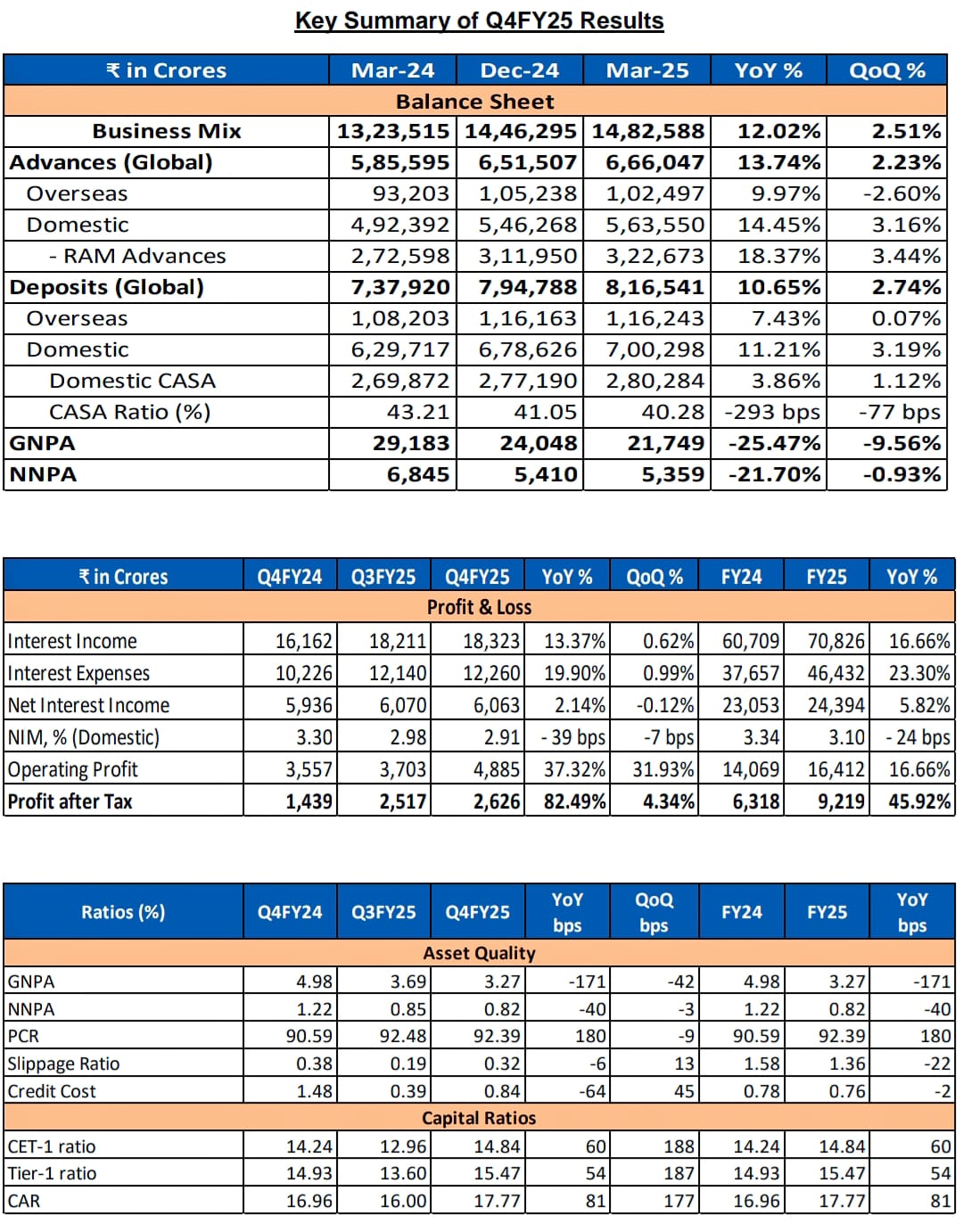

MUMBAI, 9 MAY, 2025 (GPN): Public sector lender Bank of India (BoI) announced its results for the quarter Q4 FY25 & FY24-25.Net Profit for FY25 stands at Rs. 9,219 crores witnessing growth of 46% YoY. Net Profit for Q4FY25 grew by 82.5 % YoY to Rs. 2,626 crores, ROA and ROE for FY25 stand at 0.90 % and 15.27 % respectively. The bank reported Net Interest Income (NII) for FY25 increased by 6% YoY and Net Interest Margin (NIM) of Global and Domestic for FY25 stand at 2.82 % and 3.10 % respectively.

MUMBAI, 9 MAY, 2025 (GPN): Public sector lender Bank of India (BoI) announced its results for the quarter Q4 FY25 & FY24-25.Net Profit for FY25 stands at Rs. 9,219 crores witnessing growth of 46% YoY. Net Profit for Q4FY25 grew by 82.5 % YoY to Rs. 2,626 crores, ROA and ROE for FY25 stand at 0.90 % and 15.27 % respectively. The bank reported Net Interest Income (NII) for FY25 increased by 6% YoY and Net Interest Margin (NIM) of Global and Domestic for FY25 stand at 2.82 % and 3.10 % respectively.Global and Domestic NIM for Q4FY25 stand at 2.61% and 2.91% respectively.

