MUMBAI, 11 MAY, 2021 (GPN): JSPL reports highest ever consolidated EBITDA of INR 5,287 Cr in 4QFY21

Driven by record standalone EBITDA of INR 4,884 Cr in 4QFY21

Highest ever consolidated EBITDA of INR 14,444 Cr and PAT of INR 5,527 Cr in FY21

Standalone Net debt reduced further by INR 3,067 Cr in 4QFY21 and INR 4,643 Cr in FY21

Consolidated Net debt reduced further by INR 3,475 Cr in 4QFY21 and INR 13,773 Cr in FY21

Focus shifts entirely to India Steel post Oman stake sale closure and proposed JPL divestment

Embarking on next phase of growth in Angul with expansion from 6 MTPA to 12 MTPA at

competitive capex of c.INR18k Cr

JSPL Standalone Performance

4QFY21 Highlights

Gross Revenue# INR 11,737 Cr;

Net Revenue INR 10,430 Cr;

EBITDA: INR 4,884 Cr;

Profit after tax: INR 3,426 Cr;

Steel* production : 2.07 million tonnes

Steel* sales : 1.91 million tonnes

FY21 Highlights

Gross Revenue# INR 37,051 Cr;

Net Revenue INR 33,308 Cr;

EBITDA: INR 13,055 Cr;

Profit after tax: INR 7,154 Cr;

Steel* production : 7.51 million tonnes

Steel* sales : 7.28 million tonnes

JSPL Consolidated Performance:

4QFY21 Highlights

Gross Revenue# INR 13,190 Cr;

Net Revenue INR 11,881 Cr;

EBITDA: INR 5,287 Cr;

Profit after tax: INR 1,901 Cr;

FY21 Highlights

Gross Revenue# INR 42,745 Cr;

Net Revenue INR 38,989 Cr;

EBITDA: INR 14,444 Cr;

Profit after tax: INR 5,527 Cr;

JPL Performance:

4QFY21 Highlights

Turnover: INR 1,365 Cr;

EBITDA INR 345 Cr;

Power Generation: 3,972 MU;

FY21 Highlights

Turnover: INR 4,604 Cr;

EBITDA INR 1,318 Cr;

Power Generation:. 13,075 MU;

Strong momentum witnessed in 9MFY21 by JSPL continued in 4QFY21 with the company achieving

record production, revenues and profitability during the quarter. JSPL has ended FY21 on a strong note

with Consolidated EBITDA hitting a record of INR 14,444 Cr and the company reporting a net profit (INR

5,527 Cr) after losses reported in the past 6 years.

Solid operational performance, divestment of non-core assets and lower capex have all contributed in

JSPL continuing on the path of deleveraging with net debt declining sharply from INR 35,919 Cr in FY20

to INR 22,146 Cr in FY21. As a result, JSPL’s balance sheet is now the strongest in the sector. The Company

in its endeavor to become Net Debt free has made substantial prepayment of INR 2,462 Cr in early May.

Net debt has declined to INR 10,589 Cr on Standalone basis and INR 19,332 Cr on Consolidated basis (as

on 11th May’21). Strengthening balance sheet coupled with strong upcycle witnessed in steel prices have

led to JSPL’s credit rating enhancement to A from BBB- within a span of 4 months.

Proposed divestment of JPL will further boost JSPL’s balance sheet. In addition, the divestment would also

reduce JSPL’s carbon footprint by almost half and propel the Company towards becoming Net Debt free –

a rare feat in the Steel sector, historically associated with high leverage and stretched balance sheet.

- JSPL 2.0: Next Phase of Growth

The core focus right now is to sweat out assets and make JSPL Net Debt free. Thereafter, the Company

will be embarking on a journey to expand its profitability and volumes via the Angul expansion from

6 MTPA to 12 MTPA taking JSPL’s overall Steel capacity to c.16 MTPA in India. Rich from its

experiences and learnings of the past decade, the Company plans to tread on this next phase of growth

in a measured way by not deviating from the two key guard rails: 1) Keeping Net Debt to EBITDA

below 1.5x during all times and 2) Keeping Sustainability – of financial and ESG matrices – at the

forefront.

