Bank of Baroda (BoB) Logo

Key Highlights

|

MUMBAI, 05 NOVEMBER, 2022 (GPN): State run Lender Bank of Baroda today reported a 59% Y-o-Y jump in net profit at ₹3,313 crore for the September quarter, boosted by improvement in asset quality along with margin expansion.

The management exuded confidence of continuing the good show through the course of the year, especially on the asset quality front and credit cost, though it admitted that the high double-digits loan growth at 21% in the reporting quarter is certain to temper down going forward.

The city-headquartered bank’s total income rose to ₹23,080 crore in the reporting quarter from ₹20,271 crore a year ago.

The key profitability metric net interest income, which is what the bank earned after paying interest on its funds, soared 34.5% to ₹10,714 crore, buoyed by a 48 bps expansion in margin (net interest margin in banking parlance) to 3.33%.

The lender improved its asset quality, with gross non-performing assets (NPAs) coming down to 5.31% or at ₹46,374 crore in the reporting period from 8.11% a year-ago.

Similarly, net NPAs more than halved to 1.16% at ₹9,672 crore from 2.83% or ₹19,000 crore a year ago.

As a result, provisions for bad loans and contingencies declined to ₹1,627.5 crore from ₹2,753.6 crore in the year-ago period.

Attributing the robust set of numbers to overall good performance, Sanjiv Chadha, the managing director and chief executive of the bank, said there are primarily four pillars to the Q2 numbers.

For one, the quarter was exceptionally good on the credit growth front at 19%; secondly, there was a record improvement in the margins, which rose to 3.33%.

Thirdly, as against the normal course of cost going up when sales rise, the bank could keep overall costs under tight control (its salary cost went up by just 4%); and finally in a rising interest rate regime, normally credit cost goes up but the bank’s credit cost came down, Mr. Chadha said in response to GPN during its Q2FY23 media briefing call.

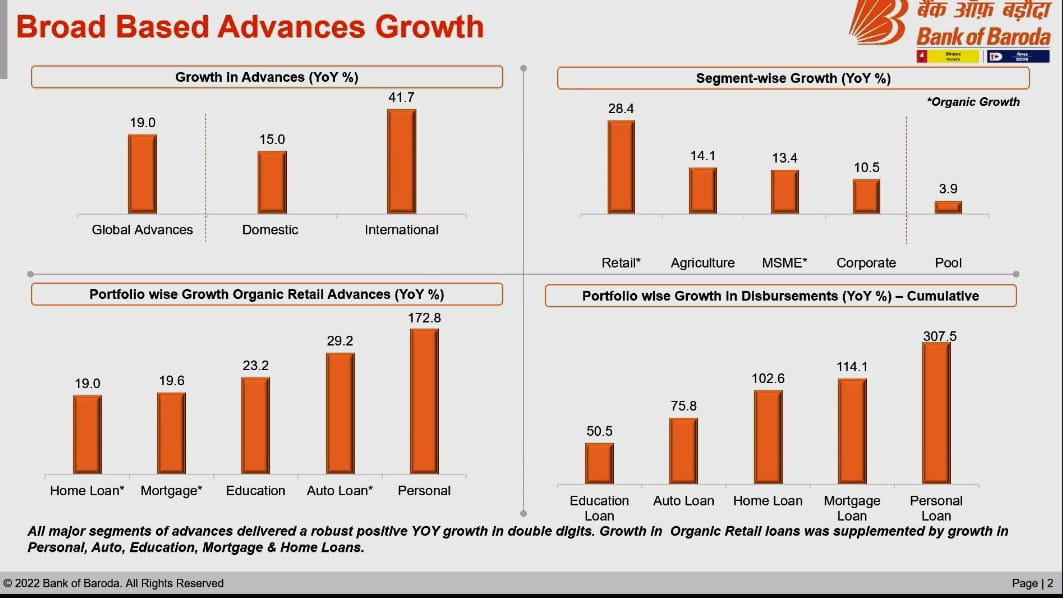

On advances growth of 19%, he said it was led by retail advances soaring 28.4%, driven by home loans, which is a high focus area for the bank, expanding at 19%, personal loans at 172.8%, auto loans at 29.2% and education loans logging 23.2% growth.

Of the total advances at ₹8,73,496 crore, domestic advances increased 15% to ₹7,16,737 crore and international advances clipped at 41.7%.

Total deposits rose 13.6% to ₹10,90,172 crore, of which domestic deposits rose 10.9% to ₹9,58,967 crore and international deposits grew 38.3% to ₹1,31,205 crore.