Bank’s Global Advances grew by 13.74% with Domestic Advances grew by 14.45% YoY. Retail Advances grew by 19.93% YoY, MSME Advances grew by 18.39% YoY followed by Agriculture Advances which grew by 16.30% YoY and Corporate Advances grew by 9.59% YoY. Deposits grew by 10.65% YoY with Domestic Deposits grew by 11.21% YoY. CASA Deposit grew by 3.86% YoY and CASA ratio stands at 40.28% as on 31st March, 2025.

On Asset quality front, Net NPA ratio at 0.82% improved by 40 bps YoY an PCR improved by 180 bps YoY and stands at 92.39%. Slippage Ratio for FY25 improved by 22 bps YoY and stands at 1.36%. Credit Cost for FY25 improves by 2 bps YoY to 0.76%. Capital Adequacy. Capital Adequacy Ratio (CAR) as at the end of FY25 stands at 17.77%.

As of date, over 440 services available in Mobile Banking App “BOI Mobile Omni Neo Bank”

Shri Rajneesh Karnatak, Managing Director and CEO, BoI, said during the post-results interaction that margins will remain under pressure due to anticipated rate cuts. The Reserve Bank of India has already cut the repo rate by 50 basis points, and a further 50 bps cut is expected. While lending rates on external benchmark-linked loans are adjusted immediately, the repricing of deposits happens with a lag, putting pressure on margins. The expected impact of the softening interest rate is around 20 basis points, he added.

Non-interest income—including fees, commission, and treasury gains—nearly doubled, rising 96 per cent to Rs. 3,428 crore in Q4FY25 from Rs. 1,747 crore a year ago.

Provisions for non-performing assets (NPAs) fell to Rs. 1,347 crore in Q4FY25 from Rs. 2,043 crore in Q4FY24.

BoI reported 13.74 per cent Y-o-Y growth in advances, reaching Rs. 6.66 trillion at the end of March 2025. The bank has provided credit growth guidance of 12–13 per cent for FY26 and has a sanctioned corporate loan pipeline of Rs. 60,000 crore, Karnatak said.

Deposits rose 10.65 per cent Y-o-Y to Rs. 8.16 trillion. The bank expects deposit growth of 11–12 per cent in FY26, he added.

Asset quality improved, with gross NPAs declining to 3.27 per cent from 4.98 per cent a year earlier. Net NPAs fell to 0.82 per cent from 1.22 per cent in March 2024. The provision coverage ratio (PCR), including technical write-offs, stood at 92.39 per cent in March 2025.

The capital adequacy ratio stood at 17.77 per cent, with the common equity tier-I (CET-1) ratio at 14.84 per cent.

Balance Sheet:

Bank’s Global Advances grew by 13.74% with Domestic Advances grew by

14.45% YoY. Bank’s Global Advances crossed ₹ 6 Lakh crores.

Overseas Advances grew by 9.97% YoY.

Retail Advances grew by 19.93% YoY, MSME Advances grew by 18.39% YoY followed by Agriculture Advances which grew by 16.30% YoY and Corporate Advances grew by 9.59% YoY.

Bank’s Deposits grew by 10.65% YoY with Domestic Deposits grew by 11.21% YoY. CASA Deposit grew by 3.86% YoY and CASA ratio stands at 40.28% as on 31st March, 2025.

Profitability:

Operating Profit for FY25 grew by 17% YoY to Rs.16,412 crores while Operating Profit for Q4FY25 grew by 37% YoY to Rs.4,885 crores.

Net Profit for FY25 stands at ₹9,219 crores witnessing growth of 46% YoY. Net Profit for Q4FY25 grew by 82% YoY to ₹2,626 crores,

Bank’s ROA and ROE for FY25 stand at 0.90% and 15.27% respectively.

Net Interest Income (NII) for FY25 increased by 6% YoY.

Net Interest Margin (NIM) of Global and Domestic for FY25 stand at 2.82% and 3.10% respectively.

Global and Domestic NIM for Q4FY25 stand at 2.61% and 2.91% respectively.

Asset Quality:

Gross NPA ratio at 3.27% improved by 171 bps YoY.

Net NPA ratio at 0.82% improved by 40 bps YoY.

PCR improved by 180 bps YoY and stands at 92.39%.

Slippage Ratio for FY25 improved by 22 bps YoY and stands at 1.36%. Slippage Ratio for Q4FY25 improved by 6 bps YoY and stands at 0.32%.

Credit Cost for FY25 improves by 2 bps YoY to 0.76%.

Capital Adequacy:

Capital Adequacy Ratio (CAR) as at the end of FY25 stands at 17.77%.

Alternate Channels:

Over 440 services available in Mobile Banking App “BOI Mobile Omni Neo Bank”.

Share of Alternate Channels in total transactions increased from ~93.9% in FY24 to ~95.9% in FY25.

Be the first to comment on "Bank of India Announces Q4FY25 Financial Results For The Quarter/Year Ended 31 March 2025 PAT jumps 82.5% to Rs. 2,626 crore"