Bank of India reported a 10% YoY growth in net profit for Q1FY25, aided by lower tax outgo. Its net profit for the quarter stood at Rs 1,703 cr, as against Rs 1,551 cr in the corresponding period a year ago.

Bank of India reported a 10% YoY growth in net profit for Q1FY25, aided by lower tax outgo. Its net profit for the quarter stood at Rs 1,703 cr, as against Rs 1,551 cr in the corresponding period a year ago.

NII was up 6% YoY to Rs 6,275 crore in Q1FY25, compared to Rs 5,915 crore in Q1FY24, aided by robust growth in advances

Provisions Of The Lender Increased 57 Per Cent On A YoY Basis And Declined 29 Per Cent Sequentially In Q1FY25 To Rs 1,293 Crore.

MUMBAI, 3 AUGUST, 2024 (GPN): State-owned Bank of India (BoI) reported a 10 per cent year-on-year (YoY) growth in net profit for the quarter ending June 2024 (Q1FY25), aided by lower tax outgo. Its net profit for the quarter stood at Rs 1,703 crore, as against Rs 1,551 crore in the corresponding period a year ago.

Net interest income (NII) was up 6 per cent YoY to Rs 6,275 crore in Q1FY25, compared to Rs 5,915 crore in Q1FY24, aided by robust growth in advances. However, its non-interest income was down 12 per cent YoY to Rs 1,302 crore.

Its net interest margin – a measure of profitability of banks – stood at 3.07 per cent in Q1FY25, up 14 basis points (bps) from the preceding quarter.

Provisions of the lender increased 57 per cent on a YoY basis and declined 29 per cent sequentially in Q1FY25 to Rs 1,293 crore.

Gross slippages for the quarter stood at Rs 2,973 crore in Q1FY25, out of which Rs 1,056 was from the MSME sector, Rs 588 crore was from the retail portfolio, and Rs 737 crore was from the agriculture portfolio. Corporate slippages for the quarter stood at Rs 564 crore.

Gross Slippages in Q1FY25 was lower than Q4FY24 and Q1FY24. The bank had reported gross slippages to the tune of Rs 3,309 crore in Q4FY24, and Rs 4,030 crore in Q1FY24.

Asset quality of the lender improved, with gross non-performing assets (NPAs) ratio at 4.62 per cent in Q1FY25, down 36 bps from the preceding quarter. Net NPAs were also down 23 bps at 0.99 per cent in Q1FY25. Provision coverage ratio (PCR) of the lender improved to 92.11 per cent in Q1FY25, as against 90.59 per cent in Q4FY24.

Advances of the lender was up 15.82 per cent YoY and 2.50 per cent sequentially to Rs 6 trillion. And, deposits were up 9.91 per cent YoY and 2.89 per cent sequentially to 6.47 trillion during Q1FY25.

@gpn-globalprimenews

KEY HIGHLIGHTS (Q4FY24)

*Global Business increased by 12.34% YoY.

* Global Deposits increased by 9.74% YoY.

* Global Advances increased by 15.82% YoY.

* Advances (Dom.) increased by 17.29% YoY.

* RAM Advances grew by 18.78% YoY and it constitutes 56.01% of Advances.

* Retail Credit grew by 20.46% YoY.

* Agriculture Credit grew by 22.18% YoY.

* MSME Credit grew by 13.06% YoY.

* CASA deposits increased by 5.51% YoY and CASA ratio at 42.68%.

* Net Profit increased by 10% YoY to Rs.1,703 Cr.

* Yield on Advances (Global) improved by 50 bps YoY.

* Yield on Advances (Dom.) improved by 52 bps YoY.

* Gross NPA ratio down by 205 bps YoY.

* Net NPA ratio down by 66 bps YoY.

* Provision Coverage Ratio (PCR) at 92.11%.

* CRAR stood at 16.18%, with CET-1 ratio at 13.62%.

Profitability:

* Net Profit for the quarter improved by 10% YoY and stood at Rs.1,703 Cr for Q1FY25 against Rs.1,551 Cr in Q1FY24.

* Operating Profit stood at Rs.3,677 Cr for Q1FY25 against Rs.3,752 Cr in Q1FY24.

* Net Interest Income (NII) increased by 6% YoY and stood at Rs.6,275 Cr for Q1FY25 against Rs.5,915 Cr for Q1FY24.

* Non-Interest Income stood at Rs.1,302 Cr for Q1FY25 against Rs.1,462 Cr in Q1FY24.

Ratios :

* NIM (Global) improved by 4 bps to 3.07% in Q1FY25 against 3.03% in Q1FY24. NIM (Domestic) improved by 6 bps to 3.43% in Q1FY25 against 3.37% in Q1FY24.

* Return on Assets (RoA) stood at 0.70% in Q1FY25 against 0.71% in Q1FY24.

* Return on Equity (RoE) stood at 13.48% in Q1FY25 against 15.18% in Q 1FY ’24.

* Cost to Income ratio (Global) stood at 51.47% in Q1FY25 against 49.14% in Q1FY24.

* Slippage ratio improved to 0.35% in Q1FY25 against 0.53% in Q1FY24.

*Credit Cost stood at 0.85% in Q1FY25 against 0.64% in Q1FY24.

