Knight Frank India- ‘Co-working: Surviving COVID-19’ Report 2020

MUMBAI, JUNE 19, 2020 (GPN) – The smaller co-working space operators are expected to find it very difficult to weather the COVID-19 storm; according to ‘Co-working: Surviving COVID-19’ report released by Knight Frank India, the global real estate consultancy. Approximately 25%, that is, 6.4 million square feet (msf) of the total 25.45 msf co-working stock in the top eight cities is operated by small players. Knight Frank India estimates that at least half of this stock amounting to 3.2 msf will be vacated by their operators within 2020 as these small operators fade away. Low occupancy and increasing cost are expected to make Co-Working operations unviable for fringe players and would therefore force smaller players to vacate their low performing offices.

MUMBAI, JUNE 19, 2020 (GPN) – The smaller co-working space operators are expected to find it very difficult to weather the COVID-19 storm; according to ‘Co-working: Surviving COVID-19’ report released by Knight Frank India, the global real estate consultancy. Approximately 25%, that is, 6.4 million square feet (msf) of the total 25.45 msf co-working stock in the top eight cities is operated by small players. Knight Frank India estimates that at least half of this stock amounting to 3.2 msf will be vacated by their operators within 2020 as these small operators fade away. Low occupancy and increasing cost are expected to make Co-Working operations unviable for fringe players and would therefore force smaller players to vacate their low performing offices.

On the positive side, the uncertain economic environment will compel more companies to look for flexible options that can adapt to and fulfil their changing requirements, without capital expenses and shorter lease terms. Knight Frank believes that while the industry is expected to see significant exit of start-up tenants and smaller occupiers as they cut on costs in this crisis scenario, the demand from large enterprises is expected to grow over the medium to long-term. The increasing need for flexibility and the competitive advantage of being a workspace expert will sustain the industry over the long term.

While there are over 250 co-working players operational in India today, an estimated 75 – 80% of the market in the top eight cities is dominated by the top 10 players. The annual space taken up by co-working players has nearly quadrupled since 2017 to a little over 8 msf(0.75 mnsq m)in 2019.

