MUMBAI, 16 JUNE, 2022 (GPN)/ By Mr Dipanwita Mazumdar, Economist, Bank of Baroda: With rise in international oil prices in the last year retail price of petrol has moved up ever since the government linked the base price to global trends i.e. April onwards. The central government has

provided relief in terms of excise duty cut first in Nov’21 and more recently in May’22. The message passed on to the states is that they too must try and lower their taxes to lower price of fuel products.

However, the challenge for any government (centre or states) is that if taxes are reduced there would be a tendency for their tax collections to get affected. It is a zero sum game.

When the centre lowers the excise duty there is an automatic transmission to the base price on which the VAT is imposed and the revenue can get affected in parallel. The countervailing force is that as the base price increases with international price of crude going up there is a natural upside to the VAT

revenue. The net effect is what matters.

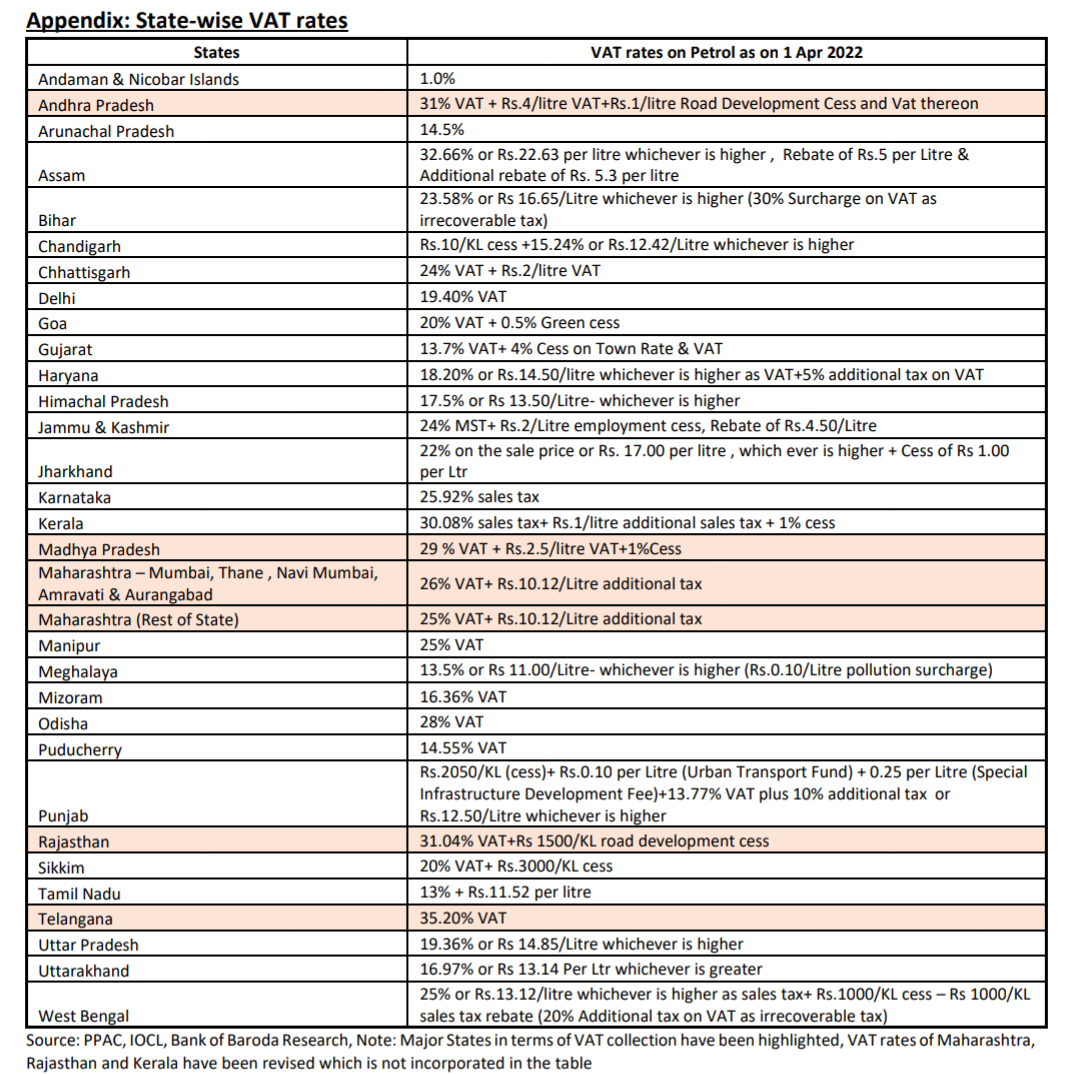

The analysis below looks at the retail price of petrol in different states assuming that the basic price to the dealers plus excise charged by the centre and dealer commission is the same. The VAT rates are

then superimposed on the base price of petrol for two points of time- November 4

th and June 1st. The VAT rates as of April 1st have been used for all states as provided by PPAC. Some states have lowered their VAT rates subsequently, which is not considered here. The purpose is to analyze the fiscal space that is available to states to lower VAT rates on petrol given that the base price has changed with the centre lowering the excise duty by Rs 8 in May while the crude oil price rise has caused the cost for OMCs to increase.

