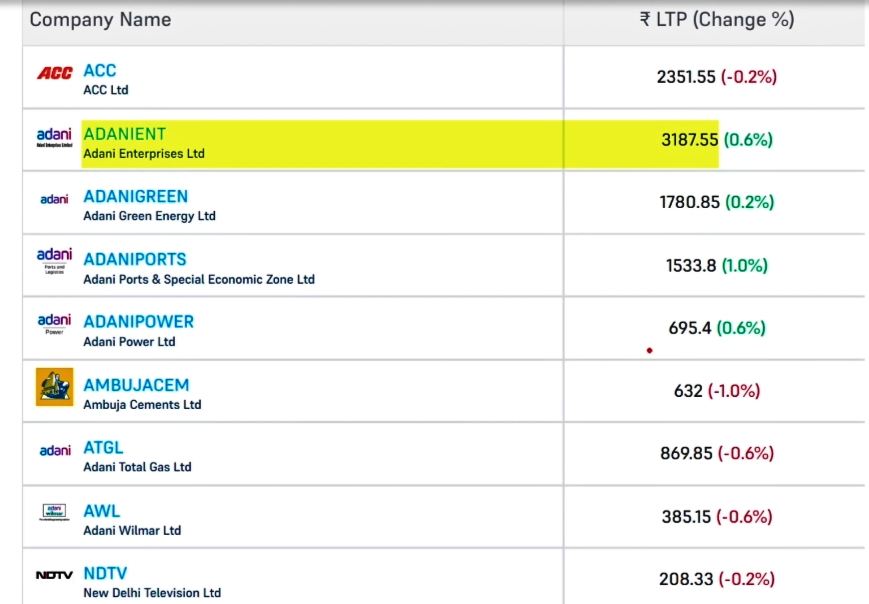

Hindenburg Research Report Impacted these Adani Group Companies

Dhaval Buch H/o SEBI Chief Madhabi Buch

MUMBAI, 12 AUGUST, 2024 (GPN): Hindenburg Research after tweeting in a late-night series of posts on X formerly Twitter on Sunday Something Big India..claimed that the joint statement by SEBI chief Madhabi Buch and her husband Dhaval Buch, brought up more questions that needed to be clarified. In it’s 2024 report Hindenburg has implicated SEBI chairperson Madhabi Puri Buch in allegedly investing in offshore firms run by the Adani group

The research firm asked Buch to reveal a client list of all those consulting with her on her offshore investments to match whether they are related to the firms that SEBI is supposed to be regulating.

On August 10, Hindenburg Research, a US short seller and financial investigation firm, released a report titled – ‘Whistleblower Documents Reveal SEBI’s Chairperson Had Stake In Obscure Offshore Entities Used In Adani Money Siphoning Scandal’.

The report followed up on their 2023 allegations against the Adani group for financial misconduct and stock price manipulation. In their 2024 report, they claimed that SEBI chief Madhabi Buch and her husband had made investments in offshore funds which were controlled by Gautam Adani’s brother Vinod Adani.

These same offshore firms had been accused of being central to the Adani group’s financial fraud.

Buch’s response now publicly confirms her investment in an obscure Bermuda/Mauritius fund structure, alongside money allegedly siphoned by Vinod Adani. She also confirmed the fund was run by a childhood friend of her husband, who at the time was an Adani director.

SEBI was tasked with investigating investment funds relating to the Adani matter, which would include funds Ms. Buch WAS PERSONALLY INVESTED IN and funds by the same sponsor which were specifically highlighted in our original report. This is obviously a massive conflict of interest.

According to the statement by Buch, investment in the two funds was made on advice of Dhaval’s childhood friend, Anil Ahuja – the person which Hindenburg on Saturday identified as the founder and Chief Investment Officer (CIO) of the Mauritius- based IPE Plus Fund and who the Adani group also in its the statement on Sunday said was a nominee of 3i Investment Fund in Adani Power (2007-2008) and served as a director of Adani Enterprises for three terms spanning nine years ending in June 2017.

“Buch’s statement also claims that the two consulting companies she set up, including the Indian entity and the opaque Singaporean entity “became immediately dormant on her appointment with SEBI” in 2017, with her husband taking over starting in 2019. Per its latest shareholding list as of March 31, 2024, Agora Advisory Limited (India), is still 99 per cent owned by Madhabi Buch, not her husband. This entity is currently active and generating consulting revenue,” Hindenburg said.

