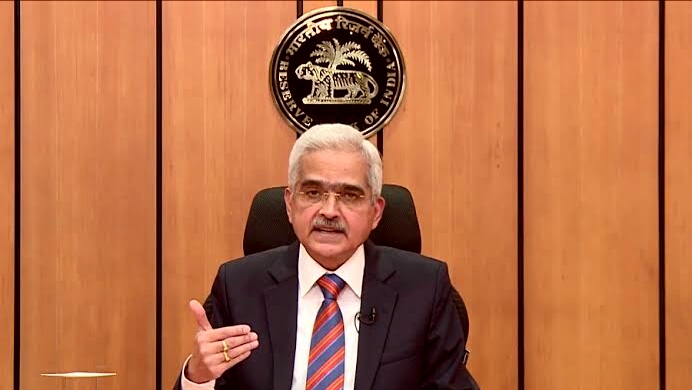

MUMBAI, 8th JUNE, 2023 (GPN): RBI Monetary Policy Committee (MPC) has kept the repo rate unchanged at 6.5%.

The decision to keep the repo rate — it is the interest rate at which the RBI lends to banks in the country — unchanged was taken unanimously by the six Monetary Policy Committee (MPC) members as inflation continues to remain above the 4 per cent target.

The RBI has been mandated by the government to keep consumer price index-based inflation (CPI) at 4 per cent with a band of +/- 2 per cent.

While announcing the policy, RBI Governor Shaktikanta Das said the consumer price inflation eased during March-April 2023 and moved into the tolerance band, declining from 6.7 per cent in 2022-23.

“Headline inflation, however, is still above the target as per the latest data and is expected to remain so according to our projections for 2023-24. Therefore, close and continued vigil on the evolving inflation outlook is absolutely necessary, especially as the monsoon outlook and the impact of El Nino remain uncertain,” Das said, adding that real GDP growth in 2022-23, on the other hand, has turned out to be stronger than anticipated and is holding up well.He said the policy repo rate has been increased by 250 basis points (bps) since May 2022 and is still working its way through the system. Its fuller effects will be seen in the coming months.

“Against this backdrop, the MPC decided to keep the policy repo rate unchanged at 6.50 per cent. The MPC will continue to remain vigilant on the evolving inflation and growth outlook. It will take further monetary actions promptly and appropriately as required to keep inflation expectations firmly anchored and bring down inflation to the target,” Das said.

He, however, said that the rate action in the policy is “a pause and not a pivot”. “It is a pause in this meeting of the MPC. I have not said anything about pivot. So, whatever I said in the last (April 2023) meeting that it’s not a pivot, I reiterate that,” he said.

On the impact of the recent increase in minimum support price (MSP) on inflation, Das said part of the hike is already built into the inflation projections.

Asked whether the RBI is closer to a change in its stance of withdrawal of accommodation compared to the April policy, Das said, “Our target (for CPI) is 4 per cent. So, our effort will also be to align all our actions to move towards and reach the target. It will, therefore, depend on the evolving situation. To say anything more than that, given the kind of uncertainties which still persists, is not desirable at this stage.”

On growth, Das said the Indian economy presents a story of resilience with macro-economic and financial stability. Prospects for growth are steadily improving and becoming broad based.

“Higher rabi crop production, expected normal monsoon, continued buoyancy in services and softening inflation should support household consumption. On the other hand, given the healthy twin balance sheets of banks and corporates, supply chain normalisation and declining

uncertainty, conditions are favourable for the capex cycle to gain momentum,” he said.

He said the headwinds from weak external demand, volatility in global financial markets, protracted geopolitical tensions and intensity of El Nino impact, however, pose risks to the growth outlook.

On the liquidity condition, Das said the decline in currency in circulation and pick-up in government spending have expanded the system liquidity. This got further augmented due to the RBI’s market operations and the deposit of Rs 2,000 banknotes in banks.

“Going forward, the Reserve Bank will remain nimble in its liquidity management, while ensuring that adequate resources are available for the productive requirements of the economy,” he said, adding that the central bank will ensure the orderly completion of the government’s market borrowing programme.

