MUMBAI, 22 NOVEMBER, 2021 (GPN): UPDATE ON THE OPERATING PERFORMANCE OF THE COMPANY UP TO OCTOBER 2021

MUMBAI, 22 NOVEMBER, 2021 (GPN): UPDATE ON THE OPERATING PERFORMANCE OF THE COMPANY UP TO OCTOBER 2021

Highlights of October 2021:

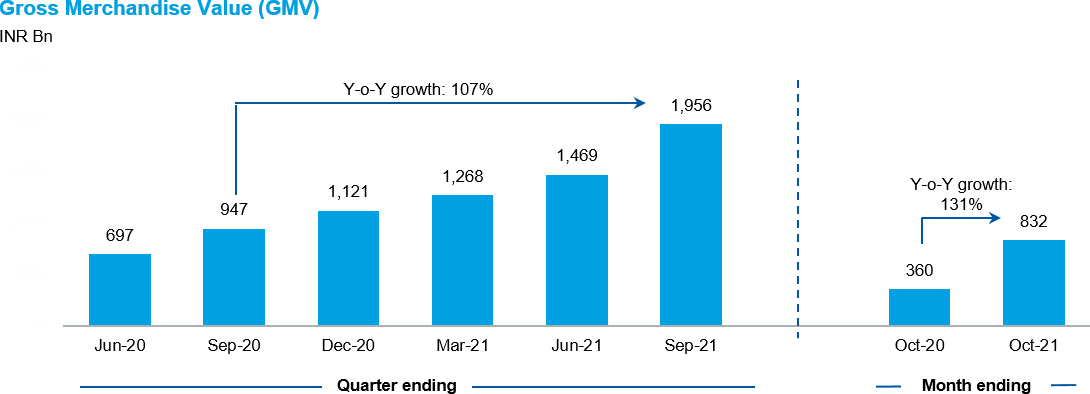

Gross Merchandise Value (GMV)1 Growth Accelerates to 131% Y-o-Y, Following a 107% Increase Y-o-Y in September quarter