The base price for petrol was Rs 79.98/litre in November and after lowering of excise by Rs 8 in May, brought the base price to Rs 81.01, which is higher. This is so because in this period the crude oil price had gone up thus enhancing the cost to the OMC by Rs 9.10/litre (the dealer commission has come

down marginally).

Some results It has been observed that 16 States have made gain between 20-30 paise/litre due to the increase in oil prices combined with cut in excise duty of the centre, while for another 12 States, the gain has been between 10-20 paise/litre.

Therefore it may be concluded that States have limited fiscal space to further cut VAT rates, in consonance with the current excise duty cut if they have to ensure that

their revenue does not decrease.

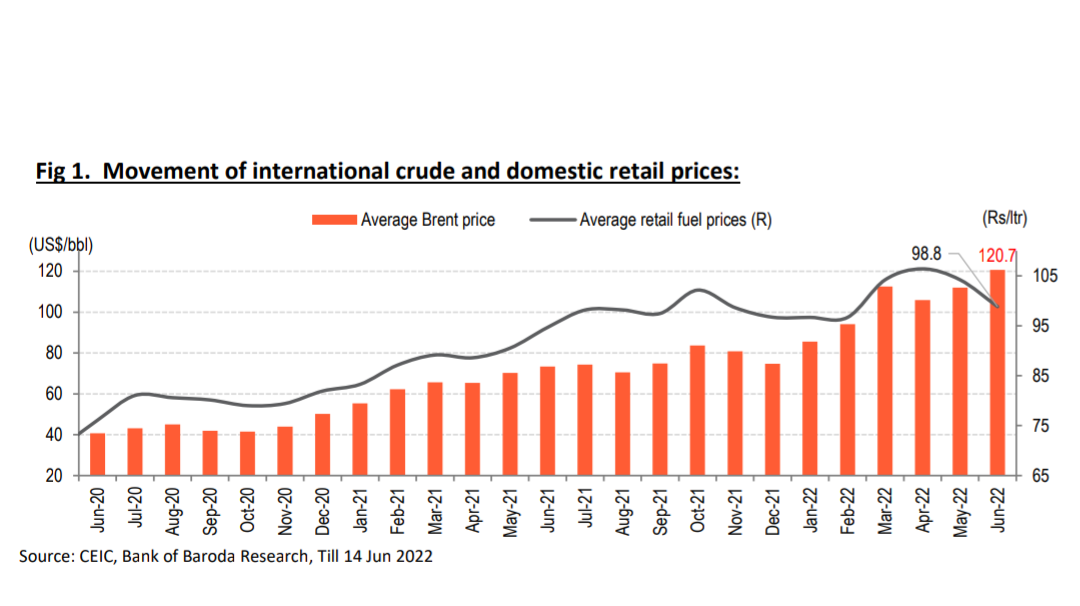

Backdrop: International crude prices have risen considerably from its low of US$ 19/bbl seen in Apr’20 during Covid-19 times. Now it is trading at +US$ 120/bbl. The volatility in international oil prices was

also seen in domestic retail prices of petrol and diesel. Domestic retail prices of petrol and diesel started increasing in tune with global oil prices. Petrol prices have risen from Rs 73/lt to Rs 113/lt between Apr’20 to Apr’22 and diesel prices from Rs 65/lt to Rs 100/lt. It is important to understand

how the mechanism of pass through of international prices to domestic retail prices work.