Shri Atul Kumar Goel, MD and CEO of Punjab National Bank (PNB) – Photo By GPN

View By Shri Atul Kumar Goel, MD and CEO of Punjab National Bank (PNB)

RBI has kept the rates and stance unchanged in line with the market expectations in view of easing retail inflation and anticipation of a further decline. Maintaining the growth projection of GDP for FY’24 at 6.5% reflects that RBI remains sanguine about the economic growth projections. Reduction of the Inflation projection for FY’24 also indicates optimism.

RBI’s announcement on allowing Scheduled Commercial Banks to set their own borrowing limits has given much required flexibility to Banks. RBI has decided to come out with a regulatory framework for permitting First Loss Default Guarantee (FLDG) arrangements in Digital Lending which will promote more transparency and discipline in digital lending environment. Similarly, proposing the framework for widening of scope of resolution of stressed assets indicate that RBI is right on the track of instilling harmonization across Regulated Entities.

RBI continues to adopt a liberal approach towards BBPS by streamlining its processes to bring more competence and boost involvement. Further, action on internationalizing RuPay Debit Cards and Pre paid Cards points to RBI’s earnest approach on broad-basing the scope of the cards and increasing comfort for Indians travelling abroad.

Overall it seems to be an action oriented policy with evenly balanced approach. However, in view of the dynamic world economic scenario, we anticipate that RBI will remain watchful.

_________________________________________

Mr. Murali Ramakrishnan MD and CEO of The South Indian Bank

“The RBI deserves praise for its efforts in controlling inflation by prudently calibrating the policy repo rate through successive quarters. MPC’s well-timed rate hikes earlier have allowed it the leeway to keep the repo rate unchanged at 6.5% for the current cycle.

Inflation, however, still remains a concern and is expected to remain above targeted levels right through FY2023-24 as per RBI’s forecasts. Accordingly, despite the pause in rate hikes, the MPC is exercising tight control over monetary conditions by continuing its stance of withdrawal of accommodation.”

_________________________________________

Manish Jain, Fund Manager, Coffee Can PMS, Ambit Asset Management

Manish Jain, Fund Manager, Coffee Can PMS, Ambit Asset Management, has shared his commentary on the market outlook.

Quote:

RBI adopts its realistic approach of balancing growth & inflation dynamics, decoupling from the global economy. Also, the past 2 months of CPI inflation is below the RBI tolerance limit, which gives comfort to the RBI to keep the repo rate & stance unchanged. The sharp swing between WPI & CPI spread from positive 880bps in May’22 to negative 560bps in Apr’23 will benefit the gross margins of consumer-facing sectors.ends

Mr. Rajesh Sharma, Managing Director, Capri Global Capital Ltd

Mr Rajesh Sharma, MD, Capri Global Capital Ltd Quote on today’s RBI Bi-monthly policy announcement

Today’s announcements by RBI to keep the repo rate unchanged after a total 250 bps increment since May 2022 is an encouraging sign to keep the positive sentiment of borrowers and would give a big boost to demand for credit appetite. It will help to stabilize the interest rate cycle. There will be a collective sigh of relief from homeowners since they have been feeling the strain of increased interest rates and longer loan terms. The pause in the rate cycle will also aid relief for MSME borrowers who are yet to recover from the pandemic stress and higher cost of borrowing. We believe RBI is evaluating trends in inflation and the movement of high-frequency indicators and global developments like a hawk to exercise a measured approach during this period in order to pave the way for sustainable economic growth and stability in the long run.

_________________________________________

Mr. Soumitra Majumdar, Partner, JSA – Photo By GPN

Mr. Soumitra Majumdar, Partner, JSA views on the Monetary Policy announced by the RBI earlier today.

“RBI’s monetary policy statement do significantly allay fears of economic slowdowns in India. The Indian economy should be able to weather several risks and geo-political tensions plaguing several developed economies and prove to be a stable and consistent investment destination. Though showing positive trends, however, inflation continues to remain the centre of RBI’ attention. Cleaner balance sheets of banks and corporates coupled with the liquidity holds promise of larger capital expenditure by both the public and private sectors. Bank’s ability to fix their inter- institutional borrowing limits testifies the sectoral strength. The proposed amendments to the stressed assets resolution circular of June 7, 2019 for including specific guidelines for compromises and settlements with borrowers, is definitely a welcome move. This will help expediting closure of settlement proposals under a certain regulatory framework – promising further cleansing of bank and corporate books, with renewed focus on further credit and business growth. Regulations for restructuring borrower accounts hit by natural calamities is again a positive move for the economy. Thrust on developing and securing the digital lending ecosystem also holds promise for credit penetration and demand- driven growth.”ends

