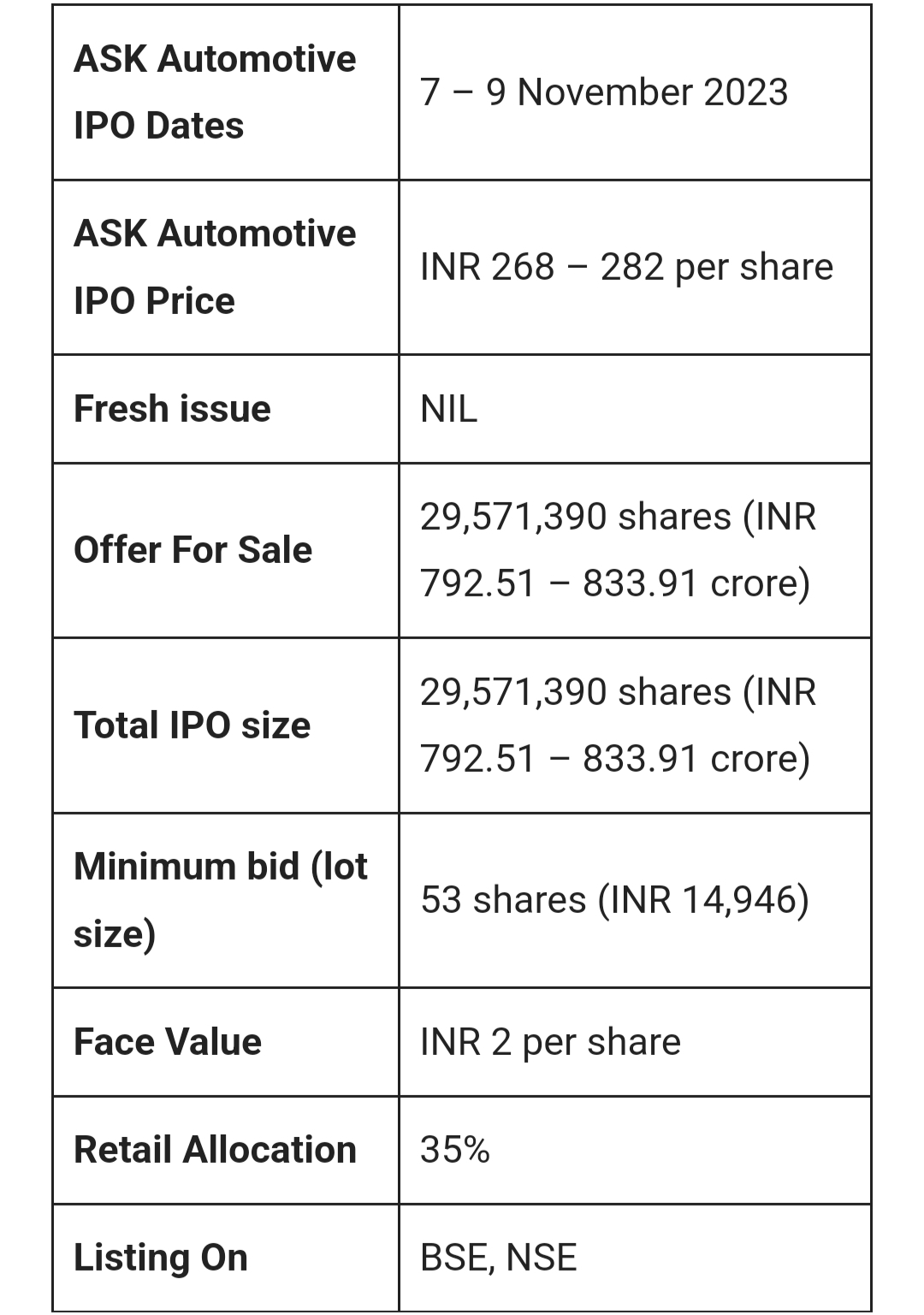

The Anchor Investor Bidding Date shall be Monday, November 06, 2023. The Bid/ Offer will open on Tuesday, November 07, 2023 for subscription and will close on Thursday, November 09, 2023.