*Yield on Advances (Global) improved by 50 bps to 8.60% in Q1FY25 against 8.10% in Q1FY24.

* Cost of Deposits (Global) stood at 4.82% in Q1FY25 against 4.22% in Q1FY24.

Business:

* Global Business increased by 12.34% YoY from Rs.12,14,808 Cr in Jun’23 to Rs.13,64,660 Cr in Jun’24.

* Global Deposits increased by 9.74% YoY from Rs. 6,96,544 Cr in Jun’23 to Rs. 7,64,396 Cr in Jun’24.

* Global Advances increased by 15.82% YoY from Rs. 5,18,264 Cr in Jun’23 to Rs. 6,00,264 Cr in Jun’24.

* Overseas Deposits increased by 8.83% YOY to Rs. 1,16,479 Cr and Overseas Advances increased by 8.32% YOY to Rs. 92,095 Cr in Jun’24.

* Domestic Deposits increased by 9.91% YoY from Rs.5,89,517 Cr in Jun’23 to Rs.6,47,917 Cr in Jun’24.

* Domestic CASA went up by 5.51% YoY from Rs.2,60,615 Cr in Jun’23 to Rs.2,74,973 Cr in Jun’24 and CASA ratio stood at 42.68%. A-.

* Domestic Advances increased by 17.29% YoY from Rs. 4,33,246 Cr in Jun’23 to Rs. 5,08,169 Cr in Jun’24.

* RAM Advances increased by 18.78% YoY to Rs.2,84,646 Cr, constituting to 56.01% of Advances in Jun’24.

* Retail Credit grew by 20.46% YoY to Rs.1,15,183 Cr in Jun’24.

* Aorig.ulture Credit grew by 22.18% YoY to Rs.88,977 Cr in Jun’24.

* MSME Credit grew by 13.06% YoY to Rs.80,486 Cr in Jun’24.

Asset Quality:

* Gross NPA declined by 20% YoY from Rs.34,582 Cr in Jun’23 to Rs.27,716 Cr in Jun’24.

* Net NPA declined by 30% YoY from Rs.8,118 Cr in Jun’23 to Rs.5,702 Cr in Jun’24.

* GNPA ratio improved by 205 bps from 6.67% in Jun’23 to 4.62% in Jun’24. Net NPA ratio improved by 66 bps from 1.65% in Jun’23 to 0.99% in Jun’24.

* Provision Coverage Ratio (PCR) stood at 92.11% in Jun’24. Capital Adequacy;

* Bank’s total Capital Adequacy Ratio (CRAR) improved by 58 bps and stood at 16.18% as on 30.06.24 against 15.60% as on 30.06.23.

* CET-1 ratio stood at 13.62% as on 30.06.24.

Capital Adequacy:

* Bank’s total Capital Adequacy Ratio (CRAR) improved by 58 bps and stood at

16.18% as on 30.06.24 against 15.60% as on 30.06.23.

* CET-1 ratio stood at 13.62% as on 30.06.24.

Priority Sector:

* Priority Sector Advances increased by 15.55% YOY and achieved 45.61% of ANBC as on Jun’24. Agricultural advances achieved 21.29% of ANBC.

* Advances to Small & Marginal Farmers achieved 11.73% of ANBC in Jun’24 against regulatory norm of 10%.

* Advances to Weaker Sections achieved 15.70% of ANBC in Jun’24 against norm of 12%.

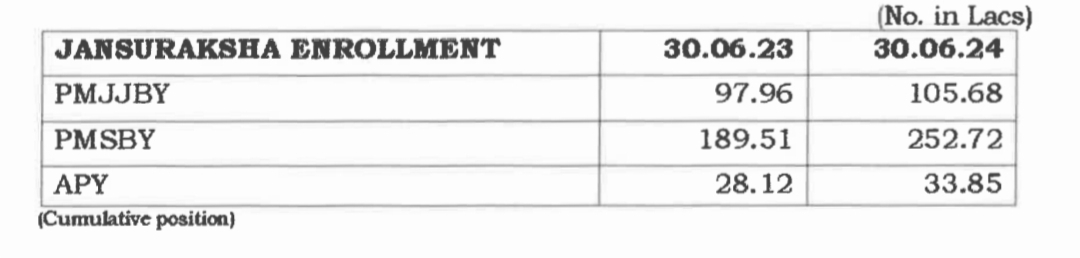

Financial Inclusion:

Bank has opened 3.78 Lakh new PMJDY accounts during Q1-FY’25.

(No. in Lacs)

Oplus_131072

Digital Banking:

* Internet Banking users: Increased to 9.0 million in Jun’24 from 8.5 million in Jun’23.

* Mobile Banking users: Increased to 4.9 million in Jun’24 from 3.4 million in Mar’24.

* Number of UPI users increased to 19.5 million in Jun’24 from 16.2 million in Jun’23.

Branch Network:

* As on 30th Jun’24, the Bank has 5155 number of Domestic branches.

* Rural: 1863 (36%), Semi-Urban: 1466 (29%), Urban: 835 (16%), Metro: 991 (19%).

ENDS/ GPN

Be the first to comment on "Bank of India (BOI) Q1FY25 PAT Increase 10% to Rs 1,703 cr, NII up 6%: Shri Rajneesh Karnatak, CMD- BOI"