_________________________________________

Mr. Suresh Khatanhar, Deputy Managing Director, IDBI Bank – Photo By GPN

Quote by Mr. Suresh Khatanhar, Deputy Managing Director, IDBI Bank on RBI Monetary Policy:

“With inflation continuing to slide, the MPC’s decision to maintain a status quo on repo rates is on expected lines. Though the Indian economy continues to remain fairly resilient, the pause in the rate hike cycle augurs well as it would further help in arresting inflation, boosting investment and consumption sentiments. The lowering of the inflation projection for FY24 to 5.1% signals towards a higher GDP growth and credit offtake can be expected to be higher. However, RBIs readiness in taking quick decisions in case of any divergence from present expectations on the inflationary front calls for cautionary optimism across the board.”ends

Mr. Dhiraj Relli, MD & CEO, HDFC Securities – Photo By GPN

Quote by Mr. Dhiraj Relli, MD & CEO, HDFC Securities viewson the Monetary Policy announced by the RBI earlier today.

“The RBI MPC left the repo rates unchanged at its meet on June 08 in line with street expectations. MPC members were in a sweet spot in the backdrop of higher than expected GDP numbers and moderating headline and core inflation print.

The MPC continued with the ‘withdrawal of accommodation’ stance (with 5:1 majority), as liquidity has turned into significant surplus mode further increased by the impact of withdrawal of Rs 2000 notes. A sustained moderation in inflation going forward may prompt the shift from “withdrawal of accommodation” to “neutral” stance.

India’s economic activity has continued to demonstrate resilience. RBI retained its GDP forecast at 6.5% in FY24.

Given the uncertainties around the impact of El-Nino conditions leading to sub-par monsoon in 2023, RBI remained cautious and revised the inflation projection by only 10bps to 5.1% for FY24. RBI Governor stressed on moving towards the primary target of 4% inflation. In this backdrop, expectation of rate cut in this calendar year seems to be faded. We expect the first rate cut perhaps in Feb 2024.”ends

_________________________________________

Mr. Abheek Barua, Chief Economist, HDFC Bank

Quote by Mr Abheek Barua, Chief Economist, HDFC Bank, commentary on RBI Monetary Policy

The A status quo policy delivered by the central bank today, keeping both the policy rate and stance unchanged. The RBI continued to be rather upbeat on growth, revising up its Q1 growth forecast to 8%, while retaining its annual forecast at 6.5% — which is higher than our estimate of 6-6.2%. On inflation, the central bank recognised the near-term easing in inflationary pressures while being cautious about the future trajectory.

The central bank lowered its inflation forecast only marginally to 5.1% and seems to be building in a buffer for any food prices spikes due to weather related disturbances during the monsoon season. If indeed these risks do not pan out, inflation could be lower than the RBI’s projections leading to subsequent communications becoming more dovish.

Today’s policy decision does little to move the needle in the bond market as it was broadly in line with expectations. Any rate cut expectations in 2023 that was being built up in the market are likely to be pushed forward for now.ends

Mr. Surendra Hiranandani, Chairman and Managing Director, House of Hiranandani

Quote from Mr. Surendra Hiranandani, Chairman and Managing Director, House of Hiranandani on RBI’s Monetary Policy Announcement from today

“The committee’s decision to maintain the present repo rate is a positive and promising step for the real estate market. By recognizing the controlled inflation, the MPC’s stance offers a ray of hope for potential homebuyers. This move is also expected to further fuel the remarkable growth witnessed in the Indian real estate market since the beginning of the year. This steady repo rate not only brings relief to the industry but also stimulates construction and infrastructure development. It ensures a favorable lending environment for developers, encouraging them to embark on new projects with stable interest rates.”ends

_________________________________________

Mr Pranay Jhaveri, MD – India and South Asia, Euronet – Photo By GPN

Quote from Mr Pranay Jhaveri, MD – India and South Asia, Euronet on today’s RBI announcement about Streamlining Bharat Bill Payment System:

“Streamlining Bharat Bill Payment System will help integrate backend systems efficiently for a seamless experience, which could also bring new players to the table and improve the ad-hoc payment system, It will be an advantage to bolster fraud monitoring and risk mitigation systems to ensure smooth online transactions.”ends