The projects undertaken in our next phase of growth can be broadly bucketed under two categories:

1.1. Volume Expansion

JSPL is all set to double its steelmaking capacity at Angul, Odisha to c12 MTPA (from 6 MTPA

currently), raising its India crude steel capacity by 66% to c.15.9 MTPA. Key projects driving volume

expansion at Angul include 4.25 MTPA Blast Furnace (BF), 2.7 MTPA Direct Reduced Iron (DRI) and

6.3 MTPA Steel Melt Shop (SMS) broadly replicating the present facilities at Angul. It will take us c.30

months to commission the 4.25 MTPA BF-BoF, with commissioning expected startingDecember 2023.

This will be followed by 2.7 MTPA DRI plant, with commissioning expected in February 2025. These

projects along with the related raw material capacities (2 MTPA coke oven, oxygen plant etc.) will

account for almost two-thirds of the planned c.INR18,000 Cr capex.

1.2. Margin Expansion

In its endeavor to become one of the highest margin steel producers globally, JSPL intends to further

reduce costs and improve its product mix at Angul. JSPL plans to construct a slurry pipeline between

Barbil-Angul (200kms) in conjunction with 12 MTPA pellet plant in Angul (2 phases of 6 MTPA each),

which would reduce iron ore logistic costs and bring in additional cash flows from pellet sales. The

first phase of the pellet plant is expected to get commissioned in September 2022 and Phase-2 will be

commissioned a year later (Sep-23). In order to improve its product mix, JSPL is also planning to

construct a 5.5 MTPA Hot Strip Mill (HSM), which will significantly increase Company’s flat steel

making capacity from 2.2 MTPA currently to 7.7 MTPA. These margin expansion projects of both

backward and forward integration account for the remaining one third capex and have a strong IRR

delivering a short payback period.

- JSPL Standalone Performance

2.1. Fourth Quarter FY21 Performance

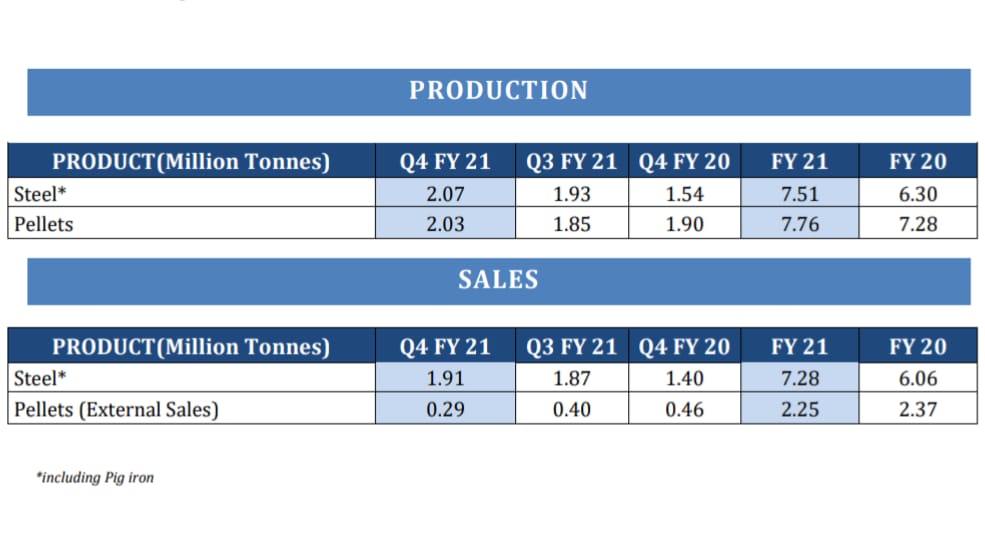

During 4QFY21, JSPL Standalone reported highest ever steel production volumes (incl. pig iron) at

2.07 million tonnes (Up 35% YoY) and sales of 1.91 million tonnes (up 37% YoY). Lucrative export

markets incentivised the company to raise its share of exports to 27% in 4QFY21 (vs. 21% in 3QFY21).

