- IBHF Intimation of NCD.

- Indiabulls Housing Finance raises Rs 1,030 cr.

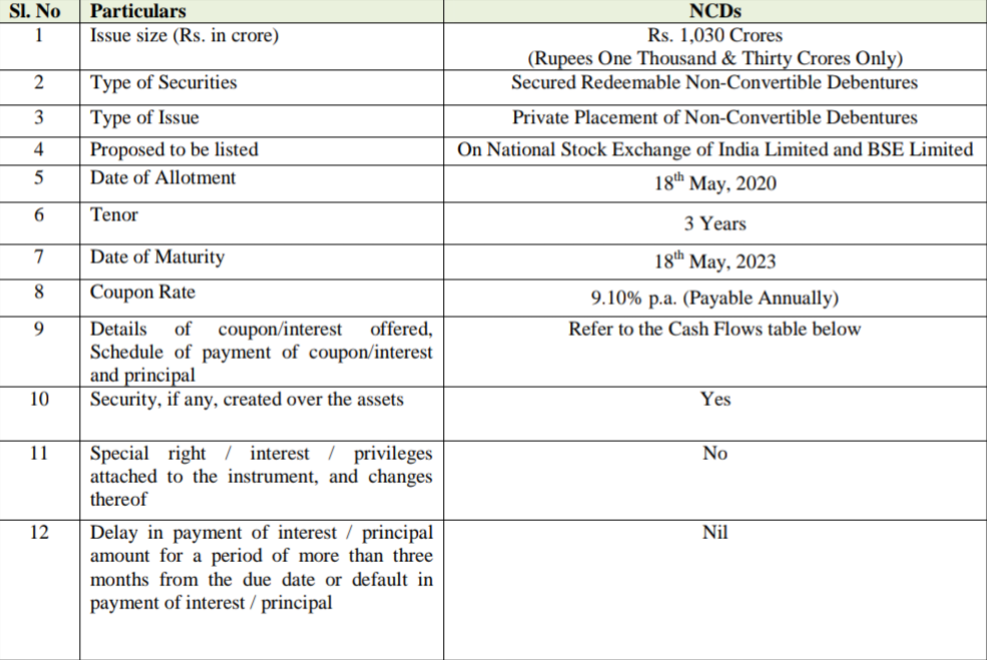

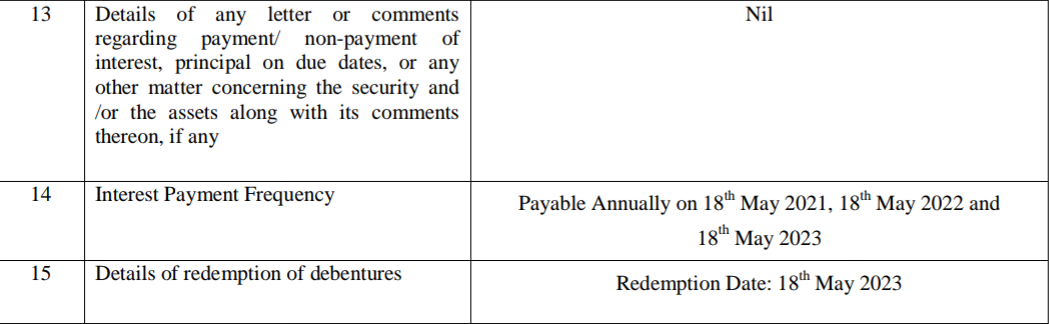

MUMBAI, 19 MAY, 2020 (GPN): Pursuant to Regulation 30 and other applicable provisions of SEBI (Listing Obligations and Disclosure Requirements)

Regulations, 2015, we wish to inform that in terms of the Board authorization dated February 5, 2020, the Company

has today, May 18, 2020, allotted 10,300 Secured, Redeemable, Non-Convertible Debentures of face value Rs. 10 lakh

each (“NCDs”) aggregating to Rs. 1,030 Crores, on a private placement basis, as per below mentioned details. These

NCDs have been subscribed by four large Indian public sector banks.

Sl. No Particulars NCDs

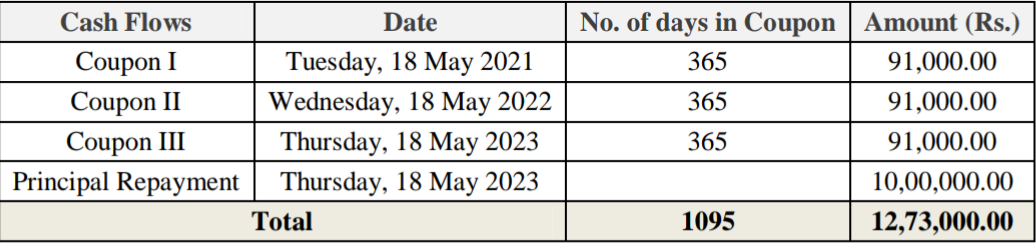

Cash Flows in respect of Debenture of face value Rs. 10 lakhs

Indiabulls Housing Finance announced it has raised Rs 1,030 crore by issuing bonds on a private placement basis.

The company on May 18 allotted 10,300 secured, redeemable, non-convertible debentures of face value Rs 10 lakh each, aggregating to Rs 1,030 crore, on a private placement basis, the company said in a regulatory filing.

The coupon rate on the bonds with three years tenor is 9.10 per cent per annum (payable annually). ENDS

Be the first to comment on "Indiabulls Housing Finance Allotment of Secured, Redeemable, Non-Convertible Debentures on a Private Placement basis – Intimation under SEBI"