- Healthcare services have been brought under the GST regime through imposition of a tax rate of 5% on hospital bed (excluding non-ICU (intensive care unit) beds) charges exceeding Rs. 5,000 per day.

- This is applicable with effect from July 18, 2022

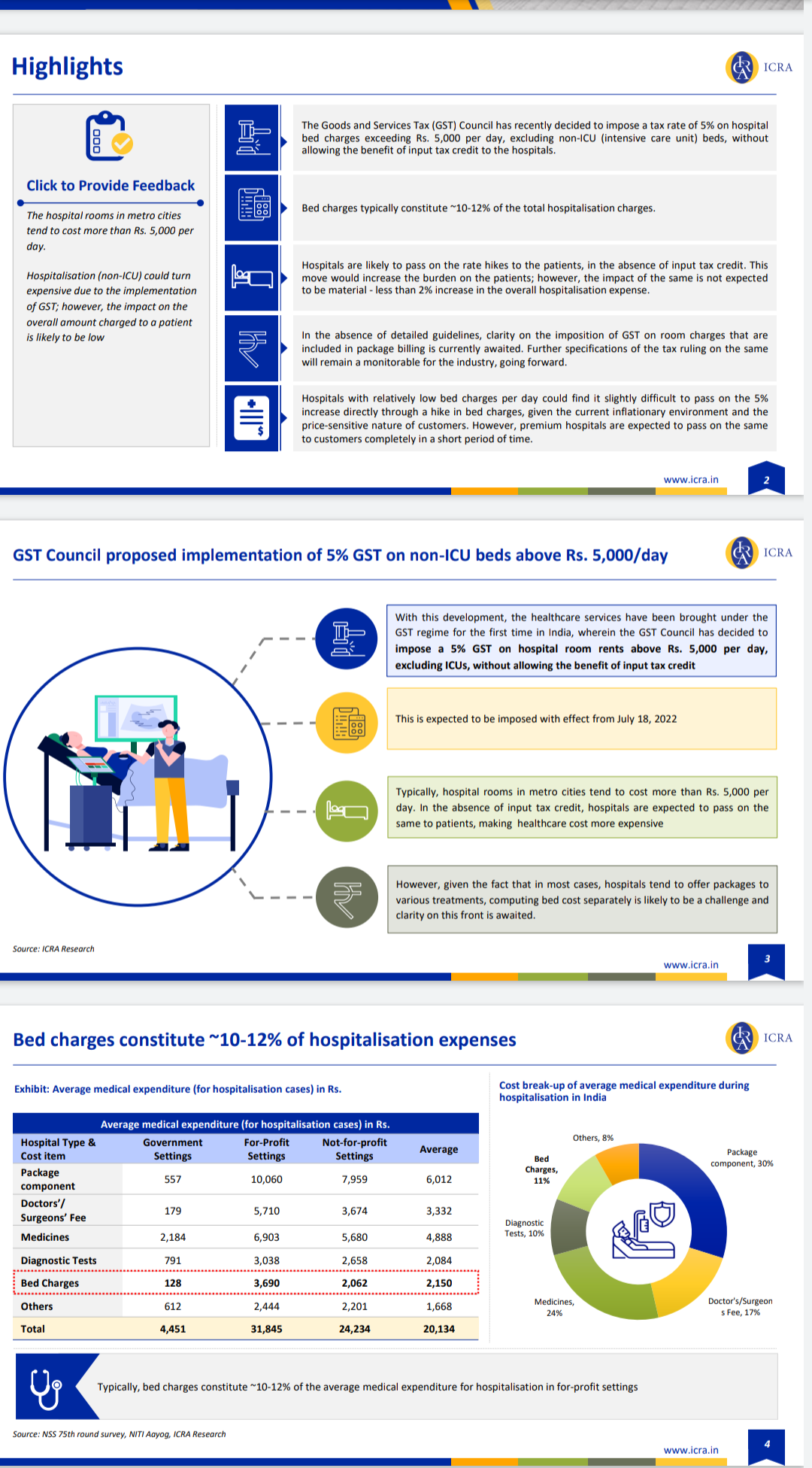

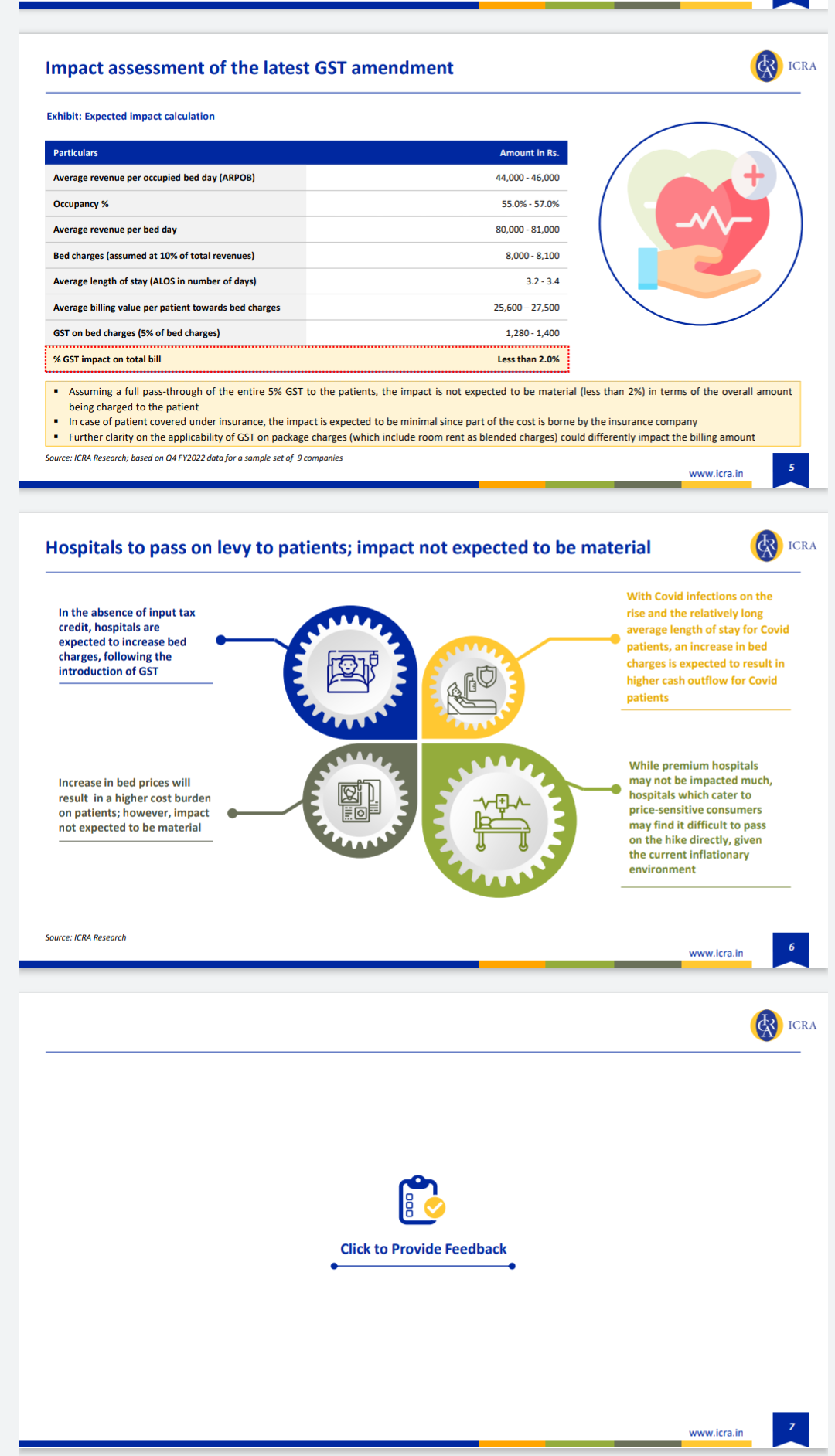

Mumbai, July 07, 2022 (GPN): The GST Council in its latest meeting has decided to impose a 5% on hospital bed (excluding non-ICU (intensive care unit) beds) charges exceeding Rs. 5,000 per day without input tax credit to the hospitals. With this, healthcare services have been brought under the GST regime for the first time. In ICRA’s view, hospitals are likely to pass on the impact of this GST levy to the patients, in the absence of input tax credit. This move would increase the burden on the patients; however, the impact of the same is not expected to be material and is estimated to be less than 2% of the overall amount being charged to the patients. That said, clarity on the imposition of goods & services tax (GST) on room charges that are included in package billing is awaited.

Says Ms. Mythri Macherla, Assistant Vice President and Sector Head, ICRA, “Typically, bed charges constitute ~10-12% of average medical expenditure for hospitalisation in for-profit hospitals. In the absence of input tax credit, we expect the hospitals to pass on the levy to patients, making it largely credit-neutral for hospitals. However, given that in most cases, hospitals tend to offer packages for various treatments, computing bed cost separately is likely to be a challenge and clarity on the same is awaited.”

Be the first to comment on "Introduction of GST on non-ICU hospital beds to be credit-neutral for hospital sector: ICRA"