Also, she remained a 100 per cent shareholder of Agora Partners Singapore until March 16, 2022, per Singaporean records, owning it during her entire time as a SEBI Whole Time Member. “She only transferred her shares into her husband name two weeks after her appointment as SEBI chairperson,” it alleged.

SEBI chief Madhabi Buch says, her fund did not invest in Adani group securities. She also states that they pulled out of the fund in 2018 and had previously invested as private citizens of Singapore.

Short-selling firm Hindenburg Research has leveled serious accusations against Madhabi Buch, the current Chairperson of the Securities and Exchange Board of India (SEBI). The allegations challenge Buch’s previous statements regarding her business interests.

According to our sources, Buch had earlier stated that two consulting firms she founded—one in India and another in Singapore named Agora—became inactive following her 2017 appointment to SEBI. She further claimed that her husband assumed control of these businesses in 2019.

However, Hindenburg’s report paints a different picture. The firm alleges that Buch retains a 99% ownership stake in the Indian entity, Agora Advisory Limited. Contrary to previous assertions, this company is reportedly active and generating consulting revenue.

Who is Madhabi Puri Buch: A Trailblazing Career in Finance Despite the current controversy, Madhabi Puri Buch’s career has been nothing stu short of remarkable. Born in 1966 and raised in Mumbai, Buch developed a strong foundation in mathematics and finance, eventually earning an MBA from the prestigious Indian Institute of Management (IIM) Ahmedabad. Her journey in the financial sector began in 1989 when she joined ICICI Bank, where she rapidly ascended the ranks.

Buch’s tenure at ICICI saw her take on diverse roles, from investment banking to marketing and product development. Her leadership qualities came to the fore when she became the first woman to serve as Managing Director and CEO of ICICI Securities in 2009. Under her guidance, ICICI Securities achieved notable success, including increased market share and the implementation of innovative investment products. Her approach to leadership was marked by a focus on risk management and operational efficiency.

Global Exposure and Return to India

After leaving ICICI, Buch expanded her horizons internationally. She servus a Consultant to the New Development Bank in Shanghai and led the Singapore office of Greater Pacific Capital, a private equity firm. These roles provided her with a broader perspective on global financial markets, enriching

Upon returning to India, Buch held non-executive director positions on the boards of several major companies, including Idea Cellular Ltd and NIIT Limited. Her diverse experience culminated in her appointment as a Whole Time Member (WTM) of SEBI in 2017, where she managed key portfolios such as surveillance and mutual funds. Her close collaboration with then-SEBI Chairperson Ajay Tyagi further cemented her influence in India’s regulatory landscape.

Leadership at SEBI: A Historic Appointment

In March 2022, Buch broke new ground by becoming the first woman to lead SEBI. Her appointment was not just a milestone for gender equality in Indian finance but also a significant moment for the country’s regulatory framework. As SEBI Chairperson, Buch has overseen vital departments related to regulation, supervision, and surveillance. Her leadership has been instrumental in advancing the National Institute of Securities Markets (NISM) and driving policy reforms aimed at modernizing India’s financial markets.

The report by Hindenburg research claims that the chief of SEBI – India’s market regulation body – had investments linked to offshore firms allegedly operated by the Adani group for stock price manipulation and financial fraud.

The Adani group released a statement on the report by Hindenburg research stating that it was a “malicious, mischievous and manipulative selections of publicly available information” and that the claims made had been discredited by the Supreme Court already.

They also said, “for a discredited short-seller under the scanner for several violations of Indian securities laws, Hindenburg’s allegations are no more than red herrings thrown by a desperate entity with total contempt for Indian laws.”

The Finance Ministry on Monday said it has nothing more to add to the statements given by the Securities and Exchange Board of India and its chairperson Madhabi Puri Buch regarding Hindenburg’s latest report.

“Sebi has made the statement. The chairperson has also made a statement. There is nothing further to be added by the government,” Economic Affairs Secretary in the Finance Ministry Ajay Seth told reporters.

Be the first to comment on "Hindenburg accusations and allegations on SEBI chief Madhabi Buch and her husband Dhaval Buch and Charges refuted by SEBI and Adani"