Key Financial results (Q3 FY20 & YTD Dec 2019):

Key Financial results (Q3 FY20 & YTD Dec 2019):

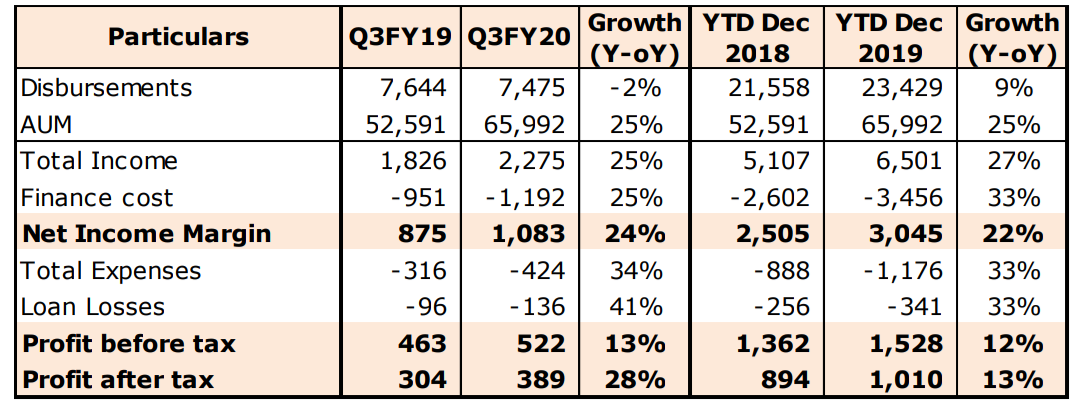

Total Income at ₹ 2,275 Cr (Up 25% YoY) for Q3 FY20 and ₹ 6,501 Cr (Up 27%

YoY) for YTD Dec 2019.

PAT at ₹ 389 Cr (Up 28% YoY) for Q3 FY20 and ₹ 1,010 Cr (Up 13% YoY) for YTD Dec 2019.

Total AUM up at ₹ 65,992 Cr (Up 25% YoY).

CHENNAI, 23 JANUARY, 2020 (GPN): The Board of Directors of CIFCL today approved the un-audited financial results for the quarter and nine months ended 31st December 2019.

Highlights:

Q3 and YTD Dec 2019 Performance:

The company has posted a strong performance in Q3 and YTD Dec 2019, despite the prevailing tough market conditions.

Performance Highlights:

Performance Highlights:

Aggregate disbursements for YTD Dec 2019 was at ₹23,429 Cr against ₹21,558 Cr of YTD Dec 2018, registering a growth of 9%. The disbursements for quarter ended Dec 2019 wasat ₹ 7,475 Cr as against ₹ 7,644 Cr for the quarter ended Dec 2018.

Vehicle Finance (VF) business has clocked a volume of ₹ 18,685 Cr for the period endedDecember 2019 as against ₹ 17,600 Cr in the previous year, reporting a growth of 6%. The same numbers for the quarter ended December 2019 was at ₹5,949 Cr as against ₹6,277 Cr for the quarter ended December 2018. The slow-down in VF disbursement is due to industry

de-growth in Commercial Vehicles segment during this quarter.

Home Equity (HE) business disbursed ₹ 3,073 Cr as against ₹ 2,803 Cr for period ended December 2018, marking a growth of 10% Y-o-Y. Disbursements for the quarter ended December 2019 was at ₹ 908 Cr as against ₹ 954 Cr for the quarter ended December 2018.

AUM grew by 25% at ₹ 65,992 Cr as on YTD Dec 2019 as compared to ₹ 52,591 Cr for YTD Dec 2018.

Vehicle Finance (VF) AUM grew by 19% to ₹ 44,589 Cr as on YTD Dec 2019 as against ₹ 37,508 Cr for YTD Dec 2018

Home Equity (HE) AUM grew by 16% to ₹ 13,000 Cr as on YTD Dec 2019 as against ₹11,186 Cr for YTD Dec 2018.

Profits before Tax (PBT) for the YTD December 2019 was at ₹ 1,528 Cr as against ₹ 1,362 Cr last year registering a growth of 12%. For the quarter ended December 19, the PBT was at ₹522 Cr as against ₹ 463 Cr for the quarter ended December 18, registering the growth of

13%.

The PBT-ROTA for YTD Dec 2019 is at 3.4% and ROE for YTD Dec 2019 is at 20.3%

Our Branch presence increased to 1073 Branches in YTD Dec 2019.

