CHENNAI, 04th NOVEMBER, 2022 (GPN): Computer Age Management Services Limited (CAMS), India’s largest registrar and transfer agent of mutual funds has announced its financial results for the Quarter and half-year ended 30th September 2022.

Key Business Highlights for the Quarter

Mutual Funds:

- CAMS AAuM at Rs.27.1 lakh Crore is at an all time high with an increase of 3.1% over Q1 FY23 – reversing the trend of last two quarters of muted growth

- CAMS serviced funds continue to maintain a dominant ~69% market share in overall AAuM

Alternative Services:

- Alternative Services vertical continued its high growth trajectory recording ~32% Y-o-Y growth in revenue in Q2 FY23

- CAMS WealthServ, the digital onboarding platform for this segment was well received by the market with 50+ signups since launch

CAMS insurance Repository

- PolicyGenie Deep Contact Tracing Solution, uniquely offered by CAMS Insurance Repository, assisted insurance companies in closing ₹ 100 Cr of unclaimed benefits till date

- eInsurance Account & e-Policy doubled in volume over Q1 FY23, on the back of sustained news of KYC requirements, eIA and e-Policy

CAMS Finserv Account Aggregator

- Our AA + TSP offering has been gaining momentum with 35+ mandates till date

- SEBI and PFRDA have released circulars to enable MFs, depositories and Pension funds to join the AA ecosystem

CAMS Digital properties

- CAMS digital properties – myCAMS & edge360, clocked the highest Q-o-Q volume growth at > 10% in the last 2 quarters which was in sharp contrast to the volume decline seen by other electronic channels

- MFCentral solidifies CAMS’s role in the MF ecosystem by providing APIs to ecosystem to digitize the mutual fund transaction journey

CAMS NPS

- CAMS launched the industry first CRA platform on cloud in March 2022. eNPS, POP, Corporate and Government Segments are live

- Within a short span of time, achieved 9.5% share and #2 position in eNPS segment

- C-Sat Score consistently over 90%

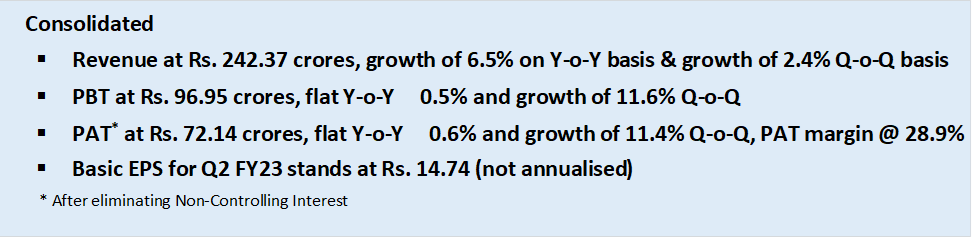

Quarterly Highlights

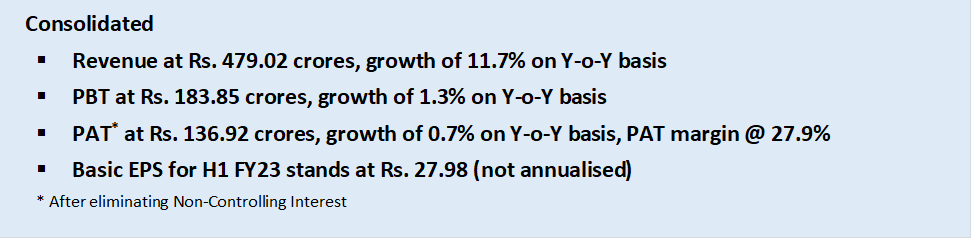

Half-Yearly Highlights

Half-Yearly Highlights

Commenting on the performance, Mr. Anuj Kumar, Managing Director said,

“It is heartening to share that the company was able to report yet another strong performance, both around operational excellence and on the financial results front. Serving 10 of the Top 15 Funds and several fast-growing Mutual Funds, assets under service touched a life-time high of Rs. 27 tn.in September 2022, clocking a 7% growth over June ’22 AuM. This milestone reinforces our focus to continually enrich our value proposition and enable a differentiated growth-path for our clients.

