Current sentiments recorded to be at their lowest.

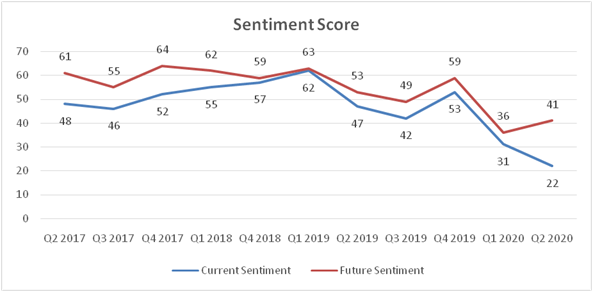

MUMBAI, AUGUST 03, 2020 (GPN): With continued economic stress and ambiguity regarding recovery, the current sentiments of the real estate stakeholders in India have been recorded at a low 22 in Q2 2020 (April – June). However, the stakeholders have shown moderate improvement in future sentiments for the next six months, albeit they remain in the pessimism zone. This was revealed in the recently released 25th Knight Frank – FICCI -NAREDCO Real Estate Sentiment Index Q2 2020 Survey.

The survey indicated that the ‘Future Sentiment Score’ of the stakeholders, though still in the pessimistic scoring zone, has seen improvement at 41 in Q2 2020 against the score of 36 in Q1 2020. This is attributed to an expected improvement in macroeconomic indicators and the adaptation to new business models shaping recovery in the next six months. This survey covering the period April – June 2020 was conducted in the first two weeks of July 2020.

The survey covers key supply-side stakeholders which include developers, private equity funds, banks and non-banking financial companies (NBFCs). A score of 50 represents a ‘Neutral’ view or status quo; a score above 50 demonstrates a ‘Positive’ sentiment; and a score below 50 indicates a ‘Negative’ sentiment.

Shishir Baijal, Chairman and Managing Director of Knight Frank India -Photo By GPN

Shishir Baijal, Chairman and Managing Director of Knight Frank India, says, “With some of the macroeconomic indicators showing marginal improvement and with the impending festive season in the second half of the year, the stakeholders have shown improved sentiments compared to the previous quarter, albeit they have remained in the pessimistic zone. At this juncture, we expect the lockdown to ease by the advent of the festive season, helping to revive economic activity and propel conversion of the pent- up demand.”

Shishir further adds, “The Central Bank and the government have announced stimulus measures that have provided much-required reprieve to the economy in these testing times. However, there is a need for further demand-boosting measures to improve sentiments in the economy. For the real estate sector in particular, there is a need for measures such as additional tax benefits for buying/renting a house, added incentives for affordable housing, easing of credit availability for the sector and a one-time restructuring of developer loans to help the sector recover from this crisis.”

Source: Knight Frank Research

Source: Knight Frank Research

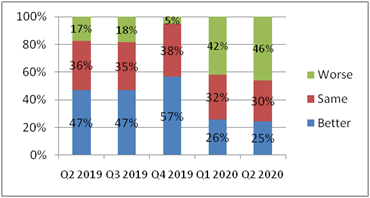

KEY FINDINGS OF THE Q2 2020 SENTIMENT INDEX SURVEY

Current Sentiment Score

- The on-going pandemic has resulted in a downturn in economic activity which has impacted the Current Sentiment Score of the stakeholders recording a low of 22 in Q2 2020.

- Before the COVID-19 crisis, India had been going through an economic slowdown and this negative mood of the market was captured in the scores of Q2 and Q3 2019 that fell in the pessimistic zone.

- Stakeholder sentiments had briefly turned optimistic in Q4 2019 on the back of government measures announced for the real estate sector. However, the sentiment of the market shifted back to pessimism, as the onset of the COVID crisis and the resulting nationwide lockdowns brought most economic activities to a standstill.

Future Sentiment Score

- The Future Sentiment Score inched up to 41 in Q2 2020 indicating a possible but cautionary revival for the real estate market.

- Improvement in macroeconomics and stakeholders adopting a new business model has created a hope for recovery in the next six months.

- The Manufacturing Purchasing Managers’ Index (PMI) in the month of June 2020 witnessed a significant jump to 47.2 against 30.8 in May 2020. According to the Centre for Monitoring Indian Economy (CMIE), the unemployment rates in India have fallen from 23.48% in May 2020 to 10.99% in June 2020 which is a key indicator of economic growth.

