Mumbai (GPN): Did you know

· In February, Mutual Funds were seen adding names like Infosys (INR 30.2bn), Reliance (23.8bn), ICICI Bank (20.1bn) and Manyavar (15.3bn), whereas they slightly trimmed holdings in TCS (INR 9.2bn), Vedanta (INR 6.1bn), Apollo Hospitals (4.9bn), and Escorts (4.9bn).

· Within Banking Sector, funds were seen adding ICICI Bank , SBI, HDFC Bank and they trimmed IndusInd Bank, PNB, City Union Bank and Axis Bank.

· Midcap: Key additions- Manyavar (INR 15.3bn), ZEE Entertainment (INR 5.7bn), Lupin (INR 5.5bn) and Ashok Leyland (INR 3.7bn). Key reductions were Escorts (INR 4.9bn), PNB (2.6bn), Voltas (INR 1.9bn), and Indraprastha Gas (INR 1.6bn).

· Smallcap: Key additions- Equitas SFB (INR 3.4bn), Metropolis Health (INR 3.3bn), IDFC (INR 1.2bn) and Barbeque Nation (INR 1.1bn). Key reductions were City Union Bank (INR 1.6bn), Indiabulls Housing (INR 1.6bn), Sterlite Tech (0.9bn), and VIP Ind (0.8bn).

The Midcap segment is between INR 10k bn to INR 40k bn marketcap and Smallcap segment is below 10k bn marketcap.

MF House wise Activity

· Aditya Birla SL MFs major additions were Axis Bank(INR1.75bn), Infosys(INR1.68bn) and Divi’s Lab(INR1.58bn). It’s major reductions were Pfizer(INR1.15bn), Procter & Gamble Hygiene(INR0.9bn) and TCS(INR0.78bn). Manyavar and Krsnaa Diagnostics were new entrants while Bajaj Consumer Care was a complete exit.

· Axis MFs prominent additions were Hindalco Inds(INR2.29bn), Bajaj Finserv(INR1.64bn) and Kotak Mah Bank(INR1.57bn). It reduced Zomato(INR2.25bn), Pidilite Inds(INR1.79bn) and Supreme Inds(INR1.15bn). New entrants included Manyavar and Linde India while Escorts was a complete exit.

· DSP MFs large additions were Tata Motors(INR3.43bn), Infosys(INR2.04bn) and MphasiS(INR1.33bn). It’s major reduce included Kotak Mah Bank(INR3.39bn), Sterlite Tech(INR1.1bn) and Relaxo Footwear(INR1.07bn). Manyavar and Forbes Enviro Sol. were new entrants while complete exit included Sterlite Tech.

· Franklin Templeton MFs major additions were ICICI Pru Life(INR1.63bn), MphasiS(INR1.56bn) and Ashok Leyland(INR1.39bn). The fund reduced exposure in Tata Consumer Products(INR1.41bn), Axis Bank(INR1bn) and HDFC Bank(INR0.99bn). The list of new entries included ICICI Pru Life and Max Healthcare Institute while CARE Ratings was a complete exit.

· HDFC MFs large additions were Reliance Inds(INR3.26bn), H D F C(INR2.18bn) and HDFC Bank(INR1.74bn). It’s prominent reductions were St Bk of India(INR2.79bn), Tata Steel(INR2.33bn) and United Spirits(INR1.34bn). Natl Aluminium and Vodafone Idea were new entrants while Abbott India was a complete exit.

· ICICI Pru MFs major additions were Infosys(INR10.61bn), H D F C(INR8.91bn) and Bharti Airtel(INR7.16bn). The fund reduced Hindalco Inds(INR5.83bn), TCS(INR5.01bn) and Vedanta(INR2.5bn). Manyavar and Techno Elec were new entrants while Metro Brands was a complete exit.

· Kotak MFs large additions were H D F C(INR3.84bn), Motherson Sumi(INR2.45bn) and Manyavar(INR2bn). It’s prominent reductions included HDFC Bank(INR2.43bn), Vedanta(INR1.63bn) and Tata Power Co(INR1.62bn). New entrants included Manyavar and Metropolis Health.

· Nippon India MFs prominent additions were H D F C(INR3.96bn), HDFC Bank(INR1.95bn) and Infosys(INR1.76bn). It’s major reductions included Vedanta(INR1.56bn), Larsen & Toubro(INR1.51bn) and Bharti Airtel(INR1.4bn). New entrants included GMR Infra while Kirloskar Oil was a complete exit.

Note: All value stated above are calculated using ending values for Feb-22.

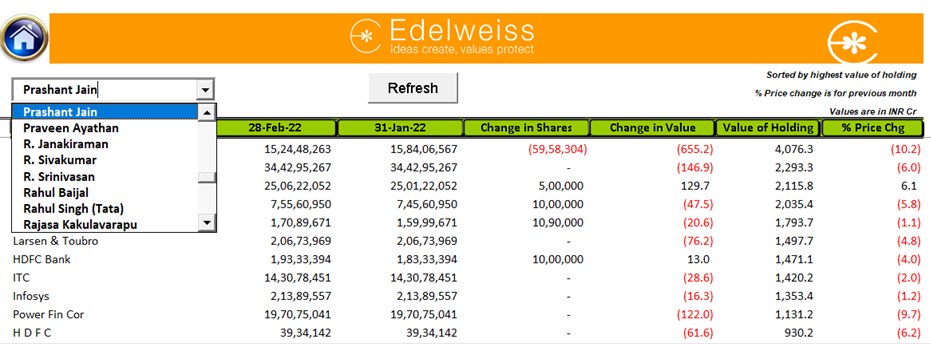

New Feature- > Fund Manager wise holdings

· In our EFI workbook, we have added a new tab – Fund Manager wise holdings. There are a total of 212 Fund Managers. This tab helps in analysing the individual FM wise holdings of all schemes managed by them.

· The sheet also highlights the % change in price of the stocks in the previous month. For instance, the current workbook depicts the % change in price for February 2022.

Link to the Workbook and Report | New Feature -> Fund Manager wise holdings (refer workbook)

Be the first to comment on "EFI March 22 Edition: MFs deployed INR 284bn in Secondary Mkts ; Key adds were Infosys , Reliance Ind and ICICI Bank | Participated in Manyavar IPO"