Bank of Baroda (BoB) Logo

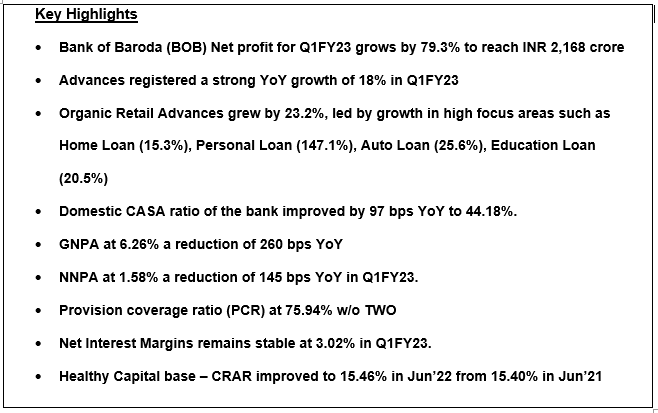

MUMBAI, 30 JULY, 2022 (GPN): State Public Sector Lender Bank of Baroda (BoB) reported a 79 per cent year-on-year (YoY) jump in first quarter (Q1FY23) standalone net profit at ₹2,168 crore against ₹1,209 crore in the year-ago period on the back of growth in net interest income and sharp decline in provisions.

Mr Sanjiv Chadha, MD & CEO, BoB said, “The bank had a good beginning in FY23 in terms of having both growth as well as good margins, It has been a reasonably satisfactory quarter for us. More so because we had some headwinds in terms of increase in interest rates, which has obviously impacted the treasury income, with market-to-market implications,”

The Bank’s net interest margin at 3.02 per cent was steady (3.04 per cent in Q1FY21), credit cost was at an all-time low (0.75 per cent), and there was an improvement in credit cycle,he added.

Mr Sanjiv Chadha, MD & CEO, BoB

Business Performance

Business Performance

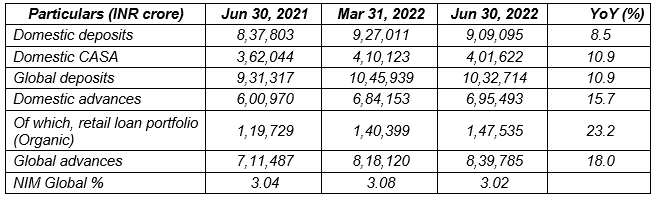

- Global Advances of the Bank increased to INR 8,39,785 crore, +18% YoY.

- Domestic Advances of the Bank increased to INR 6,95,493 crore, +15.7% YoY.

- Global Deposits increased by 10.9% YoY to INR 10,32,714 crore. Domestic Deposits increased by 8.5% YoY to INR 9,09,095 crore in Jun’22.

- Domestic Current Account Deposits stands at INR 63,440 crore, registering a growth of 10% on a YoY basis.

- Domestic Savings Bank Deposits grew by 11.1% to INR 3,38,182 crore. Overall Domestic CASA registered a growth of 10.9% on a YoY basis.

- Organic Retail loan portfolio of the Bank grew by 23.2% led by growth in Personal loan portfolio by 147.1%, Auto loan by 25.6%, Education loan by 20.5%, Home loan by 15.3% on a YoY basis.

- Agriculture loan portfolio grew by 14.4% YoY to INR 1,10,854 crore.

- Organic MSME portfolio grew by 11.1% YoY to INR 96,954 crore.

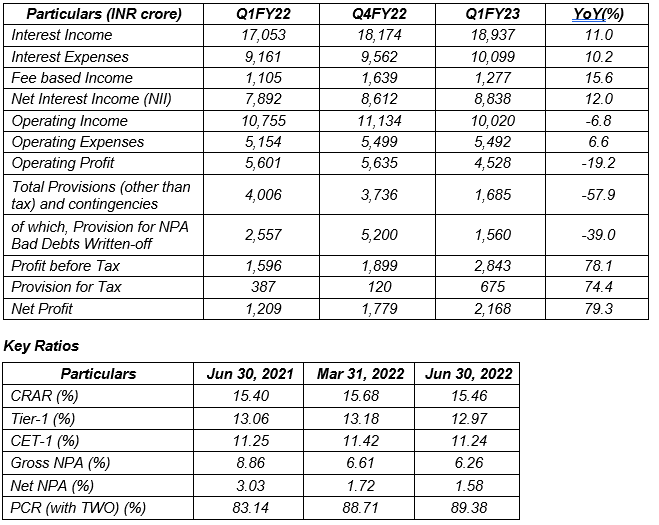

Profitability

- Net Interest Income grew by 12% to INR 8,838 crore in Q1FY23.

- Fee based Income for the quarter increased by 15.6% to INR 1,277 crore.

- Operating Income for Q1FY23 stands at INR 10,020 crore.

- Cost of Deposits reduced to 3.46% in Q1FY23 as against 3.55% in Q1FY22.

- Operating Profit for Q1FY23 stands at INR 4,528 crore.

- Core Operating Profit (ex-Treasury gains/losses and Interest on IT refund) grew by 11% YoY at INR 5,301 Cr in Q1FY23.

- Bank reported a standalone Net Profit of INR 2,168 crore in Q1FY23 as against a profit of INR 1,209 crore in Q1FY22.

- Global NIM stands at 3.02% in Q1FY23.

- Return on Assets (RoA) improved to 0.68% in Q1FY23 from 0.42% in Q1FY22.

- Return on Equity (RoE) increased by 500 bps YoY to 13.63%

- For the consolidated entity, Net Profit stood at INR 1,944 crore in Q1FY23 as against INR 1,187 crore in Q1FY22.

Asset Quality

- The Gross NPA of the Bank reduced to INR 52,591 crore in Q1FY23 from the level of INR 66,671 crore in Q1FY22 and Gross NPA Ratio improved to 6.26% in Q1FY23 from 8.86% in Q1FY22.

- The Net NPA Ratio of the Bank improved to 1.58% in Q1FY23 as compared with 3.03% in Q1FY22.

- The Provision Coverage Ratio of the Bank stood at 89.38% including TWO and 75.94% excluding TWO in Q1FY23.

- Slippage ratio decreased to 1.71% for Q1FY23 as against 3% in Q1FY22.

- Credit cost for the Q1FY23 stands at 0.75%.

Capital Adequacy

- CRAR of the Bank improved to 15.46% in Jun’22 from 15.40% in Jun’21. Tier-I stood at 12.97% (CET-1 at 11.24%, AT1 at 1.73%) and Tier-II stood at 2.49% as of Jun’22.

- The CRAR and CET-1 of consolidated entity stands at 16.03% and 11.93% respectively.

Business position

Financial result for Quarter ended 30th June 2022

Financial result for Quarter ended 30th June 2022

Be the first to comment on "Bank of Baroda announces Q1FY23 Financial Results for the Quarter ended 30th June 2022, reports 79% jump in Q1FY23 net profit at ₹2,168 cr"