When retail price of petrol rose to Rs 109.7 as on 1 Nov 2022, government gave relief to the consumers by reducing petrol duty on petrol from Rs 32.9/lt to Rs 27.9/lt. VAT also was reduced simultaneously as the base price came down. For Delhi for instance with the OMCs holding on to their price and the centre lowering excise duty, the VAT on petrol came down to Rs 15.5 from Rs 23.99 level in Nov’21.

When retail price of petrol rose to Rs 109.7 as on 1 Nov 2022, government gave relief to the consumers by reducing petrol duty on petrol from Rs 32.9/lt to Rs 27.9/lt. VAT also was reduced simultaneously as the base price came down. For Delhi for instance with the OMCs holding on to their price and the centre lowering excise duty, the VAT on petrol came down to Rs 15.5 from Rs 23.99 level in Nov’21.

Recently, in May’22, government has again cut the excise duty on petrol and diesel by Rs 8/lt (from Rs 27.9/lt to Rs 19.9/lt) and Rs 6/lt (from Rs 21.8/lt to Rs 15.8/lt),respectively. This has led to a call to states to reduce VAT in response to the current excise duty cut by the centre.

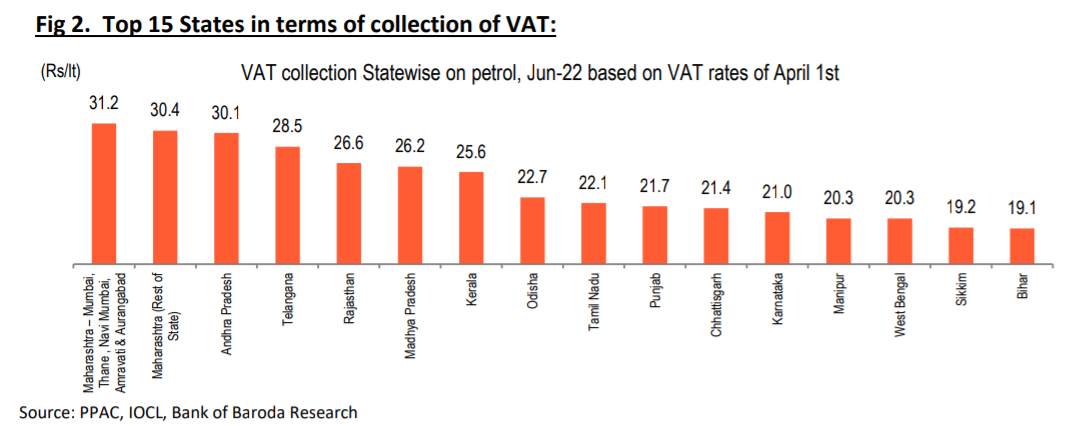

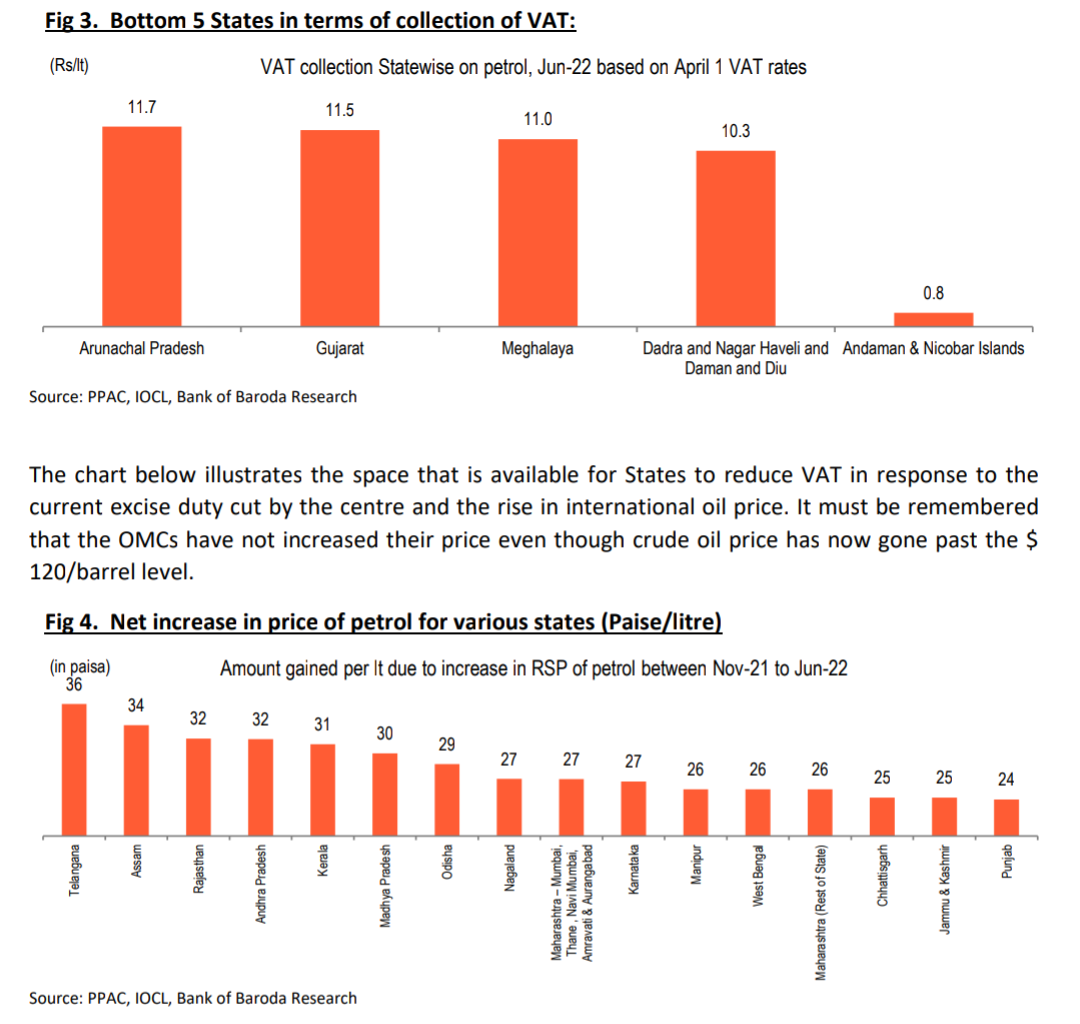

The VAT story across states Considering the VAT rates which are available as of Apr’22, it can be observed that Maharashtra,