The agriculture loan portfolio grew 14.1% to ₹1,14,964 crore, while the gold loan portfolio (including retail and agri) expanded 27.8% to ₹33,502 crore. The MSME portfolio climbed 13.4% to ₹1,01,278 crore.

Domestic current account deposits rose 7.9% to ₹64,873 crore, and domestic savings deposits grew 9.4% to ₹3,45,278 crore. Overall domestic CASA grew 9.2%.

Of the total income, fee-based income jumped by 12.3% to ₹1,515 crore, getting it an operating income of ₹12,000 crore, an increase of 7.7%.

The yield on its advances increased to 7.22% as against 6.55% a year ago, as the cost of deposits increased only marginally to 3.59% from 3.52%.

The swelling profit came despite the bank taking a ₹2,000-crore hit on its book from treasury operations as against a ₹1,300 crore profit in the year-ago period, Mr. Chadha said.

Profit was driven by recovery and write-backs of ₹5,360 crore as against a net slippage of ₹4,465 crore.

Chadha said the bank has not marked any accounts for transfer to the national bad bank or NARCL as it is more comfortable with the other recovery models like the NCLT.

On credit growth sustainability, he said overall it will moderate at the industry level but added that the bank will perform better than the industry average.

He said the corporate book was led mostly by roads, green energy (especially solar) and steel companies.

Capital adequacy ratio declined to 15.25% from 15.55% at the end of September 2021 and accordingly, the provision coverage ratio improved to 79.14%, he said.

On a consolidated basis, net profit increased to ₹3,400 crore from ₹2,168 crore.

RESULTS IN NUTSHELL:

Business Performance

- Global Advances of the Bank increased to INR 8,73,496 crore, +19% YoY.

- Domestic Advances of the Bank increased to INR 7,16,737 crore, +15% YoY.

- International advances registered a robust growth of 41.7% YoY.

- Global Deposits increased by 13.6% YoY to INR 10,90,172 crore.

- Domestic Deposits increased by 10.9% YoY to INR 9,58,967 crore in Sep’22.

- International Deposits grew by 38.3% on a YoY basis to INR 1,31,205 crore in Sep’22.

- Domestic Current Account Deposits stands at INR 64,873 crore, registering a growth of 7.9% on a YoY basis.

- Domestic Savings Bank Deposits grew by 9.4% to INR 3,45,278 crore. Overall Domestic CASA registered a growth of 9.2% on a YoY basis.

- Organic Retail loan portfolio of the Bank grew by 28.4% led by growth in Personal loan portfolio by 172.8%, Auto loan by 29.2%, Education loan by 23.2%, Home loan by 19% on a YoY basis.

- Agriculture loan portfolio grew by 14.1% YoY to INR 1,14,964 crore.

- Total Gold loan portfolio (including retail and agri.) stands at INR 33,502 crore, registering a growth of 27.8% on a YoY basis.

- Organic MSME portfolio grew by 13.4% YoY to INR 1,01,278 crore.

Profitability

- Net Interest Income grew by 34.5% YoY and 15.1% QoQ to INR 10,714 crore in Q2FY23. It registered a growth of 23% YoY for H1FY23 and stands at INR 19,013 crore.

- Fee based Income for the quarter increased by 12.3% to INR 1,515 crore.

- Operating Income for Q2FY23 stands at INR 12,000 crore, increase of 7.7% YoY.

- Yield on Advances increased to 7.22% in Q2FY23 as against 6.55% in Q2FY22.

- Cost of Deposits stands at 3.59% in Q2FY23 as against 3.52% in Q2FY22.

- Operating Profit for Q2FY23 stands at INR 6,031 crore, increase of 6.4% on a YoY basis. Operating Profit for H1FY23 stands at INR 10,558 crore.

- Core Operating Profit (ex-Treasury gains/losses and Interest on IT refund) grew by 44.6% YoY at INR 6,270 Cr in Q2FY23.

- Bank reported a standalone Net Profit of INR 3,313 crore in Q2FY23 as against a profit of INR 2,088 crore in Q2FY22.

- Global NIM stands at 3.33% in Q2FY23, increase of 31 bps QoQ. NIM for H1FY23 stands at 3.17% against 3.03% for FY22.

- Return on Assets (annualised) improved to 1.01% in Q2FY23 from 0.73% in Q2FY22. Return on Assets for H1FY23 stands at 0.84%.

- Return on Equity (annualised) increased by 554 bps YoY to 19.56% in Q2FY23. Return on Equity for H1FY23 also increased by 511 bps YoY to 16.18%.