The Price Band of the Offer has been fixed at Rs 268 to Rs 282 Per Equity Share.At the upper end of the price band, the IPO is expected to fetch Rs 833.91 crore.

Half of the issue has been reserved for qualified institutional investors, 35 per cent for retail investors, while the remaining 10 per cent for institutional investors.

The total offer size of up to 29,571,390 Equity Shares of face value Rs 2 each comprises of up to 20,699,973 equity shares by Kuldip Singh Rathee and up to 8,871,417 equity shares by Vijay Rathee.

Since the IPO is an OFS, the entire proceeds will go to the selling shareholders and the company will not receive any funds from the issue. At the upper end of the price band, the IPO is expected to fetch Rs 833.91 crore. Half of the issue has been reserved for qualified institutional investors, 35 per cent for retail investors, while the remaining 10 per cent for institutional investors. Investors can bid for a minimum of 53 equity shares and in multiples of 53 equity shares thereafter.

This Equity Shares are being offered through the red herring prospectus of the Company dated October 30, 2023 filed with Registrar of Companies, Delhi and Haryana at New Delhi (the “RHP”) and are proposed to be listed on the BSE Limited (“BSE”) and the National Stock Exchange of India Limited (“NSE”).

ASK Automotive is the largest manufacturer of brake-shoe and advanced braking (AB) systems for two-wheelers (2W) in India with a market share of approximately 50% in FY 2022 in terms of production volume for original equipment manufacturers (OEMs) and the branded independent aftermarket (IAM), on a combined basis.

The company has been supplying safety systems and critical engineering solutions for more than three decades with in-house designing, developing, and manufacturing capabilities. Its offerings are powertrain agnostic, catering to electric vehicles (EV) and internal combustion engine (ICE) OEMs.

The company has clients, including TVS Motor Company Ltd, Hero MotoCorp, Greaves Electric Mobility, and Bajaj Auto.

ASK Automotive has since diversified its operations to include offerings such as (i) AB systems; (ii) aluminum lightweighting precision (ALP) solutions, where it is a prominent player for 2W OEMs in India with a market share of 8% in FY 2022 in terms of production volume: (iii) wheel assembly to 2W OEMs; and (iv) safety control cables (SCC) products.

Further, not less than 15% of the Offer shall be available for allocation to Non-Institutional Investors (“Non-Institutional Category”) of which one-third of the Non-Institutional Category shall be available for allocation to Bidders with an application size of more than Rs 200,000 and up to Rs 1,000,000 and two-thirds of the Non-Institutional Category shall be available for allocation to Bidders with an application size of more than Rs 1,000,000 and under-subscription in either of these two subcategories of Non-Institutional Category may be allocated to Bidders in the other sub-category of Non-Institutional Category in accordance with the SEBI ICDR Regulations, subject to valid Bids being received at or above the Offer Price.

All Bidders (except Anchor Investors) shall mandatorily participate in this Offer only through the Application Supported by Blocked Amount (“ASBA”) process and shall provide details of their respective bank account (including UPI ID in case of UPI Bidders) in which the Bid Amount will be blocked by the Self Certified Syndicate Banks (“SCSBs”) or the Sponsor Banks, as the case may be. Anchor Investors are not permitted to participate in the Anchor Investor Portion through the ASBA process. For details, see “Offer Procedure” beginning on page 450 of the RHP.

JM Financial Limited, Axis Capital Limited, ICICI Securities Limited and IIFL Securities Limited are the Book Running Lead Managers to the offer.

All capitalised terms used herein but not defined shall have the same meaning as ascribed to them in the RHP. Ends

RHP Link: https://j2h5n6i6.rocketcdn.me/

Be the first to comment on "ASK Automotive Rs 834 Crore IPO to Open on Tuesday, November 07, 2023 Price Band fixed at Rs 268 – 282 per Share"