Indian Overseas Bank (IOB) Logo

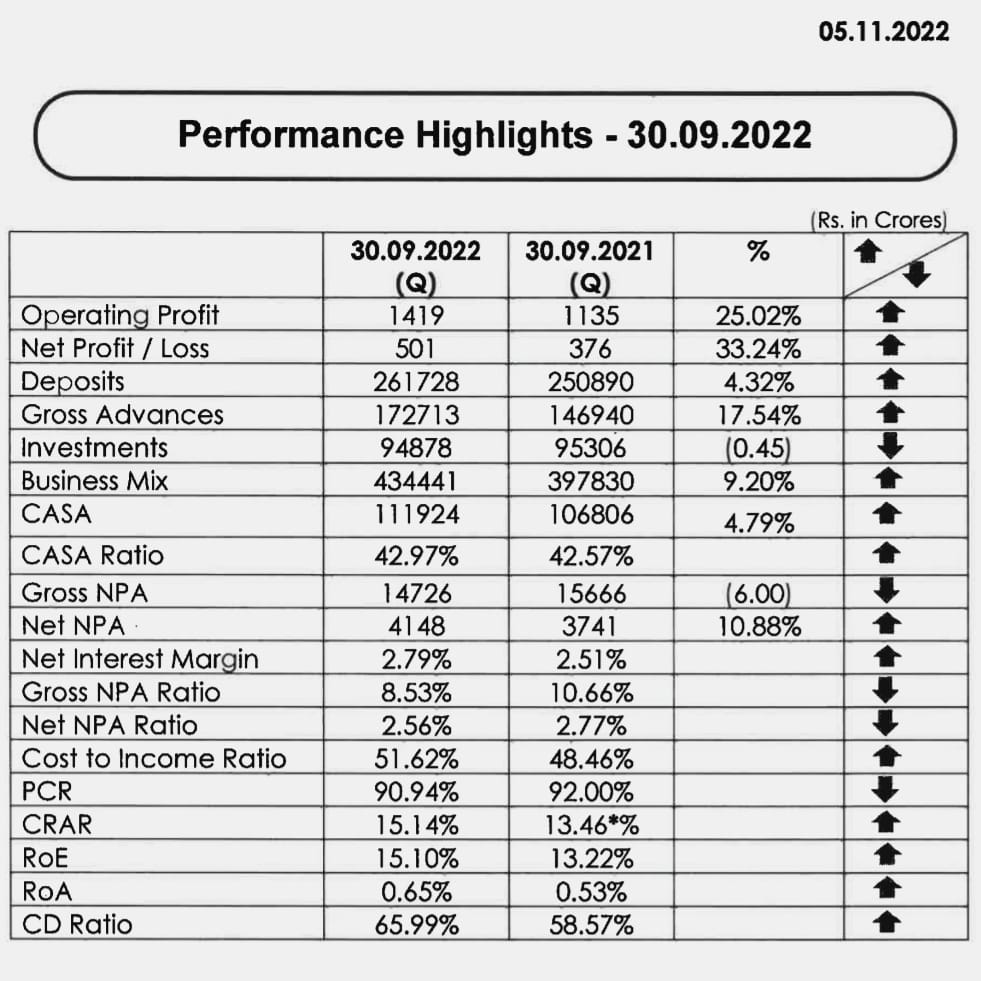

MUMBAI, 5 NOVEMBER, 2022 (GPN): Public Sector Lender, Indian Overseas Bank (IOB), announced on Saturday that its net profit for the Second Quarter of the current fiscal year increased by 33.24% to ₹501 crore from ₹376 crore in the same quarter of the previous year.

Financial Results (Q2 FY2023) – QoQ Comparison

The company has reported total income of Rs. 5854.02 crores during the period ended September 30, 2022 as compared to Rs. 5031.21 crores during the period ended June 30, 2022.

The company has reported total income of Rs. 5854.02 crores during the period ended September 30, 2022 as compared to Rs. 5031.21 crores during the period ended June 30, 2022.

The company has posted net profit of Rs. 500.20 crores for the period ended September 30, 2022 as against net profit of Rs. 393.10 crores for the period ended June 30, 2022.