Andhra Pradesh, Telangana, Rajasthan and Madhya Pradesh has the highest collection in terms of VAT on petrol. Andaman and Nicobar, Dadra, Nagar, Haveli, Daman & Diu, Arunachal Pradesh, Gujarat and

Meghalaya are the ones where the collection of VAT amount is the lowest.

As can be seen, states have limited scope to lower the VAT on petrol without affecting their tax revenue. In FY21 for instance states earned Rs 2.21 lakh crore on duties on petroleum products while the centre earned Rs 4.20 lakh crore. In the first nine months of FY22, the states earned Rs 2.07 lakh

As can be seen, states have limited scope to lower the VAT on petrol without affecting their tax revenue. In FY21 for instance states earned Rs 2.21 lakh crore on duties on petroleum products while the centre earned Rs 4.20 lakh crore. In the first nine months of FY22, the states earned Rs 2.07 lakh

crore while for the centre it was Rs 3.10 lakh crore. The centre’s collections were lower post the reduction in duty in November. In these 9 months, VAT/sales tax were Rs 1.89 lakh crore and the highest collections were in Maharashtra (Rs 24,886 crore), Uttar Pradesh (Rs 18,998 crore), Gujarat

(Rs 15,600 crore), Tamil Nadu (Rs 15,291 crore) and Karnataka (Rs 14,182 crore).

Be the first to comment on "Dipanwita Mazumdar Economist, BOB: Do states have space to lower VAT on petrol?"