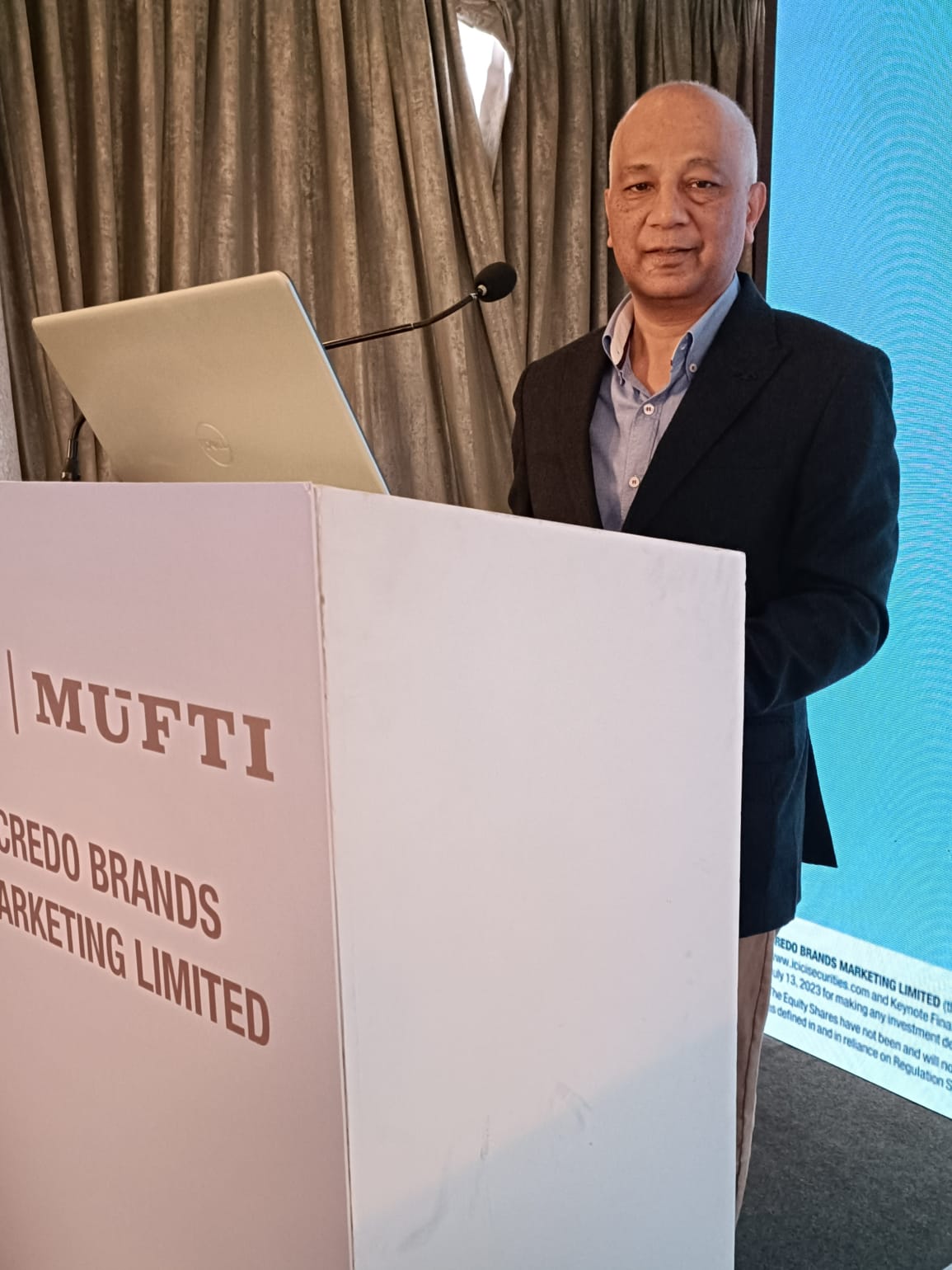

IPO Launch of (MUFTI) Credo Brands Marketing Limited: Mr. Kamal Khushlani, Chairman & Managing Director, Credo Brands Marketing Limited (Mufti) during the announcement of their Initial Public Offering at Mumbai -Photo By GPN