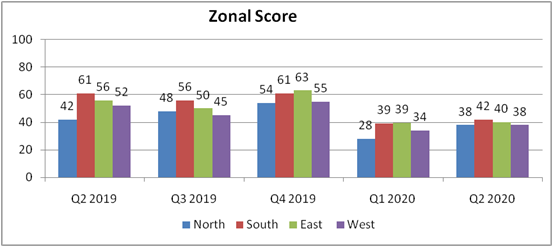

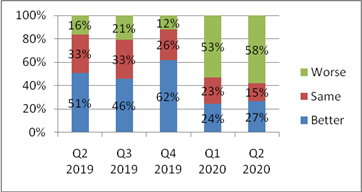

ZONAL FUTURE SENTIMENT SCORE

- The Future Sentiment Score for North, after being in the optimistic zone in Q4 2019, moved to the pessimistic zone in Q1 2020; however, since there was some revival in the business, the sentiment improved to 38 in Q2 2020,though the overall sentiments in all markets remained in the pessimistic zone.

- While the Future Sentiment Index for West has improved marginally to a score of 38 in Q2 2020 as compared to 34 in Q1 2020, South and East also witnessed a marginal upward movement with scores of 42 and 40 in Q2 2020 respectively.

Source: Knight Frank Research

Source: Knight Frank Research

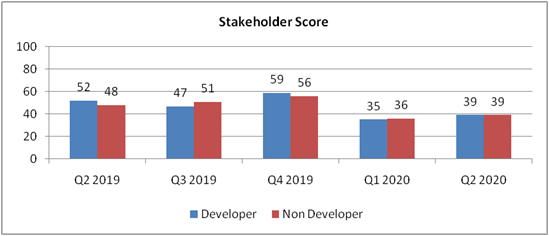

STAKEHOLDER FUTURE SENTIMENT SCORE

- Sentiment score of both developers and non-developers in the real estate sector has seen a marginal revival with scores of 39 each in Q2 2020 as compared to Q1 2020.

- Stalled construction during lockdowns and scarce availability of labour due to reverse migration are likely to result in project delays. Tighter lending norms and low demand on account of crisis-induced job losses and pay cuts will take a toll on developer cash flows. In light of such challenges, developer sentiments continue to remain pessimistic for the next six months.

Source Knight Frank Research

Source Knight Frank Research

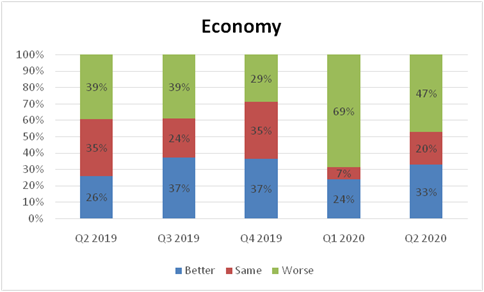

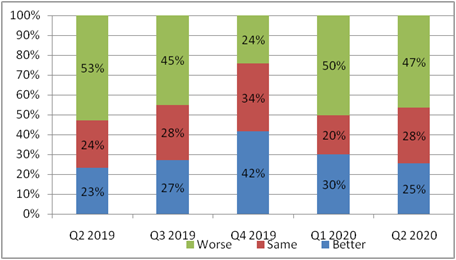

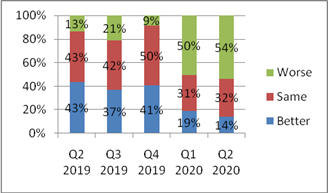

ECONOMIC OUTLOOK AND FUNDING SCENARIO

- With the Indian economy witnessing a slowdown in the last few years, the COVID-19 pandemic outbreak in early 2020 brought business activity to a standstill, translating into an even weaker economy.

- 67% of the respondents believe that the impact of the on-going crisis on the economy will either worsen or continue to remain at the current level for the next six months.

- With regards to funding, 47% of the respondents expect a further reduction in the credit flow to the real estate sector over the next six months, whereas 28% believe that the present levels of credit scarcity will continue for the next six months.

Source Knight Frank Research

Source Knight Frank Research

Funding Scenario

Source Knight Frank Research

Source Knight Frank Research

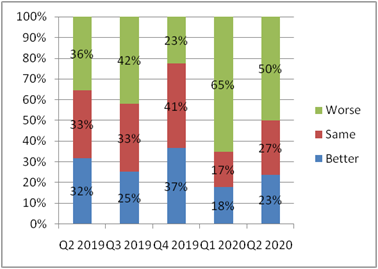

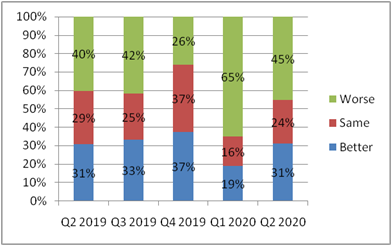

RESIDENTIAL MARKET OUTLOOK

- The residential market across the parameters of new launches, sales and prices continued to be muted in Q2 2020.

