Average deal size in Mumbai office market records an increase of 44.4% YoY in H1 2020

Average deal size in Mumbai office market records an increase of 44.4% YoY in H1 2020

HOME SALES IN MUMBAI DECLINE BY 45%YOY;LAUNCHES BY 47% YOY IN H1 2020: KNIGHT FRANK INDIA

Q2 almost a washout for sales as well as launches due to the lockdown

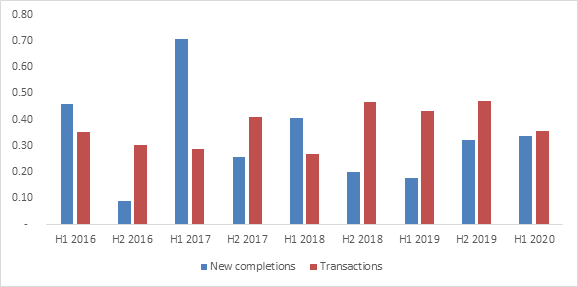

MUMBAI, JULY 18, 2020 (GPN):Knight Frank India launched the 13th edition of its flagship half-yearly report – India Real Estate: H1 2020 – which presents a comprehensive analysis of the office and residential market performance across eight major cities for the January-June2020 (H1 2020) period. The report highlights that the new office completions in Mumbai saw a significant rise of 90% YoY growth to 3.64 mnsq ft in H1 2020, while the office leasing transaction volumes saw a decline of 17% YoY to 3.85 mnsq ft in the same time. Despite a decline in leasing activity, the weighted average transacted rentals grew by 2.2% YoY in H1 2020 as the share of BKC and off-BKC with (2% YoY), and Central Mumbai (3% YoY) was high. The average deal size in Mumbai reported a significant increase of 44.4% YoY to INR 3,892 /sq m (INR 41,987 sq ft) in H1 2020 from INR 2,700 /sq m (INR 29,059 sq ft) in H1 2019. Despite the reduction in the number of deals from 160 in H1 2019 to 91 in H1 2020, the average deal size increase was primarily owing to larger deals transacted in BFSI and IT sectors.

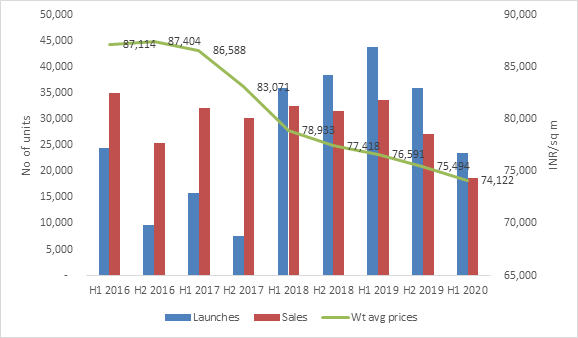

The home sales in Mumbai residential market have witnessed a decline of 45% YoY to be recorded at 18,646 units in H1 2020. Newresidential launches in Mumbai also saw a 47% YoY decline to 23,399 units. On account of the fall in sales velocity, the Quarters to Sell (QTS) for Mumbai Metropolitan Region (MMR) increased from 9.3 at the end of 2019 to 10.8 in H1 2020.

The city also experienced a marginal downward correction in quoted prices with the weighted average prices declining by approximately -3.2% YoY in H1 2020. Further, discounts upto 18%, or higher in some cases, were being offered on the negotiation table on a case-to-case basis depending on developers’ financial conditions and sales position of the project.

OFFICE MARKET HIGHLIGHTS OFMUMBAI

Source: Knight Frank Research

Source: Knight Frank Research

- While the new completion of projects recorded a hike of 90% YoY to 3.64 mnsq ft, leasing activity in Mumbai declined by 17% YoY to 3.85 mnsq ft in H1 2020. This declined was owing to the nationwide lockdown period imposed to combat COVID-19. The large leasing deals by an IT company and a BFSI company adding to 1.8 mnsq ft (0.18 mnsq m) in H1 2020 helped avert a more significant decline in leasing volumes.

- The report highlightsthat the leasing activity is likely to stay under pressure in the coming months given the economic impact of lockdown on India and global recession forecasted for 2020. While many occupiers would look to postpone their leasing decisions till things stabilize, some may be forced to give up existing spaces due to business slowdown.

