L-R : Mr. J. Samuel Joseph, Dy. MD, IDBI Bank Ltd ; Mr. Rakesh Sharma, MD & CEO, IDBI Bank Ltd ; Mr. Suresh Khatanhar, ED, IDBI Bank Ltd ; Mr. Pothukuchi Sitaram, ED, IDBI Bank Ltd during the announcement of the Bank’s Q2FY23 Results today at IDBI H.O Mumbai

MUMBAI, OCTOBER 21, 2022 (GPN): The Board of Directors of IDBI Bank Ltd. (IDBI Bank) met in Mumbai today and approved the financial results for the Quarter ended September 30, 2022.

IDBI Bank Ltd

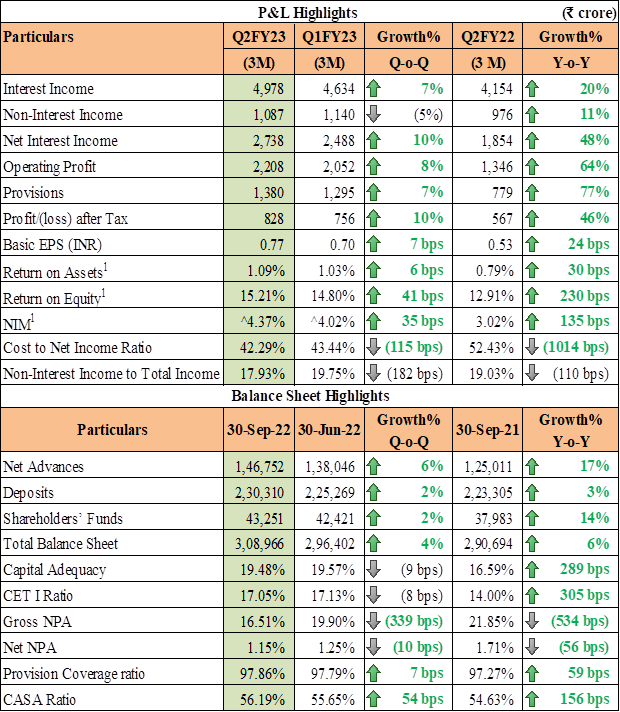

Key Summary for Q2 of FY 2023 Results

Previous periods figures have been regrouped/ restated (wherever necessary)

1– Annualized

^ – NIM excluding interest on IT refund – Q2-FY23 – 4.22% and Q1-FY23 – 3.73%

Highlights for Q2 of FY 2023

Net profit at ₹828 crore, growth of 46% YoY and 10% QoQ.

Operating Profit at ₹2,208 crore, growth of 64% YoY and 8% QoQ.

NII stood at ₹2,738 crore, growth of 48% YoY and 10% QoQ.

NIM at 4.37%, growth of 135 bps YoY and 35 bps QoQ.

Cost to Income Ratio at 42.29%, reduction of 1014 bps YoY and 115 bps QoQ.

CASA ratio at 56.19%, growth of 156 bps YoY and 54 bps QoQ.

Return on Assets (ROA) at 1.09%, growth of 30 bps YoY and 6 bps QoQ.

Return on Equity (ROE) at 15.21%, growth of 230 bps YoY and 41 bps QoQ.

Net NPA at 1.15%, reduction of 56 bps YoY and 10 bps QoQ.

Gross NPA at 16.51%, reduction of 534 bps YoY and 339 bps QoQ.

PCR stood at 97.86% as against 97.27% on Sept 30, 21 and 97.79% on June 30, 22.

Operating Performance:

Operating Performance:

- Net Profit improved by 46% for Q2-2023 to ₹828 crore as against net profit of ₹567 crore for Q2-2022. Net Profit for Q1-2023 was ₹756 crore.

- PBT improved by 85% for Q2-2023 to ₹1,437crore as against ₹775 crore for Q2-2022. PBT for Q1-2023 was ₹1,093 crore.

- Operating profit improved by 64% for Q2-2023 to ₹2,208 crore as against ₹1,346 crore for Q2-2022. Operating profit was at ₹2,052 crore for Q1-2023.

- Net Interest Income improved by 48% for Q2-2023 ₹2,738 crore as against ₹1,854 crore for Q2-2022. NII stood ₹2,488 crore for Q1-2023.

- Net Interest Margin (NIM) stood at 4.37% (4.22% excluding interest on IT refund) for Q2-2023 as compared to 3.02% for Q2-2022. NIM stood at 4.02% (3.73% excluding interest on IT refund) for Q1-2023.

- Cost of Deposit reduced by 16 bps to 3.44% for Q2-2023 as compared to 3.60% for Q2-2022. Cost of deposit stood at 3.36% for Q1-2023.

- Cost of Funds reduced by 16 bps to 3.72% for Q2-2023 as compared to 3.88% for Q2-2022. Cost of funds stood at 3.61% for Q1-2023.

Business Growth

- CASA increased to ₹1,29,407 crore as on September 30, 2022 as against ₹1,21,995 as on September 30, 2021 (YoY growth of 6%). CASA stood at ₹1,25,356 crore as on June 30, 2022.

- Share of CASA in total deposits improved to 56.19% as on September 30, 2022 as against 54.63% as on September 30, 2021 and 55.65% as on June 30, 2022.

- Net advances grew by 17% YoY to ₹1,46,752 crore as on September 30, 2022.

- The composition of corporate v/s retail in gross advances portfolio was at 35:65 as on September 30, 2022 as against 37:63 as on June 30, 2022.

Asset Quality

- Gross NPA ratio stood at 16.51% as on September 30, 2022 as against 21.85% as on September 30, 2021. Gross NPA stood at 19.90% as on June 30, 2022.

- Net NPA ratio improved to 1.15% as on September 30, 2022 as against 1.71% as on September 30, 2021. Net NPA ratio stood at 1.25% as on June 30, 2022.

- Provision Coverage Ratio (including Technical Write-Offs) improved to 97.86% as on September 30, 2022 from 97.27 % as on September 30, 2021. PCR stood at 97.79% as on June 30, 2022.

Capital Position

- Tier 1 improved to 17.05% as on September 30, 2022 as against 14% as on September 30, 2021 and 17.13% as on June 30, 2022.

- CRAR improved to 19.48% as on September 30, 2022 as against 16.59 % as on September 30, 2021 and 19.57% as on June 30, 2022.

- Risk Weighted Assets (RWA) stood at ₹1,57,840 crore as on September 30, 2022 as against ₹1,52,028 crore as on September 30, 2021. Total RWA was ₹1,53,832 crore as on June 30, 2022. Credit Risk weighted assets stood at ₹1,25,250 crore as on September 30, 2022 as against ₹1,20,644 crore as on September 30, 2021. Credit RWA was ₹1,21,798 crore as on June 30, 2022.Ends

Be the first to comment on "IDBI Bank – Announces Financial Results for Q2 of FY 2023 Reports Highest ever quarterly Net Profit at ₹828 crore"