_________________________________________

Ms. Achala Jethmalani, Economist, RBL Bank – Photo By GPN

Quote – Ms. Achala Jethmalani, Economist, RBL Bank

“In a no surprise move, monetary policy maintained a status-quo on policy rates and stance. It remains in a ‘wait & watch’ mode and vigilant on inflation trajectory. We expect a pause on policy rates through CY2023 while modulating system liquidity. The window for policy pivot to rate cuts could open-up in 1H CY2024, if inflation trajectory warrants given that growth remains robust.”ends

_________________________________________

Rajiv Sabharwal, MD & CEO, Tata Capital Ltd.- Photo By GPN

Rajiv Sabharwal, MD & CEO, Tata Capital Ltd., Quote:

- In line with the market expectations, RBI has maintained its status quo on rates and reaffirmed its withdrawal policy stance. This shows RBI’s resolve to support durable growth. This will accelerate the growth momentum in the economy

- This holistic perspective reflects the RBI’s commitment to ensuring a sustainable balance between growth and inflation, which is crucial for the long-term health of the economy

- RBI continues to offer assurance to the markets that there will be a rebalance in the overall systemic liquidity.

_________________________________________

Mr. George Alexander Muthoot, MD, Muthoot Finance – Photo By GPN

Mr. George Alexander Muthoot, MD, Muthoot Finance, Quote:

“The RBI commentary in today’s monetary policy was fairly optimistic on the resilience of Indian economy growth. On expected lines, the RBI MPC continued to maintain status quo on repo rate, and maintained its focus on the withdrawal of accommodation. The MPC further retained the GDP projection at 6.5% and set the target to achieve 4% inflation going forward, reflecting a cautiously optimistic outlook for the economy, while also continuing to remain vigilant on the inflation front. Indian economy remains resilient as indicated by the high frequency indicators, domestic demand conditions, improving household consumption and investment activity. Muthoot Finance recorded highest-ever quarterly gold loan disbursement in Q4FY23 and as Indian economic growth picks up, we continue to remain positive on gold loan demand. Strong urban demand, higher rabi production, and improving rural demand further add to our optimism on growth.

We welcome the RBI proposal of widening the Scope of Prudential Framework for Stressed Assets to all regulated entities and streamline the current prudential norms regarding the restructuring of borrower accounts impacted by natural disasters.

Mr. Samyak Doshi Director Bhoomi Group – Photo By GPN

Mr. Samyak Doshi, Director, Bhoomi Group, says, repo rate unchanged will boost home sales – Comment on todays RBI Policy announcement

“Keeping the repo rate unchanged at 6.50 per cent will encourage home buyers to come forward and fulfil their long-cherished dream of owning a home. This will improve market sentiments and give a boost to home sales. The government has been supportive and has introduced a slew of policy measures that have sustained home sales. This pause in repo rate hike will give an impetus to the affordable housing category of home buyers, benefiting them immensely. The government should have reduced the repo rate as property prices are already on the rise and this would have brought some relief to home buyers. We hope the government reduces stamp duty rates which will lighten the burden of home buyers, going forward.”Ends

_________________________________________

Mr. Ajit Banerjee, Chief Investment Officer (CIO), Shriram Life Insurance Company – Photo By GPN

“RBI on expected lines continued with the rate pause decision which it had announced in April’23 and maintained the status quo on stance on withdrawal of accommodation as the fight for taming the inflation continues. It has emphasised on the continued global fluidic situation prevailing. The policy tone was balanced, but it remained non-committal on the decision on future rate actions by MPC. Probably it is very unlikely if RBI would precede the Fed in reversing its course of rate hikes in the future.

RBI lowered FY24 inflation projection by 10 bps to 5.1% Y-o-Y basis and retained FY24 GDP projections at 6.5% Y-o-Y. Slowing inflation and a robust economic recovery are certainly aiding the RBI to stay put on rates but it has raised concerns on the global growth slowdown and the resultant impact it will have on the domestic economy.

After today’s meeting, it seems that the present pause by RBI on rate actions may continue for this calendar year.”