- In Mumbai, the average deal size increased to 44.4% YoY to INR 41,987 sq ft, despite the reduction in the number of deals from 160 in H1 2019 to 92 in H1 2020.

- The sector ofBFSI had the highest share of transactions in H1 2020 at 41%, followed by Information Technology (IT) at 35%. The share of the IT sector spiked up in H1 2020 due to a large deal by a leading IT company. However, the share of co-working sector in new leasing declined from 7% in H1 2019 to 3% in H1 2020.

- In terms of location, Central Mumbai saw an exponential growth of 353% YoY to 0.67 mnsq ft transactions in H1 2020 followed by CBD & off CBD with 40% to 0.09 mnsq ft and PBD with 8% to 1.57 mnsq ft.

- The business districts of MMRwhich were witnessing stronger rent growth in the recent years witnessed tapering of rent growth due to the lockdown. The rent growth across business districts was marginalwith SBD Central recording the highest rent growth at 4% YoY followed by Central Mumbai at 3%, SBD West at 2%, BKC & off BKC at 2% and CBD & off CBD at1%.

- Rental renegotiations are currently underway and they could not be completed due to the lockdown. The report mentions that due to economic slowdown, there is downward pressure on rentals which would reflect in transactions taking place in the second half of 2020. Rentals are likely to correct in certain business districts, though not on the lines of the post-2008 GFC period.

Rajani Sinha, Chief Economist and National Director, Research, Knight Frank India -Photo By GPN

Rajani Sinha, Chief Economist and National Director, Research, Knight Frank India said, “The nationwide lockdown has brought the hitherto healthy momentum in office market of MMR toa halt. Businesses have become conscious of the impact of the lockdown and have therefore put their expansion plans on hold leading to lower leasing activity specially in Q2 2020. Companies are further looking to save on operating expenses by seeking to renegotiate existing leases. Overall the leasing activity is likely to stay under pressure in the coming months given the economic impact of lockdown on India and global recession forecasted for 2020.”

Rajani Sinha further added, “Co-working spaces, that had been observing phenomenal rise till end of 2019, were quick to go into a wait and watch mode, as the vacancy in co-working spaces increased as a direct result of the lockdown. Operators are expected to remain cautious about new space take-up in the coming six months further impacting the office space take up.”

RESIDENTIALMARKET HIGHLIGHTS OF MUMBAI

Source: Knight Frank Research

Source: Knight Frank Research

- The on-going pandemic has brought the construction and on site sales activity at a halt. Residential sales declined by 45% YoY to 18,646 units in H1 2020, and new launches were lower by 47% YoY to 23,399 units. The second quarter was a challenging period and almost a washout for both launches as well as sales.

- The city’s weighted average prices were lower by 3.3% YoY to INR 6,886 sq ft in H1 2020. Developers have not reduced quoted prices much, as it has much larger implications on the project. In one-on-one negotiations on the table with the homebuyers, developers have been seen offering discounts upto18% or even more in few cases.

- To keep the market economics in play during the pandemic hit the industry, developers are offering many indirect offers such as deferred payment plans, assured rentals, EMI waivers, subvention schemes, PLC waivers, and free clubhouse membership. Absorption of GST and stamp duty charges by developers are also on offer in the market.

- In line with buyer preferences, 54% of the total sales in H1 2020 were below INR 5 mn ticket size, followed by above INR 5 mn ticket size segments with 46% share respectively.

Rajani Sinha, Chief Economist and National Director, Research, Knight Frank India -Photo By GPN

Rajani Sinha, Chief Economist and National Director, Research, Knight Frank India said,“The impact of the lockdown has been severe on the residential sector, which was already facing challenges due to slower economic growth, erosion of end user’s financial confidence and challenges of NPAs. The issues are further compounded for both the supply and demand side as lending activities have reduced as financial institutions have become extremely cautious in extending loans. Going forward, for the development side of the residential segment, the government’s proactive actions such as extension of subsidy schemes, reduction in stamp duty rates, one-time restructuring schemes and changes to FDI policywill be required for the sector torevive. While for the end users to return to investing in real estate, the government would have to provide long term financial security through growth oriented economic policies.” ENDS

Be the first to comment on "OFFICE LEASING DECLINES 17% YOY IN H1 2020 SAVED BY 2 LARGE DEALS FOR A BIGGER SLIDE: Knight Frank India"