- For the consolidated entity, Net Profit stood at INR 3,400 crore in Q2FY23 as against INR 2,168 crore in Q2FY22.

Asset Quality

- The Gross NPA of the Bank reduced by 12% QoQ to INR 46,374 crore in Q2FY23 and Gross NPA Ratio improved to 5.31% in Q2FY23 from 6.26% in Q1FY23.

- The Net NPA Ratio of the Bank improved to 1.16% in Q2FY23 as compared with 1.58% in Q1FY23.

- The Provision Coverage Ratio of the Bank stood at 91.73% including TWO and 79.14% excluding TWO in Q2FY23.

- Slippage ratio declined to 1.53% for H1FY23 as against 2.45% in H1FY22.

- Credit cost for the Q2FY23 stands at 0.79%.

Capital Adequacy

- CRAR of the Bank stands at 15.25% in Sep’22 from 15.55% in Sep’21. Tier-I stood at 12.81% (CET-1 at 10.95%, AT1 at 1.86%) and Tier-II stood at 2.44% as of Sep’22.

- The CRAR and CET-1 of consolidated entity stands at 15.77% and 11.60% respectively

Business position

| Particulars (INR crore) | Sep 30, 2021 | Jun 30, 2022 | Sep 30, 2022 | YoY (%) |

| Domestic deposits | 8,64,603 | 9,09,095 | 9,58,967 | 10.9 |

| Domestic CASA | 3,75,766 | 4,01,622 | 4,10,151 | 9.2 |

| Global deposits | 9,59,483 | 10,32,714 | 10,90,172 | 13.6 |

| Domestic advances | 6,23,368 | 6,95,493 | 7,16,737 | 15.0 |

| Of which, retail loan portfolio (Organic) | 1,23,424 | 1,47,535 | 1,58,506 | 28.4 |

| Global advances | 7,34,033 | 8,39,785 | 8,73,496 | 19.0 |

| NIM Global % | 2.85 | 3.02 | 3.33 | 48 bps |

Financial result for Quarter ended 30th September 2022

| Particulars (INR crore) | Q2FY22 | Q1FY23 | Q2FY23 | YoY(%) |

| Interest Income | 16,692 | 18,937 | 21,254 | 27.3 |

| Interest Expenses | 9,126 | 10,099 | 11,080 | 21.4 |

| Fee Income | 1,349 | 1,277 | 1,515 | 12.3 |

| Net Interest Income (NII) | 7,566 | 8,838 | 10,174 | 34.5 |

| Operating Income | 11,145 | 10,020 | 12,000 | 7.7 |

| Operating Expenses | 5,476 | 5,492 | 5,969 | 9.0 |

| Operating Profit | 5,670 | 4,528 | 6,031 | 6.4 |

| Total Provisions (other than tax) and contingencies | 2,754 | 1,685 | 1,628 | -40.9 |

| of which, Provision for NPA Bad Debts Written-off | 2,600 | 1,560 | 1,654 | -36.4 |

| Profit before Tax | 2,916 | 2,843 | 4,403 | 51.0 |

| Provision for Tax | 828 | 675 | 1,090 | 31.6 |

| Net Profit | 2,088 | 2,168 | 3,313 | 58.7 |

Key Ratios

| Particulars | Sep 30, 2021 | Jun 30, 2022 | Sep 30, 2022 |

| CRAR (%) | 15.55 | 15.46 | 15.25 |

| Tier-1 (%) | 13.21 | 12.97 | 12.81 |

| CET-1 (%) | 11.39 | 11.24 | 10.95 |

| Gross NPA (%) | 8.11 | 6.26 | 5.31 |

| Net NPA (%) | 2.83 | 1.58 | 1.16 |

| PCR (with TWO) (%) | 83.42 | 89.38 | 91.73 |

About Bank of Baroda

Bank of Baroda (“The Bank”) established on July 20, 1908 is an Indian state-owned banking and financial services organization, headquartered in Vadodara (earlier known as Baroda), in Gujarat, India. Under the ‘Alternative Mechanism’ scheme, the Government announced the amalgamation of Vijaya Bank and Dena Bank with Bank of Baroda which came into effect on April 1, 2019.

Bank of Baroda is one of India’s largest banks with a strong domestic presence spanning 8,161 branches and 11,461 ATMs and Cash Recyclers supported by self-service channels. The Bank has a significant international presence with a network of 94 overseas offices spanning 17 countries.

Visit BoB at Website: www.bankofbaroda.com

=======

Be the first to comment on "Bank of Baroda announces Financial Results for the Quarter ended 30th September 2022"