MUMBAI, 29th OCTOBER 2023 (GPN): PTC India Financial Services (PFS) has reported a 65 per cent jump in its net profit to Rs 51.46 crore for the September 2021 quarter.

The non-banking finance company had posted a net profit of Rs 31.85 crore in the corresponding quarter of the previous financial year.

However, the total income during July-September quarter also fell to Rs 242.34 crore, against Rs 297.98 crore in the year-ago period, PFS said.

Net Interest Margin (NIM) (Earning Portfolio) improved to 4.14 per cent in Q2FY22 compared to 3.70 per cent in Q2FY21. Capital adequacy ratio for the quarter stood at 26.06 per cent hereby providing strong cushion for growth and expansion, it said.

“The total outstanding credit i.e. aggregate of loan assets and non-fund based commitments against sanctioned loans, stood at Rs 9,633 crore as on 30th September, 2021. Loan assets aggregated to Rs 9,290 crore and outstanding non-fund-based commitments aggregated to Rs 343 crore,” it said.

Fresh loans of Rs 541 crore sanctioned and further disbursements of Rs 433 crore have been made during the quarter in the areas of sustainable financing, it added.

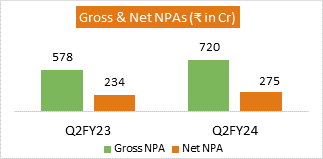

The Management said,“We are pleased to unveil the impressive financial results achieved during the first half of the fiscal year 2024, solidifying our commitment to consistent performance. Overcoming the various challenges encountered, our Company has undertaken a strategic overhaul, reinforcing our operational infrastructure with a seasoned and proficient leadership team. Our strategic moves has positioned us to embark on an upward trajectory, gearing ourselves for sustained growth in the foreseeable future. Our current focus remains dedicated to enhancing the overall quality of our portfolio, with a keen emphasis on resolving lingering stress assets.

The Management said,“We are pleased to unveil the impressive financial results achieved during the first half of the fiscal year 2024, solidifying our commitment to consistent performance. Overcoming the various challenges encountered, our Company has undertaken a strategic overhaul, reinforcing our operational infrastructure with a seasoned and proficient leadership team. Our strategic moves has positioned us to embark on an upward trajectory, gearing ourselves for sustained growth in the foreseeable future. Our current focus remains dedicated to enhancing the overall quality of our portfolio, with a keen emphasis on resolving lingering stress assets.

Our concerted effort underscores our unwavering dedication to fortify the foundation of our business, ensuring the optimal management of risks and bolstering the resilience of our operations. In parallel, we are actively engaging in the strategic alignment of fresh credit lines, aiming facilitation for systematic expansion with sustainable growth to sunshine sectors, to continue to deliver enduring value to all our stakeholders.”

Ø Total Income for Q2FY24 stood at ₹ 201.81 crore as compared to ₹ 195.84 crore in Q2FY23

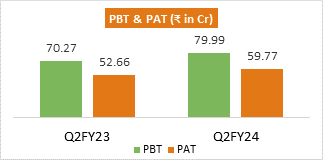

Ø Profit before Tax (PBT) and Profit after Tax (PAT) for Q2FY24 increased to ₹ 79.99 crore and ₹ 59.77 crore compared to ₹ 70.27 crore and ₹ 52.66 crore in Q2FY23 respectively

Ø Yield on Earning Portfolio improved to 10.89% in Q2FY24 compared to 10.58% in Q2FY23

Ø Debt Equity Ratio improved to 1.94 times in Q2FY24 compared to 2.38 times in Q2FY23 thereby providing cushion to further leverage with growth

Ø Net Interest Margin (NIM) (Earning Portfolio) increased to 4.46% in Q2FY24 compared to 4.34% in Q2FY23

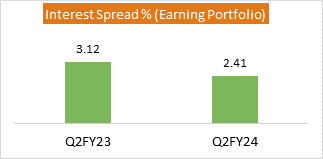

Ø Spread (Earning Portfolio) for Q2FY24 stood at 2.41% compared to 3.12% in Q2FY23

Ø Cost of borrowed funds has increased to 8.48% in Q2FY24 compared to 7.46% in Q2FY23 in line with market trendØ

Total Income for Q2FY24 stood at ₹ 201.81 crore compared to ₹ 193.23 crore in Q1FY24

Ø Profit before Tax (PBT) and Profit after Tax (PAT) for Q2FY24 increased to ₹ 79.99 crore and ₹ 59.77 crore compared to ₹ 49.24 crore and ₹ 36.76 crore in Q1FY24 respectively

Ø Yield on Earning Portfolio improved to 10.89% in Q2FY24 compared to 10.77% in Q1FY24

Ø Debt Equity Ratio improved to 1.94 times in Q2FY24 compared to 2.05 times Q1FY24 thereby providing cushion to further leverage with growth

Ø Net Interest Margin (NIM) (Earning Portfolio) increased to 4.46% in Q1FY24 compared to 4.33% in Q1FY24

Ø Spread (Earning Portfolio) for Q2FY24 stood at 2.41% compared to 2.42% in Q1FY24

Ø Cost of borrowed funds have been increased to 8.48% in Q2FY24 compared to 8.35% in Q1FY24 in line with market trend

Ø Net Interest Income (NII) for Q2FY24 stood at ₹ 81.46 crore compared to ₹ 80.04 crore in Q1FY24

Ø Total Income for H1FY24 stood at ₹ 395.04 crore compared to ₹ 403.05 crore in H1FY23

Ø Profit before Tax (PBT) and Profit after Tax (PAT) for H1FY24 stood at ₹ 129.23 crore and ₹ 96.53 crore compared to ₹ 137.94 crore and ₹ 103.22 crore in H1FY23 respectively

Ø Yield on Earning Portfolio improved to 10.83% in H1FY24 compared to 10.54% in H1FY23

Ø Debt Equity Ratio improved to 1.94 times in H1FY24 compared to 2.38 times H1FY23 thereby providing cushion to further leverage with growth

Ø Net Interest Margin (NIM) (Earning Portfolio) increased to 4.40% in H1FY24 compared to 4.28% in H1FY23

Ø Spread (Earning Portfolio) for H1FY24 stood at 2.42% compared to 3.05% in H1FY23

Ø Cost of borrowed funds have been increased to 8.41% in H1FY24 compared to 7.49% in H1FY23 in line with market trend

Ø Net Interest Income (NII) for H1FY24 stood at ₹ 161.50 crore compared to ₹ 170.02 crore in H1FY23.

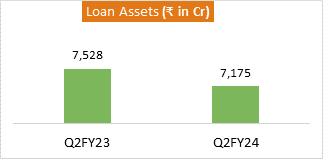

Ø The total outstanding credit i.e. aggregate of loan assets and non-fund based commitments against sanctioned loans, stood at ₹ 7,175 crores as on 30th September, 2023

Ø Capital Adequacy Ratio as on 30th September, 2023 stood at 38.58%.Ends

Be the first to comment on "PFS – ‘PTC India Financial Services Ltd’ Announces Q2FY24, PAT Soars 65% to Rs 52 crore"