For 9M FY2020 – Revenue growth of 34.3% | PAT growth of 46.2% (y-o-y)

For Q3 FY2020 – Revenue growth of 27.4% | PAT growth of 31.3% (y-o-y)

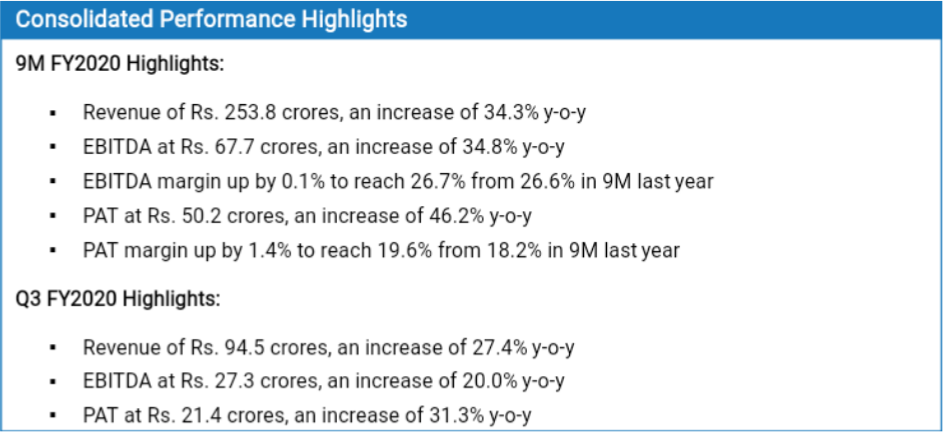

Consolidated Performance Highlights

9M FY2020 Highlights:

- Revenue of Rs. 253.8 crores, an increase of 34.3% y-o-y

- EBITDA at Rs. 67.7 crores, an increase of 34.8% y-o-y

- EBITDA margin up by 0.1% to reach 26.7% from 26.6% in 9M last year

- PAT at Rs. 50.2 crores, an increase of 46.2% y-o-y

- PAT margin up by 1.4% to reach 19.6% from 18.2% in 9M last year

Q3 FY2020 Highlights:

Q3 FY2020 Highlights:

- Revenue of Rs. 94.5 crores, an increase of 27.4% y-o-y

- EBITDA at Rs. 27.3 crores, an increase of 20.0% y-o-y

- PAT at Rs. 21.4 crores, an increase of 31.3% y-o-y

- PAT margin up by 0.3% to reach 22.3% from 22.0% in Q3 last year

NEW DELHI, FEBRUARY, 3, 2020 (GPN): Affle (India)Limited, a consumer intelligence drivenglobal technology Company, today announced the results for third quarter and nine months ended December 31, 2019.

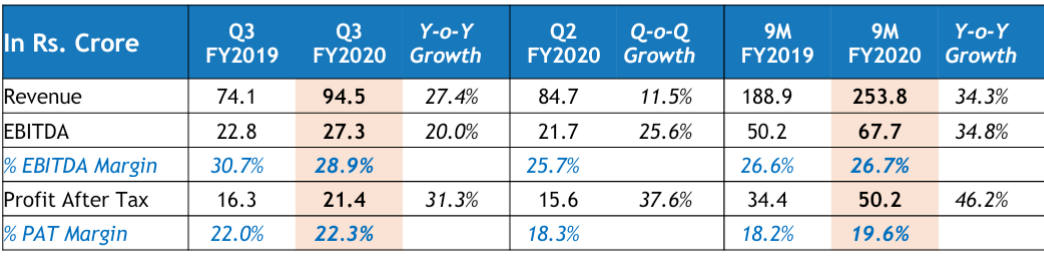

Affle reported a robust performance for 9M FY2020 with a consolidated revenue of Rs. 253.8 crores, an increase in revenue by 34.3% y-o-y. EBITDA was at Rs. 67.7 crores, an increase of 34.8% y-o-y; registering anEBITDA margin expansion of 0.1%. PATincreased by 46.2% y-o-y to Rs. 50.2 crores,and PAT margin expanded by 1.4%. For Q3 FY2020, consolidated revenue was at Rs. 94.5 crores, an increase of 27.4% y-o-y. EBITDA was at Rs. 27.3 crores, an increase of 20.0% y-o-y. PAT increased by 31.3% y-o-y to Rs. 21.4 crores, and PAT margin expanded by 0.3%. The company generated operating cash flow of Rs. 36.2 crores in 9M FY2020.