Capital Issue – Preferential Allotment:

The Board of directors at their meeting held this afternoon have, subject to the approval of shareholders, approved an Issue of equity shares by way of preferential issue to Cholamandalam

Financial Holdings Limited, a promoter entity up to an amount not exceeding Rs.300 crores in one or more tranches at such price in accordance with Chapter V of SEBI (Issue of Capital and

Disclosure Requirements) Regulations, 2018.

Asset Quality

Notwithstanding the tight market conditions, CIFCL continues to maintain strong asset quality with a marginal increase in the Stage 3 receivables from 3.30% in Dec’18 to 3.54% in Dec’19 (under IND AS) with a provision coverage of 33.0%.

Capital Adequacy:

The Capital Adequacy Ratio (CAR) of the company as on 31st December 2019, was at 17.04% as against the regulatory requirement of 15%.

Appointment of Mr. Ravindra Kumar Kundu as Executive Director of the Company:

The Board at its meeting held this afternoon has also approved the appointment of Mr. Ravindra Kumar Kundu President & Business Head – Vehicle finance as an Executive Director of the Company for a period of five years with immediate effect. Mr. Kundu has been with the Company since 2000 and has an overall experience of 30 years including 20 years in the Company. He joined the Company in Vehicle Finance business in 2000 and during his tenure, has handled

various functions including credit, collections and business.

Managing Director’s Comments:

Commenting on the results, Arun Alagappan, Managing Director, stated “In Q3 of FY 20, faced with the slowdown in the auto sector we changed our product mix to shore up our net interest income. Accordingly, we were able to grow our AUM at over 25% and PAT growth over 28%.

While doing this we were able to contain our Stage 3 levels at 3.5% which is a reflection of our asset quality.”

About Cholamandalam

Cholamandalam Investment and Finance Company Limited (Chola), incorporated in 1978 as the financial

services arm of the Murugappa Group. Chola commenced business as an equipment financing company and

has today emerged as a comprehensive financial services provider offering vehicle finance, home loans, home

equity loans, SME loans, investment advisory services, stock broking and a variety of other financial services to

customers.

Chola operates from 1073 branches across India with assets under management above INR 65,000 Crores.

The mission of Chola is to enable customers enter a better life. Chola has a growing clientele of over 8 lakh

happy customers across the nation. Ever since its inception and all through its growth, the company has kept a

clear sight of its values. The basic tenet of these values is a strict adherence to ethics and a responsibility to all

those who come within its corporate ambit – customers, shareholders, employees and society.

For more details, please visit www.cholamandalam.com

About Murugappa Group.

Founded in 1900, the INR 369 Billion (36,893 Crores) Murugappa Group is one of India’s leading business

conglomerates. The Group has 28 businesses including nine listed Companies traded in NSE & BSE.

Headquartered in Chennai, the major Companies of the Group include Carborundum Universal Ltd.,

Cholamandalam Financial Holdings Ltd., Cholamandalam Investment and Finance Company Ltd., Cholamandalam MS General Insurance Company Ltd., Coromandel International Ltd., Coromandel Engineering Company Ltd., E.I.D. Parry (India) Ltd., Parry Agro Industries Ltd., Shanthi Gears Ltd., Tube Investments of India Ltd., and Wendt (India) Ltd. Market leaders in served segments including Abrasives, Auto Components, Transmission systems, Cycles, Sugar, Farm Inputs, Fertilisers, Plantations, Bioproducts and Nutraceuticals, the Group has forged strong alliances with leading international companies such asGroupe Chimique Tunisien, Foskor, Mitsui Sumitomo, Morgan Advanced Materials, Sociedad Química y Minera de Chile (SQM),Yanmar & Co. and Compagnie Des Phosphat De Gafsa (CPG). The Group has a wide geographical presence all over India and spanning 6 continents.

Renowned brands like BSA, Hercules, Montra, Mach City, Ballmaster, Ajax, Parry’s, Chola, Gromor, Shanthi

Gears and Paramfos are from the Murugappa stable. The Group fosters an environment of professionalism and

has a workforce of over 50,000 employees. For more details, visit www.murugappa.com

Be the first to comment on "CHOLAMANDALAM INVESTMENT AND FINANCE COMPANY LIMITED (CIFCL) UNAUDITED FINANCIAL RESULTS FOR THE QUARTER AND NINE MONTHS ENDED 31 st DECEMBER 2019 Total AUM crossed ₹ 65,000 Crs (Up 25%) and PAT stood at ₹ 389 Crs (Up 28%) in Q3 FY20"