Steel prices continued their upward momentum during the quarter. However, secondary rebar prices

witnessed a sharp decline for a brief period in the beginning of the quarter before recovering. Rising

steel prices, improved mix and higher volumes helped JSPL Standalone report a record EBITDA of INR

4,884 Cr . Strong operating profit and declining interest costs have resulted in JSPL standalone posting

its highest ever quarterly profit of INR 3,426 Cr. However, sharp rise in iron ore prices coupled with

increase in prices of electrodes, alloys, refractories and other such raw materials continue to exert

downward pressure on margins.

Pellet production in 4QFY21 increased 7 % YoY. External sales of pellets however reduced to 0.29

million tonnes (down 38% YoY) due to higher internal consumption as production ramps up.

2.2. FY21 Performance

Notwithstanding the massive disruption caused by the pandemic in early FY21, JSPL’s wide product

profile and geographical diversification stood the Company in good stead helping JSPL report higher

production and sales y-o-y in 1QFY21. As the economy gradually unlocked, the steel demand and

prices have continued to boost company’s volume with the production rising in each successive

quarter. For the full year, standalone production (incl. pig iron) increased by 19% y-o-y to hit a record

of 7.51 million tonnes (vs 6.30 million tonnes in FY20) while Standalone Steel (incl. pig iron) sales

also reached the highest ever level of 7.28 million tonnes (up 20% YoY). Better export markets during

the year resulted in JSPL exports rising by 226% to 2.53mt in FY21, accounting for 35% of the overall

sales (vs. 13% in FY20)

After hitting a bottom in June 20 quarter, the steel prices have seen a sharp recovery with NSR’s rising

consistently in every quarter. Improving prices, higher volumes and better cost efficiencies have

resulted in JSPL Standalone EBITDA hitting a record of INR 13,055 Cr. Record operating profit and

declining interest expense have contributed in JSPL net profit reaching the highest ever level of INR

7,154 Cr in FY21.

The Pellet operations at Barbil also reported record production of 7.76 million tonnes in FY21 (vs.

7.28 in FY 20). However, with ramp up of the India steel operations, external sales of 2.25 million

tonnes were lower (-5% y-o-y).

- Jindal Power Ltd (JPL)

3.1. Fourth Quarter FY21 Performance

Improved power demand and coal availability led to JPL reporting generation of 3,972 million units

in Q4FY21 (+63% y-o-y).

Given the pent up demand there was some benefit of higher pricing on the spot exchanges and

increased volumes were largely offset by higher coal and other costs with JPL reporting an EBITDA of

INR 345 Cr (up 17% YoY). The costs were also impacted by certain disruptions in few of the units

because of high ash congestion and ensuing breakdowns. Units are scheduled for substantial overhaul

in the coming quarters.

The Ministry of Coal, GoI had declared JPL as the successful bidder for Gare Palma IV/1 coal mine.

However, the company is still waiting for the vesting order from MoC before it can take control of the

mine which has been delayed by several months owing to the ongoing pandemic.

3.2. Full Year FY21 Performance

On an annual basis, JPL generated EBITDA of INR 1,318 Cr (up 9% YoY) primarily driven by higher

volumes and improved spot pricing. The Generation for FY21 stood at 13,075 million units compared

to 9,583 million units for FY20. Post the opening up of lockdowns earlier in the year, the sector

benefitted from pent up demand as manufacturing activity picked up and coal stocks were easily

available.

JPL divestment is a game changer: After running an exhaustive sale process that lasted for 4

months, where the company approached 33 potential buyers, JSPL recently proposed divestment of

JPL to Worldone Private Ltd for an all cash equity value consideration of INR 3,015 Cr. Post JPL

divestment, JSPL will transform into a pure play steel company with all its operations in India – one of

the highest growth economies globally. The divestment will significantly help JSPL reduce emissions

improving ESG score, strengthen its balance sheet via debt reduction, shift entire management focus

on company’s strong domestic steel business and improve return ratio’s for our investors as we

progress towards becoming a Net Debt free company. The Proposed Sale is subject to necessary

approvals of shareholders of the Company, regulatory approvals, approvals from lenders of the

Company and Target Company, contractual approvals and such other approvals, consents,

permissions and sanctions as may be necessary in line with extant relevant guidelines. The long stop

date for completion of the Proposed Sale is 12 months.