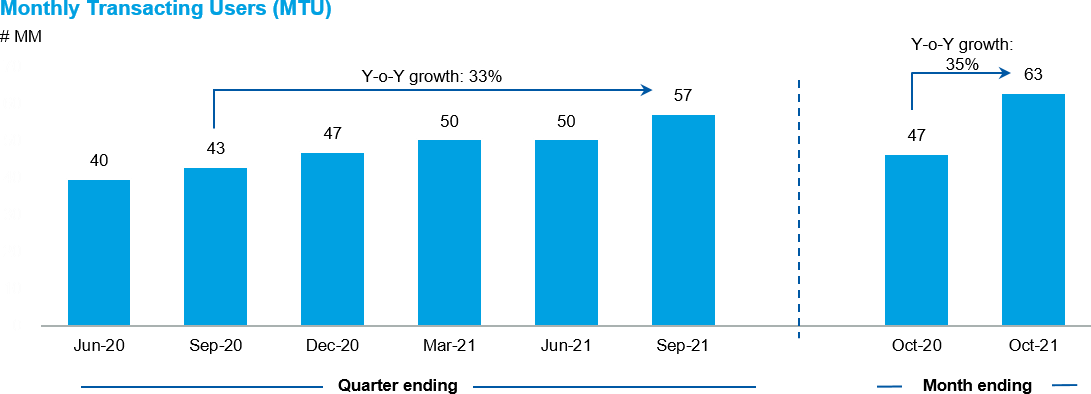

Monthly Transacting Users (MTU)2 of 63 million, Increase of 35% Y-o-Y

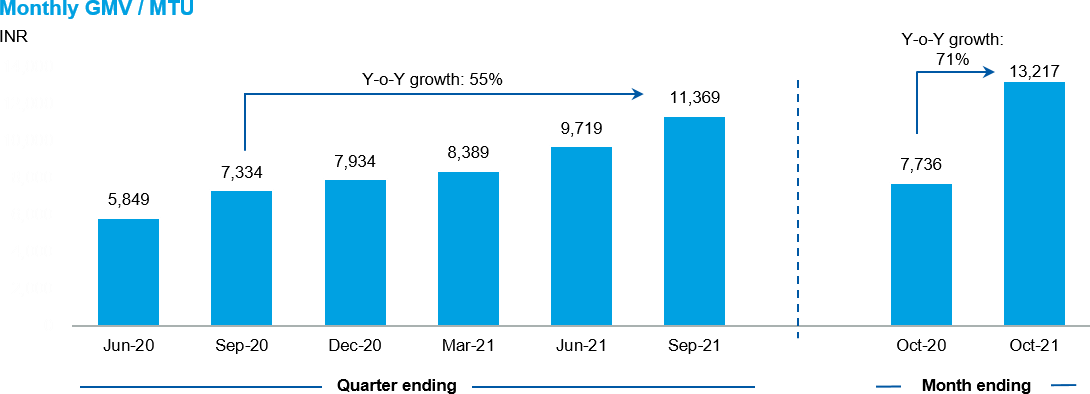

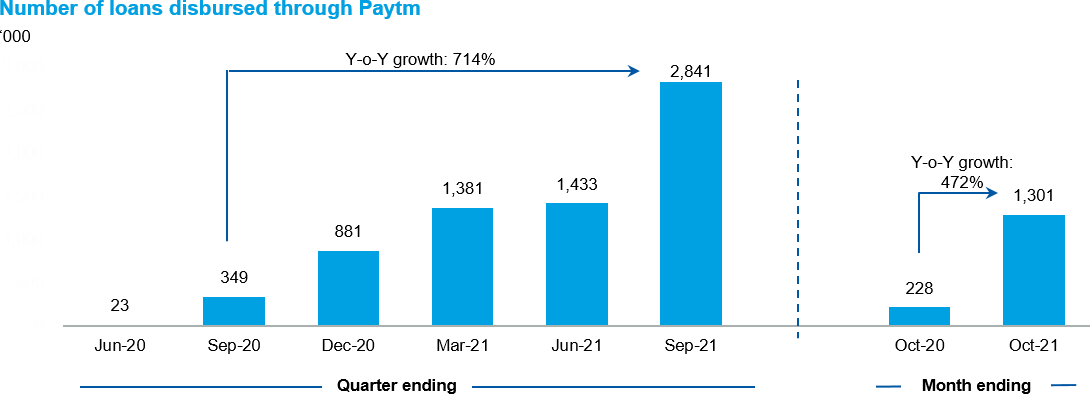

71% Y-o-Y Increasing in Monthly GMV / MTU Highlighting Increasing Engagement 1 million additional merchant devices deployed over the last 12 months Continued Growth in Lending Business; 1.3 million Loans Disbursed in the month

Loan Disbursals through our platform reached $1 billion annualized run-rate; INR 6,270 million ($84 million) for October 2021, an increase of 418% Y-o-Y

Our strong operating performance continued in the month of October 2021, with increasing numbers of consumers and merchants transacting on our ecosystem, increasing frequency of transactions and increasing adoption of our different products and services.

In keeping with our disclosures in the prospectus, the growth momentum in GMV continued in October 2021 driven by festive season spends, as well as an increase in: number of merchants and consumers, adoption of new products, transactions for both online and in-store merchants, and in deployed devices. GMV processed through our platform for the month of October 2021 aggregated to approximately INR 832 billion ($11.2 billion), growth of 131% over the month of October 2020.

GMV is defined as value of total payments made to merchants through transactions on our app, through Paytm payment instruments or through our payment solutions, over a period. It excludes any consumer-to-consumer payment services such as money transfers

2 MTU: Monthly Transacting User or unique users with at least one successful transaction in a particular calendar month.

As disclosed in our prospectus, our monthly transacting users (“MTU”) have consistently grown in FY 2021 and in the first two quarters of FY 2022 and the trajectory has continued in October 2021 with 63 million MTUs, growth of 35% Y-o-Y over the 47 million MTUs in October 2020.

As outlined in our prospectus, the trend of growth in our GMV / MTU representing one facet of our consumer and merchant engagement has continued to increase since second quarter of FY 2021 and in October 2021 our monthly GMV / MTU increased to INR 13,217 ($177), growth of 71% over INR 7,736 ($104) for the month of October 2020.

We continued to witness strong adoption of our devices business amongst merchants. As disclosed in the prospectus, the total number of devices deployed across our merchant base has increased from 0.9 million as on June 30, 2021 to approximately 1.3 million as on September 30, 2021 to approximately 1.4 million as on October 31, 2021.

As outlined in our prospectus, our lending business has seen good adoption since launch of products such as Paytm Postpaid and personal loans with financial institution partners. Due to cautious approach in making new disbursements due to the second wave of the COVID-19 pandemic in May 2021 and June 2021, we processed a total of 1.4 million loans through our financial institution partners in Q1 FY 2022. We saw continued recovery in the segment as our financial institution partners’ disbursal almost doubled with over 2.8 million loans in Q2 FY 2022. The October 2021 month saw continued increase in adoption across our different financial services products. The lending business, continued to show very strong growth as a result of rapid scale up of all of our lending products, including Postpaid, consumer loans and merchant loans. Our financial institution partners disbursed a total of 1.3 million loans in October 2021 aggregating to a total disbursal of INR 6,270 million ($84 million), implying a 472% increase in numbers of loans disbursed Y-o-Y and 418% increase in value of loans disbursed Y-o-Y.

The table below, summarizes the key operating metrics as highlighted above.

The table below, summarizes the key operating metrics as highlighted above.

| For quarter ending | For month of | ||||||||||

|

Jun-20 |

Sep-20 |

Dec-20 |

Mar-21 |

Jun-21 |

Sep-21 |

Sep-21

Y-o-Y growth |

Oct-20 |

Oct-21 |

Oct-21

Y-o-Y growth |

||

| GMV | INR bn | 697 | 947 | 1,121 | 1,268 | 1,469 | 1,956 | 107% | 360 | 832 | 131% |

| Average MTU | million | 40 | 43 | 47 | 50 | 50 | 57 | 33% | 47 | 63 | 35% |

| Monthly GMV / MTU | INR | 5,849 | 7,334 | 7,934 | 8,389 | 9,719 | 11,369 | 55% | 7,736 | 13,217 | 71% |

| Number of loans disbursed through Paytm | ‘000s | 23 | 349 | 881 | 1,381 | 1,433 | 2,841 | 714% | 228 | 1,301 | 472% |

| Value of loans disbursed through Paytm | INR bn | 0.4 | 2.1 | 4.7 | 6.9 | 6.3 | 12.6 | 499% | 1.2 | 6.3 | 418% |

| Total devices deployed (cumulative) | million | 0.2 | 0.3 | 0.6 | 0.8 | 0.9 | 1.3 | n/a | 0.4 | 1.4 | n/a |

Notes:

- Exchange rate used $1 = INR 74.5

- GMV is defined as value of total payments made to merchants through transactions on our app, through Paytm payment instruments or through our payment solutions, over a period. It excludes any consumer-to-consumer payment services such as money transfers

- MTU: Monthly Transacting User or unique users with at least one successful transaction in a particular calendar month.

- Total loans disbursed by financial institution partners through our platform include both consumer loans and merchant loans and excludes, the number and the value of, loans sourced by third parties through advertising on our platform, and aggregation of EMIs on our POS devices.

Be the first to comment on "Operating performance report during the month of October 2021 by Paytm"