_________________________________________

Mr. Rohit Gera, Managing Director, Gera Developments -Photo By GPN

Quote from Mr. Rohit Gera, Managing Director, Gera Developments on MPC has decided to keep Repo Rate unchanged at 6.5%

“The action to keep the report rate unchanged was along expected lines as a result of inflation coming under control. This would provide comfort to home buyers who saw affordability decline with the increase in rates over the past 6 months. Hopefully we will see the rates start to move down thereby increasing affordability in the hands of home buyers.”Ends

_________________________________________

Invesco Mutual Fund

Quote By Mr. Vikas Garg – Head of Fixed Income, Invesco Mutual Fund.

“Against the backdrop of challenging global monetary policy outlook, MPC delivers second consecutive pause on policy rate indicating increasing comfort on external resilience as well as domestic growth – inflation dynamics. Stance still maintained as “withdrawal of accommodation” to keep flexibility against any negative surprises on global front and monsoon; only to be changed to Neutral later. Overall, a pause as expected with lesser likelihood of further rate hikes. Nonetheless, a long wait for rate cut cycle as inflation remains higher than the 4% target.”ends

HDFC Bank

HDFC Bank’s, RBI Policy Review: Status Quo with some caution

RBI Policy Review: Status Quo with some caution:

The RBI kept its policy rate and stance unchanged today as expected. The central bank’s commentary on growth remained upbeat while it recognised the recent easing pressure on inflation. Although, the RBI remained more cautious about the future trajectory of inflation and emphasised that it remains committed to anchoring inflation close to 4%.

We think that this resolve to do “whatever is necessary” to bring inflation down on a sustained basis to the median target is likely to push forward rate cut expectations that some sections of the market had started pricing in for as early as October 2023. That said, it does not mean that the RBI will keep rates on hold until inflation actually reaches 4%. We think that once the inflation uncertainty moderates and a path towards the 4% target is visible, the RBI could start its rate cut cycle if growth conditions so demand. We do not see this happening before Q1 2024.

Growth and Inflation: The RBI retained its growth forecast at 6.5% for FY24 and revised up its Q1 & Q2 forecast to 8% and 6.5% respectively. For inflation, the RBI recognised the moderating near-term pressures on inflation,revising down its Q1 FY24 estimate to 4.6% (from 5.1% earlier). However, it kept its forecasts for the second half unchanged at an average of 5.3% and seemed to be more cautious – perhaps factoring in a negative impact from any food price spikes due to weather related disturbances during the monsoon season. For the year, the RBI only marginally revised down its inflation forecast to 5.1% from 5.2% earlier.

The Australian Met office yesterday shifted its El Nino outlook from a watch to alert and suggested a 70% probability of an El Nino event developing through the year. Although, the development of a positive Indian Ocean Dipole (IOD) – which leads to higher rainfall in India – could act as some sort of offset if El Nino conditions do develop. The interaction of these opposing weather disturbances would be critical in determining both the inflationNand rural recovery outlook over the coming months. If indeed the conditions are more benign, inflation could be lower than the RBI’s projections leading to subsequent communications becoming more dovish. We continue to hold on to our inflation forecast of 4.8% for FY24 and project GDP growth at 6%.

Liquidity: Liquidity conditions have improved over the last few weeks (with system liquidity average at INR 2 lakh Cr) led by the withdrawal of 2000 rupee notes (50% of the INR 3.6 lakh Cr has come back of which 85% have been in bank deposits), redemptions of G-sec securities, and rise in government spending. The RBI has continued to manage liquidity conditions through VRRR and VRR auctions. For now, these could remain as the preferred tools for liquidity management. In the post policy press conference, the RBI mentioned that they would like to align the overnight call money rate to the repo rate signalling that the central bank is likely to remain in a liquidity absorption mode and is comfortable with lower levels of liquidity surpluses. Whether this warrants more durable liquidity absorption still remains uncertain and could be premature. Moreover, liquidity surplus could naturally come down somewhat from current levels by the second half of June on the back of advance tax outflows.

Market Reaction: Bond market reaction was largely muted as the policy outcome was largely on expected lines and the RBI did not revise down FY24 inflation projections significantly. The 10-year bond yield was last trading at 7.01% vs. yesterday’s close of 6.98%. On the FX front, the USD/INR was trading firm at 82.55, at the time of writing.ends

Be the first to comment on "Views by Industry Experts and Stalwarts on the RBI Monetary Policy announced earlier today"