The company has reported EPS of Rs. 0.2646 for the period ended September 30, 2022 as compared to Rs. 0.2079 for the period ended June 30, 2022.

| Financials | Q2 FY2023 | Q1 FY2023 | % Change |

| Total Income | ₹ 5854.02 crs | ₹5031.21 crs |  16.35% 16.35% |

| Net Profit | ₹500.20 crs | ₹393.10 crs |  27.24% 27.24% |

| EPS | ₹0.2646 | ₹0.2079 |  27.27% 27.27% |

Financial Results (Q2 FY2023) – YoY Comparison

The company has reported total income of Rs. 5854.02 crores during the period ended September 30, 2022 as compared to Rs.5092.68 crores during the period ended September 30, 2021.

The company has posted net profit / (loss) of Rs.500.20 crores for the period ended September 30, 2022 as against net profit / (loss) of Rs.376.51 crores for the period ended September 30, 2021.

The company has reported EPS of Rs.0.2646 for the period ended September 30, 2022 as compared to Rs.0.1991 for the period ended September 30, 2021.

| Financials | Q2 FY2023 | Q2 FY2022 | % Change |

| Total Income | ₹ 5854.02 crs | ₹5092.68 crs |  14.95% 14.95% |

| Net Profit | ₹500.20 crs | ₹376.51 crs |  32.85% 32.85% |

| EPS | ₹0.2646 | ₹0.1991 |  32.90% 32.90% |

Financial Results (Half Year Ended FY2023) – YoY Comparison

The company has reported total income of Rs.10885.23 crores during the 6 Months period ended September 30, 2022 as compared to Rs.10705.17 crores during the 6 Months period ended September 30, 2021.

The company has posted net profit / (loss) of Rs.893.30 crores for the 6 Months period ended September 30, 2022 as against net profit / (loss) of Rs.706.18 crores for the 6 Months period ended September 30, 2021.

The company has reported EPS of Rs.0.4725 for the 6 Months period ended September 30, 2022 as compared to Rs.0.3735 for the 6 Months period ended September 30, 2021.

| Financials | Half Year Ended FY2023 | Half Year Ended FY2022 | % Change |

| Total Income | ₹10885.23 crs | ₹10705.17 crs |  1.68% 1.68% |

| Net Profit | ₹893.30 crs | ₹706.18 crs |  26.50% 26.50% |

| EPS | ₹0.4725 | ₹0.3735 |  26.51% 26.51% |

Asset Quality:

| Asset Quality | Q2 FY2023 | Q1 FY2023 | Q2 FY2022 |

| Gross NPA | ₹14726.35 crs | ₹14919.06 crs | ₹15665.69 crs |

| Gross NPA % | 8.53% | 9.12% | 10.66% |

| Net NPA | ₹4148.60 crs | ₹3698.12 crs | ₹3741.21 crs |

| Net NPA % | 2.56% | 2.43% | 2.77% |

Gross NPA was at ₹ 14726.35 crs in Q2 FY2023 against ₹ 15665.69 crs in Q2 FY2022. The same was at ₹ 14919.06 crs in Q1 FY2023.

Net NPA was at ₹ 4148.60 crs in Q2 FY2023 against ₹ 3741.21 crs in Q2 FY2022. The same was at ₹ 3698.12 crs in Q1 FY2023.

GNPA was at 8.53% of Gross advances as on September 30, 2022 as compared to 10.66% as on September 30, 2021 and 9.12% as of June 30, 2022.

Net NPA was at 2.56% of Gross advances as on September 30, 2022 as compared to 2.77% as on September 30, 2021 and 2.43% as of June 30, 2022.

| Ratios | Q2 FY2023 | Q1 FY2023 | Q2 FY2022 |

| RoA % | 0.65% | 0.51% | 0.53% |

| CAR (BASEL III) % | 15.14% | 14.79% | 15.41% |

Return on Average Assets (RoA) is at 0.65% for Q2 FY2023 against 0.51% in Q1 FY2023 and 0.53% in Q2 FY2022.

In Q2 FY2023, Bank’s total Capital Adequacy Ratio (CAR) was at 15.14%, as compared to 14.79% in Q1 FY2023 and 15.41% in Q2 FY2022.

Shares of Indian Overseas Bank was last trading in BSE at Rs. 21.65 as compared to the previous close of Rs. 19.35. The total number of shares traded during the day was 4760328 in over 5415 trades.

The stock hit an intraday high of Rs. 21.90 and intraday low of 19.35 – Ends.

Be the first to comment on "Indian Overseas Bank (IOB) Announces Q2FY23 Results posts 33% Jump in PAT at Rs. 501 crores in Q2FY23"