Mr. Suraj Moraje, ED & CEO, QUESS CORP

BENGALURU, INDIA – 27th MAY, 2020 (GPN): Quess Corp, India’s leading business services provider announced its financial results for the quarter and year ended 31st March 2020 today.

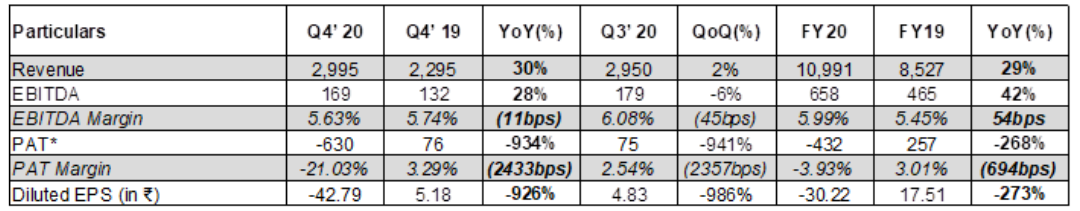

The key consolidated financial parameters are:

*FY20 PAT is after one-time non-cash charge on account of goodwill impairment & change in tax regime

*FY20 PAT is after one-time non-cash charge on account of goodwill impairment & change in tax regime

Financial Highlights (Q4 & FY20):

- Q4 FY20 Revenues grew 30% YoY (organic growth of 27%) and 2% QoQ (all organic) driven by an exceptional performance in general staffing (up 67%)

- FY20 revenue was up 29% to ₹10,991cr with headcount growing by 21% to ~384,000

- Quarterly EBITDA grew 28% YoY to ₹169cr. EBITDA decreased marginally QoQ on account of COVID impact

- FY20 EBITDA was up 42% to ₹ 658crwith margin improvement of 54 bps

- FY 20 Operating PAT, i.e., before the one off exceptional items and Ind AS adjustments (comparable to last year PAT)up 11% at ₹ 284 crores

- FY 20 Reported PAT includes one off non-cash charge of ₹ 664 crores on account of Goodwill impairment and change in tax regime

- Improvement in cash position due to continuous focus on collections – combinedDSO improved to 57 days from 63 days in Q4FY19 and 59 days in Q3FY20

- OCF for FY20 grew 16% YoY withconversion ratio marginally higher at 44%vs same period last year. Normalised OCF / EBITDA conversion (adjusted for pre-released expenses) stands at 51%, implying 34% growth in normalised OCF

- QOQ Net Debt increased by ₹ ~41cr to₹ ~354cr, primarily on account of ₹100 crores precautionary working capital linesdrawn in March 2020 due to COVID impact.However, Gross debt / EBITDA levels remained largely flat

Q4 Corporate Actions:

- COVID update:

- At Quess, we have always believed in Winning Together with our 3 pillars, our Customers, People and Investors. This is especially true when faced with adversity and challenges. We are standing by our 3 pillars in these challenging times and supporting them through the COVID-19 Pandemic

- Our first reaction post-COVID was to ensure our employees and associates were secure, and to put in place appropriate BCPs

- We moved ahead of most of our industry to work from home, resulting in our being extraordinarily prepared to process salaries and close invoices even while being 100% remote

- Management change: Mr. Suraj Morajetook over as Group CEO & Executive Director on April 1, 2020

- Stake purchase: Board approved cash-neutral increase of stake in Terrier Security Services from 49% to 74%

- Optimization of Group Structure: Board approved the merger of 4 wholly owned subsidiaries with Quess – Goldenstar, Greenpiece, MFX India and Trimax Smart Infra

- Other key business updates:

- Termination of JV between QEBC and East Bengal Football club with effect from May 31, 2020

- In the Ahmedabad Smart City Project, out of the total project cost of ₹ 230cr, ₹ 97.5cr was collected till Q4’ 20

Q4 Business Updates:

