MUMBAI, 4 JULY, 2020 (GPN): The Board of Directors of Indiabulls Housing Finance Ltd. (IBH) announced its unaudited financial results for the quarter ended March 31st 2020.

The numbers are reported under Indian Accounting Standards (Ind AS).

IBH’s Profit:

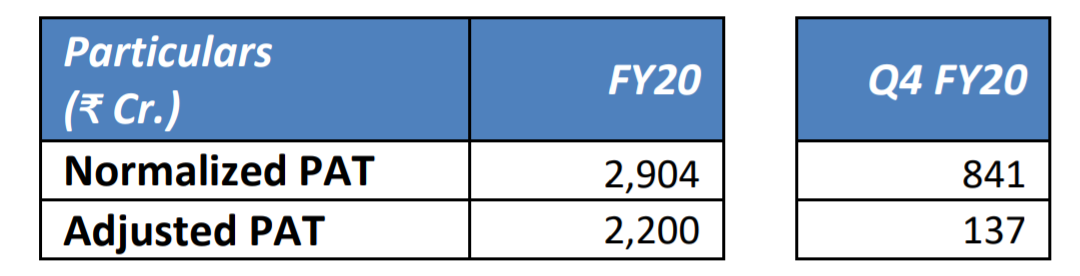

IBH has chosen to adopt a conservative approach on account of macro uncertainties resulting from COVID-19 and have provided for 1% of its loan book, i.e. ₹ 700 Cr, from the P&L on account of COVID-19. Adjusted for the COVID-19 related provisions, taken through the P&L, aggregating to ₹ 700 Cr, Normalized PAT for the Company for the quarter is ₹ 841 Cr, and

for full FY20 is ₹ 2,904 Cr.

Highlights:

₹ 1,802 Cr of profit on fair valuation of holding in OakNorth Bank has been routed through Other Comprehensive

Income [OCI], instead of the P&L as required by IndAS – such routing is consistent with our past practise of

recognising fair value gains and realised gains through the OCI. Further, the routing through OCI in the consolidated financials has been done to facilitate a dip of ₹ 1,798 Cr into the OCI to create provisions.

The Company has also provided for 1% of its loan book, i.e. ₹ 700 Cr, from the P&L on account of COVID-19.

In all, the total provisions now stand at ₹ 3,741 Cr, including conservative provisions created on account of COVID-19 pandemic. Total provisions at 5.4% of loan book and 218% of GNPA

Of the total provisions of ₹ 3,741 Cr, besides ECL and regulatory provision, ₹ 2,391 Cr of extra provisions are

available representing 3.4% of loan book

Over the last 3 months IBH has raised ₹ 9,494 Cr of long term monies representing 12.5% of the Company’s total liabilities