- In terms of supply of new residential units, 50% of the stakeholders opined that the situation for new launches will either improve or remain the same in the next 6 months.

- With respect to sales, 31% of the stakeholders are of the opinion that residential sales will get better in the next six months.

- 49% of the respondents feel that prices will weaken further in the next six months, while the remaining 51% think that prices will continue to remain around the current levels or increase in the next six months.

Residential Launches

Residential Launches

Residential Sales

Residential Sales

Residential Prices

Residential Prices

Source: Knight Frank Research

Dr. Niranjan Hiranandani, National President, NAREDCO and Founder & MD, Hiranandani Group, said, “The economy was cratering even before the pandemic hit, with demand stagnation leading to declining GDP growth over successive quarters. The unprecedented Covid19 pandemic and the consequent total economic lockdown had a big dent on sentiments and activity level in Q2 2020. However, realizing the importance of livelihood along with lives has resulted in a recalibrated restart of the economic activities which will have an improved cascading effect gradually. In the backdrop of the current liquidity, labour and raw material shortage, Industry seeks handholding by the government to ease out economic distress. This could be done by reduction in taxes, levies; stamp duties and GST for stipulated time frame to generate demand shock which is imperative to kick start the economic uptick. Simultaneously, in addition to the fiscal stimulus industry pegs high hopes on One Time Debt Restructuring, additional stress fund and enhanced credit flow supply to facilitate working capital requirement of businesses to revive back.

Now as India slowly reopens, the needle seems to be moving, but is it enough to watch. Indian economy is consumption driven and resumption of purchase of houses will rekindle the real estate which in turn reboot about 300 industries with its positive effect and lead to generation of more than five crore jobs across the country. The supply chain disruption has pushed the growth of the Logistics parks sector along with high potential demand in the data centre business in wake of the data protection bill. The social distancing and work from home norms may continue as new normal, which will definitely witness a spurt in demand for residential. Also, demand in commercial and retail spaces will gradually see an uptick with improved economic activities.”

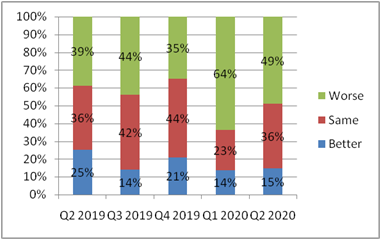

OFFICE MARKET OUTLOOK

- In terms of supply, around 46% of the respondents believe that the new office supply will continue to deteriorate in the next six months, whereas the remaining 55% still believe that new supply will either improve or remain stagnant.

- In the case of leasing activity, 27% of the respondents believe that activity on leasing will improve in the next six months, whereas 73% believe that it will remain around the same level or worsen.

- Stakeholders’ outlook with regards to future rental markets improved by a few percent points where 54% of the stakeholders believe that the rental market will be under pressure for the next six months and 46% think that it will be the same or increase in the next six months.

New Office Supply

New Office Supply  Leasing Volume

Leasing Volume

Rentals

Rentals

Source: Knight Frank Research

Sanjay Dutt, Managing Director & CEO, Tata Realty & Infrastructure Ltd, Chairman, FICCI Real Estate Committee, said, “The sentiment for residential market is expected to remain low with a desire for “unlocking of the lockdown” and therefore better outlook for next quarter. However, if one does this survey again towards the end of the month, it will correct again to current lows. I believe given the constraints, the challenges and the emotional impact, current residential sales are also commendable. Developers have adapted AI, Digitization and SOP’s at accelerated pace. The office market on the other hand has shown nearly 98-99% rent collection, low relevant micro market vacancies with some marginal rental growth abundantly demonstrating its sustainability. This can be attributed to the fact that office is linked to global consumption complemented by cost arbitrage, talent pool, scale, competitiveness, and geopolitical advantage. The retail and the institutional investors are flocking to REITS. You will see by end of the year close to 100 million sq. ft. listed at the exchanges. We expect US$ 2-3 Billion investment to exchange hands by March’ 21. Some vacancies at Tier 2 tenants and developments is expected.” ENDS

Be the first to comment on "Real Estate players expect next 6 months to be moderately better: 25th Knight Frank-FICCI-NAREDCO Sentiment Index"