The CPCU business continued a stronggrowth momentum delivering a total of 5.60crore of converted users in 9M FY2020, up 34.6% as compared to 4.16 crore converted users delivered in 9M last year.

Historically, our third quarter which hasalways been financially robust driven byfestive season sales, continued its performance trend this time too with the Company registering a strong growth on both year-on-year basis and sequential basis (q-o-q).

| In Rs. Crore | Q3 FY2019 | Q3 FY2020 | Y-o-Y

Growth |

Q2 FY2020 | Q-o-Q

Growth |

9M FY2019 | 9M FY2020 | Y-o-Y

Growth |

| Revenue | 74.1 | 94.5 | 27.4% | 84.7 | 11.5% | 188.9 | 253.8 | 34.3% |

| EBITDA | 22.8 | 27.3 | 20.0% | 21.7 | 25.6% | 50.2 | 67.7 | 34.8% |

| % EBITDA Margin | 30.7% | 28.9% | 25.7% | 26.6% | 26.7% | |||

| Profit After Tax | 16.3 | 21.4 | 31.3% | 15.6 | 37.6% | 34.4 | 50.2 | 46.2% |

| % PAT Margin | 22.0% | 22.3% | 18.3% | 18.2% | 19.6% | |||

Commenting on the results, Anuj Khanna Sohum, the Chairman, MD and CEO of Affle said:

Commenting on the results, Anuj Khanna Sohum, the Chairman, MD and CEO of Affle said:

“Affle’s growth has been broad-based coming from both existing and new customers, across the key industry verticals and across India & Other Emerging Markets. India, which is our dominant market is growing much faster than the average industry growth in digital advertising, where for 9M FY2020 India registered a revenue growth of 47.8% y-o-y. Our international business largely driven by the growth in Other Emerging Markets particularly SEA and MEA, increased at 22.8% y-o-y.

The growth in Affle’s Consumer Platform business powered by the CPCU business has been encouraging and is well supported by the overall consumer trends of greater time spent across connected devices, increased adoption of online payments and consistent growth in digital marketing spends by advertisers. We also launched a new product ‘Vizury Engage360’, an artificial intelligence driven Omnichannel Marketing Platform, that strengthens our CPCU driven business model. Our Board of Directors have also formed two investment committees to evaluate the India and international investment opportunities that can further augment strategic and competitive position of the business and enhance value for all our stakeholders.” ENDS

About Affle

Affle is a global technology company with a proprietary consumer intelligence platform that delivers consumer engagement, acquisitions and transactions through relevant Mobile Advertising. The platformaims to enhance returns on marketinginvestment through contextual mobile adsand also by reducing digital ad fraud. While Affle’s Consumer platform is used by online & offline companies for measurable mobile advertising, its Enterprise platform helps offline companies to go online through platform-based app development and enablement of O2O commerce.

Affle (India) Limited successfully completed its IPO in India and now trades on the stock exchanges (BSE: 542752 &NSE: AFFLE). Affle Holdings is theSingapore based promoter for Affle (India)Limited, and its investors include Microsoft, D2C (an NTT DoCoMo, Dentsu & NTT Advertising JV), Itochu, Bennett Coleman & Company (BCCL) amongst others.

For more information, visit – www.affle.com

Be the first to comment on "Affle (india) Limited reports PAT of Rs. 21.4 crores, 31.3% y-o-y"