MUMBAI, 18 OCTOBER, 2024 (GPN): Godavari Biorefineries Ltd. will offer its shares for bidding through an initial public offering at a price band of Rs 334-352 per share, the company announced on Friday.

MUMBAI, 18 OCTOBER, 2024 (GPN): Godavari Biorefineries Ltd. will offer its shares for bidding through an initial public offering at a price band of Rs 334-352 per share, the company announced on Friday.The offer consists of a fresh issue of shares worth Rs 325 crore and an offer for sale of more than 65 lakh shares, amounting to Rs 230 crore, by its existing shareholders and promoters.

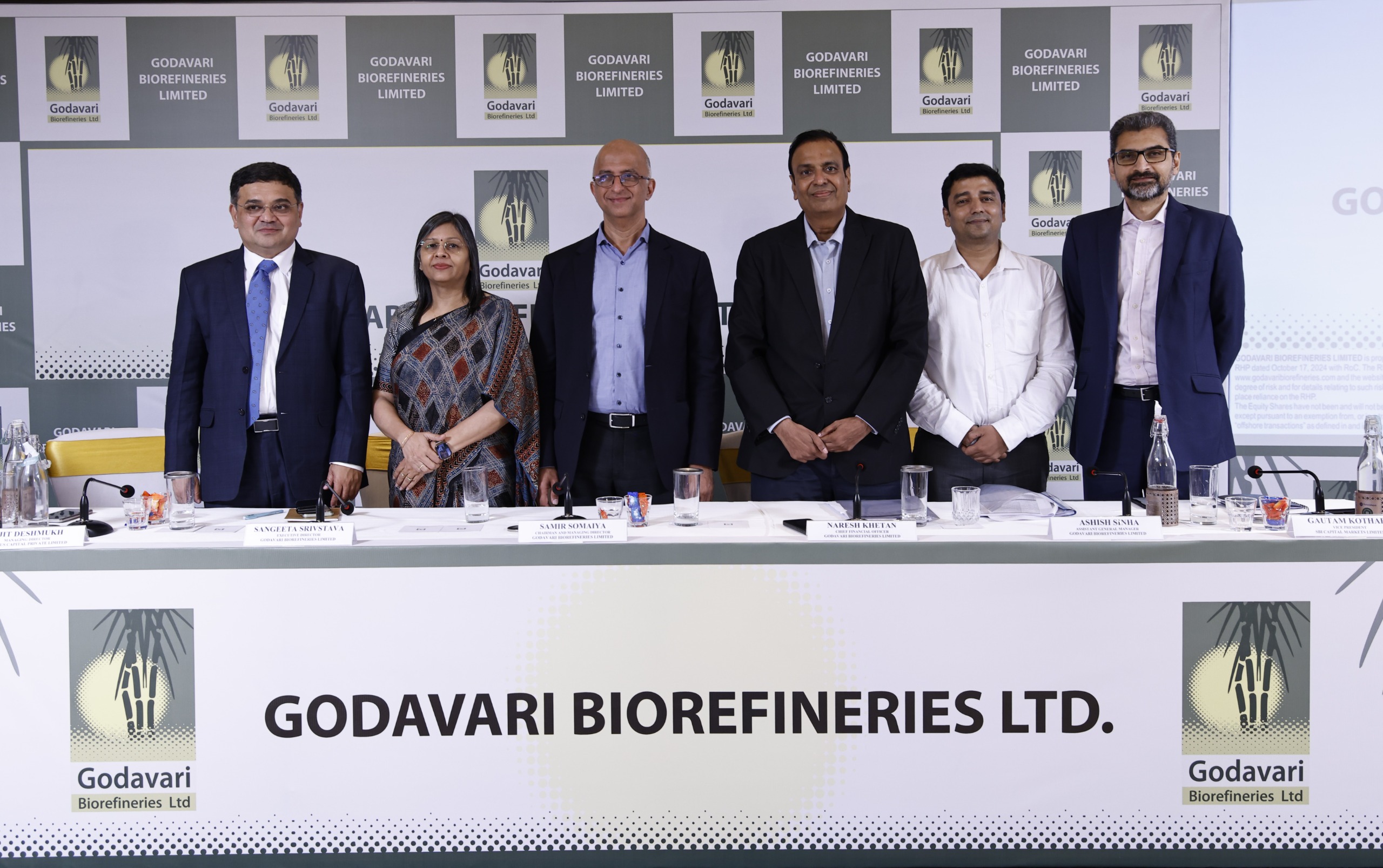

Private equity firm Mandala Capital AG will be exiting the company by selling the entire stake of 49 lakh shares in the OFS. The selling promoters include Somaiya Agencies Pvt., Samir Shatilal Somaiya, Lakshmiwadi Mines and Minerals Pvt., Filmedia Communications Systems Pvt. and Somaiya Properties and Investments Pvt.Godavari Biorefineries’ Initial Public Offer will open on October 23 and close on October 25. The company will seek funds from institutional investors via the anchor round on October 22. The shares will list on exchanges on October 30.

Proceeds from the fresh issue will be used for repaying debt amounting to Rs 240 crore, and the remaining funds will be utilised for general corporate purposes. It had consolidated debt of Rs 748.9 crore as of June 2024.

The book running lead managers (BRLM) of the Initial Public Offer are SBI Capital Markets Ltd. and Equirus Capital Pvt. Ltd.The company is one of India’s largest ethanol producers by volume, with a bio-refinery capacity of 570 KLPD for ethanol production. Its diverse portfolio includes bio-based chemicals, sugar, ethanol, and power, catering to industries such as food, beverages, pharmaceuticals, personal care, and fuel. In line with government initiatives to boost ethanol blending, Godavari plans to expand its distillery capacity from 600 KLPD to 1,000 KLPD.

Godavari Biorefineries supplies products to leading companies including Hershey India, Hindustan Coca-Cola Beverages, and LANXESS India, among others.

Be the first to comment on "Godavari Biorefineries IPO to Open on Wednesday, October 23, 2024 Price Band Fixed at Rs. 334 – 352 Per Share"