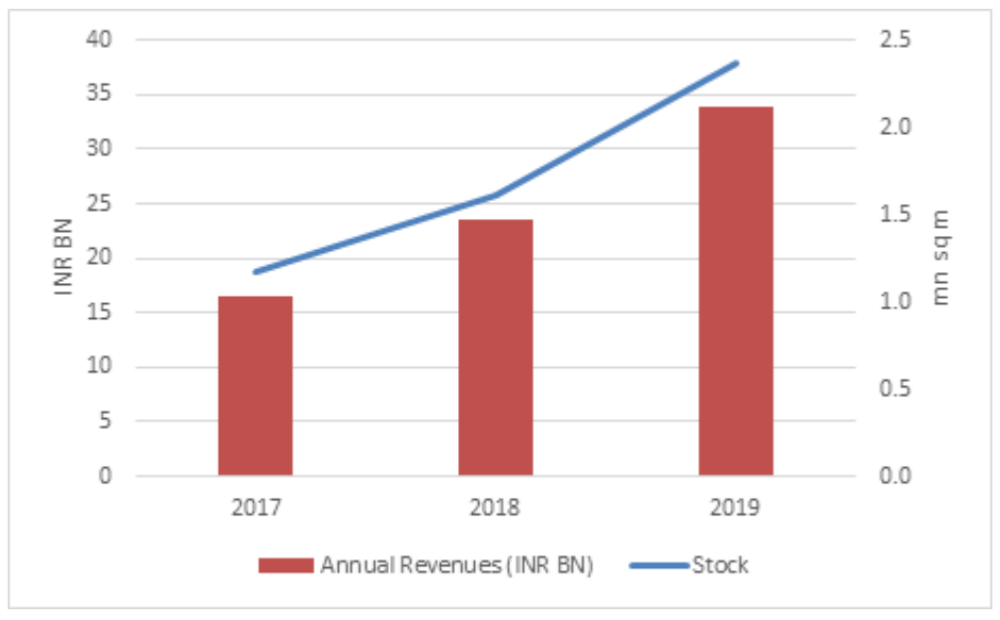

BRISK GROWTH IN CO-WORKING INDUSTRYSTOCK AND REVENUE

Source: Knight Frank Research

Source: Knight Frank Research

Gross revenues of the co-working business in India have more than doubled since 2017 to an estimated INR 34 bn or USD 470 mn in 2019. The top eight cities of India contained an estimated25.45 msf(2.4 mnsq m)of co-working stock at the end of 2019, which is about 3.4% of the total office stock. Various estimates place the same metric for the US at a much lower 1.5-2%. In the long term, Knight Frank India expects that the need for flexible office format will result in its share growing steadily, globally and in India as well.

| Stock across major markets (mn sq ft) | |||

| Top cities | 2017 | 2018 | 2019 |

| Ahmedabad | 0.09 | 0.15 | 0.22 |

| Bengaluru | 3.93 | 5.55 | 7.85 |

| Chennai | 0.93 | 1.33 | 1.95 |

| Hyderabad | 1.91 | 2.62 | 4.68 |

| Kolkata | – | 0.01 | 0.03 |

| Mumbai | 2.50 | 3.08 | 3.67 |

| NCR | 1.89 | 3.20 | 4.73 |

| Pune | 1.33 | 1.46 | 2.32 |

| India | 12.59 | 17.40 | 25.45 |

Source: Knight Frank Research

| Transactions across major markets (mn sq ft) | |||

| Top cities | 2017 | 2018 | 2019 |

| Ahmedabad | – | 0.06 | 0.07 |

| Bengaluru | 0.73 | 1.62 | 2.29 |

| Chennai | 0.14 | 0.40 | 0.61 |

| Hyderabad | – | 0.71 | 2.06 |

| Kolkata | – | – | 0.02 |

| Mumbai | 0.71 | 0.58 | 0.59 |

| NCR | 0.26 | 1.31 | 1.53 |

| Pune | 0.38 | 0.13 | 0.87 |

| India | 2.22 | 4.81 | 8.05 |

Source: Knight Frank Research

Bengaluru and NCR have been major markets for flexible office space due to the proliferation of a start-ups and a greater acceptance of the flexible workspace format by resident companies in the technology sector.