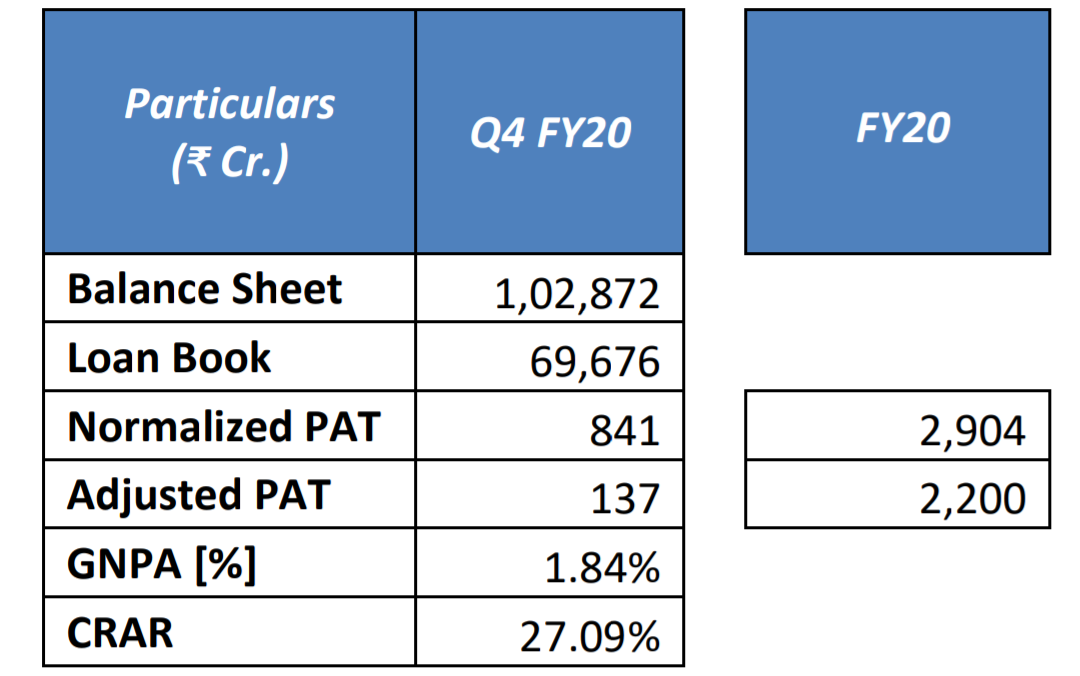

Balance sheet size at the end of FY20 is at ₹ 1,02,872 Cr.

On balance sheet loan book stands at ₹ 69,676 Cr.

Normalized PAT for FY20 is ₹ 2,904 Cr. and for Q4 FY20 is ₹ 841 Cr. Adjusting for additional conservative provisions

of ₹ 700 Cr, Adjusted PAT is at ₹ 2,200 Cr. for FY20 and ₹ 137 Cr. for Q4 FY20

Gross NPAs stands at 1.84%. Effectively Net NPA of ZERO

Capital adequacy stands at 27.09% and Tier 1 at 20.31%

Company’s liquidity buffer stood at ₹ 13,410 Cr as at end of FY20, representing 13% of its Balance Sheet

The Company’s ALM is fully matched for all granular buckets for 10 years and beyond. The company has a positive balance across all buckets and will have a positive net cash of ₹ 10,686 Cr at the end of first year.

Key Financials:

Conservative Provisioning:

Conservative Provisioning:

IBH has adopted a conservative & prudent approach to provisioning, given macroeconomic uncertainties

due to COVID-19. To effectively tackle any and all potential future contingencies the balance sheet has

been strengthened by creation of additional conservative provisions of ₹ 700 Cr, representing 1% of the

Company’s loan book, through the P&L and another additional ₹ 1,798 Cr of provisions, from its gain on fair valuation of holding in OakNorth Bank, routed through the Other Comprehensive Income [OCI] as

required by IndAS.

Combining the two, the total provision buffer has now been shored up to ₹ 3,741 Cr which is 5.4% of the loan book and 218% of GNPA as of March 2020. The Company’s Gross NPA as at March 2020 stands at 1.84%. With the extra provisions created during the quarter, the Company has effectively achieved ZERO Net NPA status and now carries ₹ 2,391 Cr of extra provisions, representing 3.4% of loan book, to tide over any contingencies arising out of Covid-19.

Funds raised in last 3 months:

The last 3 months have been the best since September 2018 in terms of the funds raised by the Company.

IBH raised a total of ₹ 9,494 Cr., representing 12.5% of the total liabilities of the Company, through various institutions, including ₹ 1,275 Cr. of 5-year term loans; ₹ 1,230 Cr. of bonds of maturity greater than 3

years; and ₹ 5,120 Cr. of bonds and loans of between 1 and 3 years. Even during the lockdown the Company was able to securitise developer loans and generate ₹ 1,870 Cr. of long-term monies co-terminus with the loans. This was a big achievement as the Company was able to complete what is usually a

logistically cumbersome exercise coordinating across multiple locations to achieve this. Along with the retail sell down, securitization of loans has always been a core element of the Company’s business model.

Moratorium:

In line with the RBI’s guidelines and as per policy approved by the Board, the Company has extended the benefit of moratorium to all customers, retail as well as wholesale. As at the end of June, 20% of IBH’s customers have availed of the moratorium. Customers are being educated on the economics of the

moratorium and the proportion of customer opting for moratorium has thus declined from the peak of

35%. Collections have effectively doubled from April to May and again from May to June. The Company

has made requisite loan provisions for the loan book under moratorium.

Board Approval to Raise Funds:

The Company’s focus till the end of H1FY20 will be on maintaining adequate liquidity on balance sheet and

conserving capital. The Board of Directors of the Company approved fund raise of up to $ 300 Mn either

through equity or debt. ENDS

Be the first to comment on "Indiabulls Housing Finance Limited announces its Q4 and FY20 Financial Results FY20 PAT of ₹ 2,904 Cr. Q4 FY20 PAT of ₹ 841 Cr. Total Provisions of ₹ 3,741 Cr. equivalent to 5.4% of Loan Book"