IPO Launch of (MUFTI) Credo Brands Marketing Limited: (L-R) Mr. Vishal Desai, Senior Vice President, Equity Capital Market, (DAM Capital Advisors Limited), Mr. Rasik Mittal, Chief Financial Officer, (Credo Brands Marketing Limited, Mr. Kamal Khushlani, Chairman & Managing Director (Credo Brands Marketing Limited), Vineet Suchanti, Managing Director (Keynote Financial Services Limited), Mr. Saurabh Jain, Vice President (ICICI Securities Limited) during the announcement of their Initial Public Offering at Mumbai – Photo By GPN

- Price Band of Rs 266 – ₹280 per equity share bearing face value of Rs 2 each (“Equity Shares”)

- Bid/Offer Opening Date – Tuesday December 19, 2023 and Bid/Offer Closing Date – Thursday December 21, 2023

- Minimum Bid Lot is 53 Equity Shares and in multiples of 53 Equity Shares thereafter.

- The Floor Price is 133 times the face value of the Equity Share and the Cap Price is 140 times the face value of the Equity Share.

MUMBAI, 14 DECEMBER, 2023 (GPN): Credo Brands Marketing (Mufti Menswear) IPO will open for Subscription on Tuesday, December 19. The company will be selling its shares in the range of Rs 266-280 a piece with a lot size of 53 equity shares and its multiples thereafter. The bidding for the issue will close on Thursday, December 21.

The company is looking to raise a total of close to Rs 550 crore, which entirely includes an offer-for-sale (OFS) component by its promoters, promoter group and other investors shareholders. The anchor book for the issue will open on Monday, December 18.

Kamal Khushlani launched the brand “Mufti” 25 years ago with a vision to redefine menswear. It believes in providing a meaningful wardrobe solution for multiple occasions in a customer’s life, with our product offerings ranging from shirts to t- shirts to jeans to chinos, that caters to all year-round clothing. The products are designed to provide a youthful appearance while keeping up with the ongoing fashion trends.

Mufti’s product mix has evolved significantly over the past several years from consisting of only shirts and trousers to a wide range of products including t-shirts, sweatshirts, jeans, cargos, chinos, jackets, blazers and sweaters in relaxed holiday casuals, authentic daily casuals to urban casuals, party wear and also athleisure categories as on date.

The company currently operates 1,773 retail outlets across India, as of May 31, 2023. These include 379 exclusive brand stores, 89 large format stores and 1,305 multi-brand stores. The company’s reach extends from major metropolitan areas to Tier III cities. As of March 31, 2023, the company is present in 582 cities.

The Mumbai-based Fashion retailer launched “Muftisphere” in the year 2014, a customer loyalty programme, to provide benefits to its customers for shopping the brand thereby increasing their stickiness with the brand. As on November 1, 2023, it had 137,000 followers on its Instagram page, 3.40 million followers on its Facebook page and 15,200 subscribers on its Youtube channel.

The Offer is being made through the Book Building Process, wherein not more than 50% of the Offer shall be available for allocation on a proportionate basis to Qualified Institutional Buyers, not less than 15% of the Offer shall be available for allocation to Non-Institutional Bidders and not less than 35% of the Offer shall be available for allocation to Retail Individual Bidders.

IPO Launch of (MUFTI) Credo Brands Marketing Limited: Mr. Kamal Khushlani, Chairman & Managing Director, Credo Brands Marketing Limited (Mufti) during the announcement of their Initial Public Offering at Mumbai -Photo By GPN

IPO Launch of (MUFTI) Credo Brands Marketing Limited: Mr. Rasik Mittal, Chief Financial Officer, (Credo Brands Marketing Limited (MUFTI) during the announcement of their Initial Public Offering at Mumbai -Photo By GPN

For the period ended on June 30, Credo Brands reported a net profit of Rs 8.58 crore with a revenue of Rs 119.43 crore. The company’s bottomline came in at Rs 77.51 crore with a revenue of Rs 509.32 crore for the financial year ended on March 31, 2023.

The company has reserved half of the issue or 50 per cent for the qualified institutional bidders (QIBs), while retail investors will get 35 per cent of reservation in the net offer. Remaining 15 per cent of the shares shall be allocated towards non-institutional investors.

DAM Capital Advisors Limited, ICICI Securities Limited, Keynote Financial Services Limited* are the book running lead managers and Link Intime India Private Limited is the registrar to the Offer. The Equity shares are proposed to be listed on BSE and NSE on December 27, Wednesday as stated in the release. Ends

Be the first to comment on "Mufti Brand Maker’s Credo Brands Marketing Rs 550 Cr IPO To Open On Dec 19, Sets Price Band at Rs 266-280 a share"