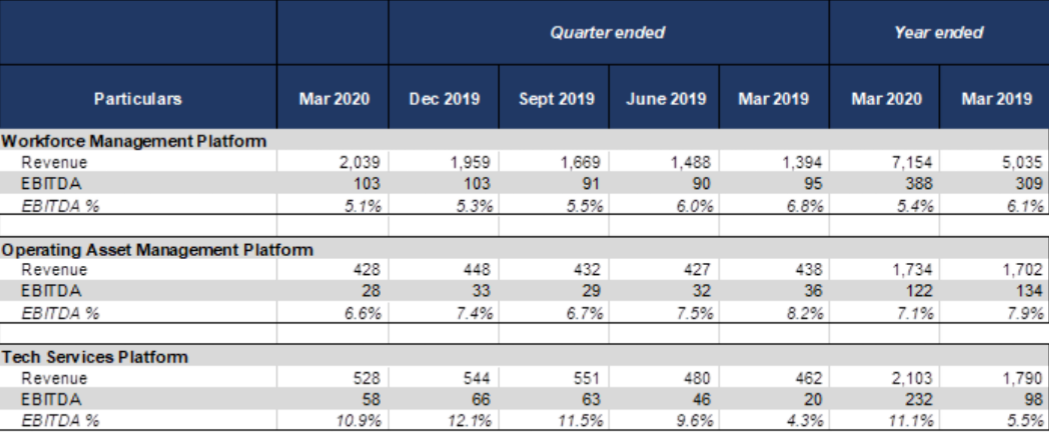

The key business updates, split platform-wise, are as follows:

Workforce Management Platform:

- General Staffing won 27 new logos,including a large retail deal. Headcount growth dampened by a slowdown in general rehiring. Increased cross sell penetration – more than 50% of customers work with >1 vertical

- IT Staffing improved productivity (e.g., fitments per recruiter, invoicing time), enhanced sourcing from 6 to 12 channels, increased focus on high margin segments, and introduced training services

- Training & Skill Developmentexpanded B2B segment sales while transitioning in B2C capability from TCIL. Focus on digitization of content

- Overall emphasis on digitisation,with greater focus on digitally-enabled VAS, back-end RPA implemented for 500+ clients covering 80K+ associates

Operating Asset Management Platform:

- IFM top line flat QoQ largely due to lockdown impact on food business. YoY margin expansion by 1.5 percentage points through higher share of comprehensive contracts. Expanded sales team and deepened focus on verticalization for growth push in FY 21

- Terrier Security continued rapid growth with healthy customer acquisition and focus on integrated man tech solutions with a common digital platform. Improved collections performance and expanded training capabilities to facilitate rapid scale-up

- Industrial business restructured, adding several new customers in focus verticals (power, metal and ONG O&M) and dunning unprofitable services

Tech Services:

- IT Services business delivered a strong quarter in NA and India, invested in growth

- HRO business grew topline 7% YoY in India and internationally, processing highest volume in Q4. Focus on further strengthening technology platform

- CLM/BPM business acquired 6 clients in Q4. Revenue and EBITDA lower QoQ due to lockdown impact

Segment Wise Performance:

Commenting on the financial results, ED & CEO Mr. Suraj Moraje said, “Quess delivered a strong year, with 29% revenue growth and 42% EBITDA growth. Our focus on OCF generation (including DSO reduction from 69 days in FY19 to 62 days in FY20) saw us grow OCF by 34% on a normalized basis. We are especially pleased by the growth delivered by our General Staffing and Allsec businesses. We have taken resolute steps to further develop our business and to face headwinds that the global COVID-19 crisis seeded in Q4. We are confident that these actions will continue to boost our OCF growth and ROE in the medium term, while ensuring the institution emerges stronger and even more resilient from this tragic period for humankind.” ENDS

Commenting on the financial results, ED & CEO Mr. Suraj Moraje said, “Quess delivered a strong year, with 29% revenue growth and 42% EBITDA growth. Our focus on OCF generation (including DSO reduction from 69 days in FY19 to 62 days in FY20) saw us grow OCF by 34% on a normalized basis. We are especially pleased by the growth delivered by our General Staffing and Allsec businesses. We have taken resolute steps to further develop our business and to face headwinds that the global COVID-19 crisis seeded in Q4. We are confident that these actions will continue to boost our OCF growth and ROE in the medium term, while ensuring the institution emerges stronger and even more resilient from this tragic period for humankind.” ENDS

About Quess Corp

Quess Corp Limited (BSE: 539978, NSE: QUESS), is India’s leading business services provider. At Quess, we excel in helping large and emerging companies manage their non-core activities by leveraging our integrated service offerings across industries and geographies which provides significant operational efficiencies to our clients. Quess has a team of over 384,132 employees across India, North America, South America, South East Asia and the Middle East across platforms such as Workforce Management, Operating Asset Management and Technology Services. Quess serves over 2,600 clients worldwide. Established in 2007, Quess is headquartered in Bengaluru, India and has a market cap of approx. ₹ 3,130cr as of March 31st, 2020.

For further details on Quess Corp Ltd., please visit:http://www.quesscorp.com.

Be the first to comment on "Navigating successfully in turbulent times: Quests Corp announces its financial results for Q4FY20 and full year FY20"