Despite the global situation-led market volatility, individual investors’ participation remained vigorous. CAMS serviced Funds scaled another peak in Sept. 2022 crossing the milestone of Rs.7500 Crore of inflows from SIPs in a single month. Concurrently, our Equity AuM saw a double digit increase of 11% in Sept.’22 over June’22. Our digital platforms continued to make significant contribution and clocked a 10% increase in transaction volumes over the previous quarter, which was in sharp contrast to the volume decline seen by other electronic channels. Our strong online presence attracts about 300,000 MF investors to login every day.

The AIF business continues to record robust growth with revenues growing 32% Y-o-Y in Q2 FY23. There is accelerated adoption of our digital onboarding solution Wealthserv with the sign-ups crossing fifty clients. Lending companies, Insurance Companies and broking houses are seeing compelling value in our Account Aggregator platform CAMSfinserv for their digital transformation strategy. Both new client acquisition and onboarding wins of the previous quarter (on the platform for live data-pulls) are seeing active momentum.

Our new CRA platform for NPS completed two quarters post launch and the eNPS module has ~ 10% market share of the new eNPS sales in the industry. Our industry first “deep tracing solution” from CAMSRep Insurance Repository – to reach policyholders with unclaimed amounts – has been well received with large Insurers subscribing to the solution. This platform has assisted insurance companies in tracing ₹ 100 Cr of unclaimed benefits. eInsurance Accounts & e-Policy doubled in volume over Q1, on the back of news of mandatory KYC, eIA and e-Policy.”

Quarterly Financial highlights – Y-o-Y and Q-o-Q – Consolidated

| Particulars (Rs. Crs.) | Q2 FY23 | Q2 FY22 | Y-o-Y | Q1 FY23 | Q-o-Q |

| Revenue | 242.37 | 227.60 | 6.5% | 236.65 | 2.4% |

| Profit Before Tax (PBT) | 96.95 | 96.47 | 0.5% | 86.90 | 11.6% |

| Profit After Tax (PAT) and

Before Non-controlling interest |

72.10 | 72.56 | (0.6%) | 64.61 | 11.6% |

| Non-controlling interest | (0.04) | – | – | (0.17) | – |

| Profit attributable to Owners | 72.14 | 72.56 | (0.6%) | 64.78 | 11.4% |

| PAT Margin (%) | 28.9% | 31.3% | 26.9% |

About CAMS Limited (www.camsonline.com) BSE: 543232; NSE: CAMS

CAMS is a technology-driven financial infrastructure and services provider to mutual funds and other financial institutions with over two decades of experience. The Company is India’s largest registrar and transfer agent of mutual funds with an aggregate market share of approximately 69% based on mutual fund average assets under management (“AAUM”) managed by its clients and serviced by them. Over the last five years, the Company has grown its market share from approximately 61% during March 2015 to approximately 69%, based on AAUM serviced. Its mutual fund clients include ten of the fifteen largest mutual funds based. The Company is market leading service partner to alternative investment funds and portfolio managers with full-stack digital and fund administration services. CAMS is the primary Payments services provider for Mutual funds and several NBFCs. Services to insurance companies and eInsurance services are provided via the subsidiary CAMSRep. The company has recently launched account aggregator service CAMSfinserv, a path-breaking initiative for consent-based data sharing and Central Record-keeping services for National Pension System. Ends

Be the first to comment on "CAMS ANNOUNCES Q2 FY23 RESULTS CONSOLIDATED PAT UP BY 11.4% Q-o-Q AND FLAT Y-o-Y, RECOMMENDS 2NDINTERIM DIVIDEND OF Rs. 8.50 PER SHARE"