- Global Ventures

- Mozambique: Chirodzi mine produced 811 KT ROM (up 37% YoY) in 4QFY21.The Mozambique

operations continued to ramp up production this year and ended FY21 at 3.22 million tonnes (up

29% compared to 2.50 million tonnes in FY20). Mozambique operations reported EBITDA at

US$0.48mn for 4QFY21 and US$0.43mn for FY21. - South Africa: During 4QFY21, Kiepersol mine in South Africa produced 135 KT ROM (up 41%

YoY). The Mine operations continued to ramp up ending the year with a production of 622 KT

ROM (up 43% YoY) for FY21. The mine reported EBITDA of US$0.77 mn for the quarter and

US$6.09mn for the year (vs US$ 4.18 mn in FY20)

- Australia: Both Wongawilli & Russell Vale mines continue to remain under care & maintenance.

The development application for the Russell Vale Revised Preferred Underground Expansion

Project (UEP) has been approved by the Independent Planning Commission of NSW (IPC) subject

to certain conditions. Environmental Protection and Biodiversity Conservation (EPBC) referral is

currently under process. The Company is aiming to restart coal shipments in 2QFY22. - JSPL Consolidated Performance

5.1. Fourth Quarter FY21 Performance

Improved performance across steel, power and overseas mining operations in 4QFY21, have resulted

in JSPL reporting the highest ever Consolidated Gross Revenue of INR 13,190 Cr . Strong operational

performance coupled with better pricing environment have led to Consolidated EBITDA hitting a new

record of INR 5,287 Cr. Higher EBITDA and declining interest costs have led to net profit of INR 1,901

Cr .

5.2. Full Year FY21 Performance

Strong FY21 performance for the India steel and power business, helped JSPL report a record

Consolidated Gross Revenue of INR 42,745 Cr and EBITDA of INR 14,444 Cr. Consolidated PAT

(Continuing Operations) not only turned positive after posting a loss for the past 6 years, but also hit

an all-time high of INR 5,527 Cr.

Company’s unflinching focus on strengthening the balance sheet has resulted in consolidated net debt

declining further by INR 3,475 Cr in 4QFY21 (INR 13,773 Cr in FY21). As on March 2021, JSPL

reported Consolidated Net Debt of INR 22,146 Cr. Net Debt to EBITDA (Trailing) at the end of

March’21 stood at 1.53 x (vs 2.35 x as on December ’2020). - Outlook

Structural changes in China to curb steel exports (removal of export rebate), strong focus on reducing

carbon emissions and ongoing geopolitical tensions are likely to provide continued support to current

steel upcycle, in our view. India however is currently facing threat from the ongoing second wave of

Covid-19, which has turned out to be much severe compared to earlier wave. JSPL remains committed

to prioritising human lives in these challenging times and has been diverting oxygen supply to various

states (daily run rate has been increased to 120 tonnes recently from 100 tonnes). JSPL is providing

Liquid Medical Oxygen to the states of Telangana, Maharashtra, Andhra Pradesh, Gujarat, Odisha,

Chhattisgarh, Madhya Pradesh, Delhi and Haryana. While slowdown in construction activities within

the country and diversion of oxygen supply has resulted in lower production and sales recently,

strong export markets due to change in Chinese policies and ongoing vaccination drive involving

country’s broader population bode well for steel demand and pricing outlook in FY22 and beyond.

Outlook for Indian steel producers has turned extremely bright in the past year and JSPL’s decision to

divest power assets (JPL) is in line with our renewed strategy to focus on the company’s promising

India Steel operations.

Be the first to comment on "JSPL ANNOUNCES FINANCIAL RESULTS FOR FOURTH QUARTER & FY 2020-21 – JSPL 2.0 Vision: Only Indian Steel Company with Net Debt Free Balance Sheet"