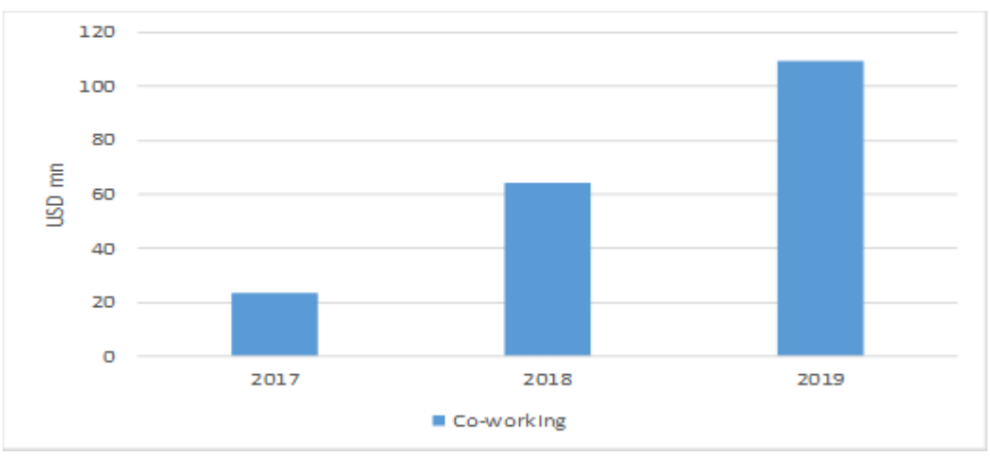

Private Equity Investments in Co-working The co-working engine was fuelled by private equity investors looking to cash in on a high growth opportunity. This growth capital spurred an expansion spree that saw co-working operators claiming nearly 13% of the total office space transacted during 2019. Close to USD 110mn of private equity investments were made in co-working businesses in 2019. Although this amounts to just under 4% of the total private equity investments seen in the Indian office sector as a whole, investments in co-working businesses have grown over 71% YoY in 2019.Awfis, GoWork, BHIVE, Workspace, 91springboard,Indiqube and Innov8 were among the prominent recipients of private equity infusions.

PRIVATE EQUITY INVESTMENTS IN CO-WORKING (USD)

Source: Knight Frank Research, Venture Intelligence

Source: Knight Frank Research, Venture Intelligence

Shishir Baijal, Chairman & Managing Director, Knight Frank India said, “The Indian co-working business, much like other sectors will feel the impact of the COVID- 19 pandemic with the fringe players likely to make an exit. This will be a period of shake-out for this segment where we expect larger players with a greater weightage of enterprise tenants to endure. Though the immediate fallout of tenant exits and revenue disruptions will be challenging, a renewed focus on tenant safety and the still attractive premise of flexibility, especially in the light of the current economic uncertainty should ensure that sustenance and growth of the co-working industry in the long-term.”

COVID-19: Market impact on co-working

- Demand from MSMEs and start-up tenants to reduce to a great extent: On an average, they make up approximately 25-40% of the tenant rosters of prominent co-working operators, but there are some players who have up to 60% of their portfolio constituted of these tenants.

- Smaller operators will be most impacted: Nearly 80% of the co-working players in India do not operate at the scale of the top 10 in the industry. Small operators will not be able to sustain, due to their disproportionate exposure to start-ups and SME tenants that do not have the financial muscle to outlive this crisis.

- Demand from large enterprises expected to sustain and grow over medium to long term: Most operators that have built large capacities of over 15,000 seats across Indian cities have a 60-75% weightage of large enterprise clients and demand from this segment is expected to sustain and grow over the medium to long term.

- Shorter tenures and lower membership costs: Co-working operators with higher weightage of enterprise tenants will remain reasonably insulated from immediate tenant exits. However, it will still not protect them from having to re-negotiate per seat costs and renewal terms.

- Renegotiation with landlords and a focused shift toward revenue or profit-sharing agreements: As in the case of mall and office space occupiers, co-working operators are also renegotiating rents downward or asking for a temporary moratorium in rents. Additionally, co-working players will increasingly look to acquire office space on revenue or profit – sharing terms to reduce their own fixed costs and improve their financial resilience in the event of a downturn.

- Business focus shift toward customised and managed co-working offices in long term: We expect that co-working industry will need to steer toward a customized Managed Office model that will allow occupiers to pick and choose the amenities they pay for and nothing more.

COVID-19: Operational impact on co-working

The co-working industry will be expected to adopt new norms that determine tenant safety in order to protect its well-earned reputation. Post COVID 19, the next few years will be defined by experimentation, with businesses re-evaluating their expectations from an office space.

- De-densification: The current norm in the industry for space per seat is at approximately 65-70 sq ft (70% efficiency) and this could well go up to 100 sq ft per seat to accommodate the more contemporary norms once the dust from COVID-19 settles.

- Enhanced safety and hygiene norms in line-with official guidelines and protocols will be crucial. Efforts will have to be made to minimize the physical contact points that an employee needs to make in order to function in an office environment. Reduction in communal spaces, shared amenities and the open office format will be a big point of focus to lower the risk of infections further. While these safety measures would entail an increase in costs, adopting these best practices is critical to inspire confidence in occupiers to return to the co-working office. ENDS

Be the first to comment on "The need for flexible office formats to sustain demand for the co-working segment in long-term: Knight Frank India"