NEW DELHI, 2nd NOVEMBER, 2020: Oriental Bank of Commerce & United Bank of India have been amalgamated with Punjab National Bank w.e.f

01.04.2020. Accordingly financials as on September 2019 & March 2020 are combined figures of three banks. The combined financials have been arrived by aggregation of numbers.

KEY HIGHLIGHTS

Global Business of the Bank at Rs. 17,86,670 Crore with a YoY growth of 1.06%.

Global Deposit of the Bank grew by 1.37% on Y-o-Y basis to Rs. 10,69,747 Crore.

Domestic CASA Share improved by 253 bps on Y-o-Y basis to 44.10% in Sept’20. CASA Deposits grew by 7.01% on Y-o-Y basis to Rs. 4,59,477 Crore in Sept’20. Savings Deposit grew YoY by 9.05%.

Gross Global Credit grew by 0.59% on Y-o-Y basis to Rs. 7,16,924 Crore.

Retail, Agriculture & MSME (RAM) Credit grew by 5.73% on Y-o-Y basis to Rs. 3,76,477 Crore.

Retail Credit grew by 3.85% on Y-o-Y basis to Rs. 1,30,158 Crore in Sept’20. Housing loan grew by 9.77% on Y-o-Y basis to Rs. 83,929 Crore in Sept’20.

CRAR as per Basel III increased to 12.84% in Sept’20 from 12.63% in June’20.

Operating Profit grew by 7.1% on Y-o-Y basis to Rs. 5,675 Crore in Q2 FY’21.

Net Profit for the quarter is at Rs. 621 Crore as on Sept’20 as against Net Profit of Rs 308 crore and Rs. 757 Crore as on June’20 and Sept’19 respectively.

Global NIM improved to 3.21% in Q2FY21 from 2.5% in Q1FY21 and 2.58% in Q2FY20.

NNPA ratio at 4.75% in Sep’20 improved by 64 bps from 5.39% in June’20.

Provision Coverage Ratio (PCR) improved by 225 bps to 83.00% as on Sept’20 from 80.75% as on June’20

Business Performance in Key Parameters (as on 30.09.2020)

❖ Domestic Deposits increased by 0.88% on Y-o-Y basis to Rs. 10,41,681 Crore as at the end of Sept’20.

❖ Domestic Advances increased by 0.52% on Y-o-Y basis to Rs. 6,97,341 Crore as at the end of Sept’20.

❖ Domestic Business increased by 0.73% on Y-o-Y basis to Rs. 17,39,022 Crore as on Sept’20 from Rs. 17,26,342 Crore as on Sept’19.

❖ Current Deposit stood at Rs 66,593 crore at Sep’20. Savings Deposit grew YoY by 9.05% on Y-o-Y basis to Rs. 3,92,884 Crore.

❖ Agriculture Advances grew by 12.39% YoY to Rs 1,24,350 crore as at Sep’20.

Priority Sector

❖Priority sector (PS) Credit is at Rs. 2,78,384 Crore as on Sept’20. ❖National Goal achievement under PS and Agriculture is 41.60% and 18.10% of ANBC, exceeding the target of 40% and 18% respectively. ❖Credit to Small and Marginal farmers is Rs. 56,806 Crore as on Sept’20. National Goal achievement is 8.49% of ANBC, exceeding the target of 8%. ❖Credit to Weaker Sections is at Rs. 73,705 Crore as on Sept’20. National Goal achievement is 11.01% of ANBC, exceeding the target of 10%.

Profitability

❖Net Interest Income grew YoY by 29.3% to Rs 8,393 crore during Q2FY21 and by 18.9% to Rs 15,142

crore during HY21.

❖Total Income stood at Rs 23,439 crore during Q2FY21 and at Rs 47,731 crore during HY21.

❖Total Expenditure declined by 6.4% to Rs 17,764 crore during Q2FY21 and by 2.3% to Rs 36,776 crore

during HY21.

❖Operating Profit grew by 4.9% on Y-o-Y basis to Rs. 10,955 Crore in HY21.

Efficiency Ratios

Global Yield on Advances improved to 8.09% in Q2FY21 from 8.04% in Q2FY20 and 7.64% in

Q1FY21.

Global Cost of Deposits improved to 4.48% in Q2FY21 from 5.34% in Q2FY20 and 4.92% in Q1FY21.

Cost to Income Ratio declined QoQ to 47.87% in Q2FY21 from 49.41% in Q1FY21.

Asset Quality

❖Gross Non Performing Assets (GNPA) ratio declined to 13.43% as on Sept’20 from 15.66% in Sept’19.

❖Provision Coverage Ratio (PCR) excluding TWO improved to 67.90% as on Sept’20 from 65.34% as on

June’20.

❖Credit Cost stood at 2.27% in Sep’20.

Capital Adequacy

❖CRAR as on Sept 30, 2020 improved to 12.84%. Out of which, Tier-I CRAR is 10.33%, CET-I is 9.53%

and Tier-II CRAR is 2.51% as on Sept’20.

Digitalization

❖Internet Banking users crossed 236 Lakh. UPI transactions increased YoY by 72% to 42.05 Crore.

❖POS installed increased YoY by 17.05% to 91,929.

❖Bharat/BHIM QR Code installed increased YoY by 187% to 2,19,125.

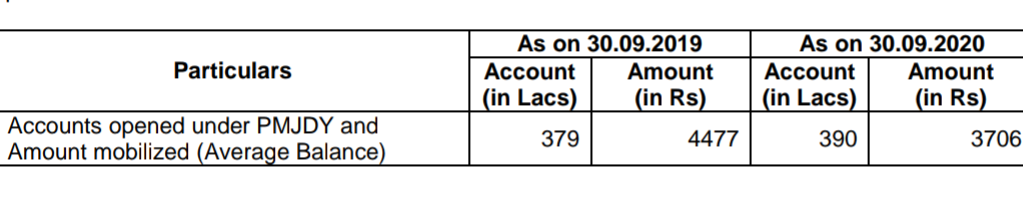

Financial Inclusion

❖Amount mobilized under Pradhan Mantri Jan Dhan Yojana stood at Rs. 3706 (Average Balance) as on

Sept’20.

Particulars

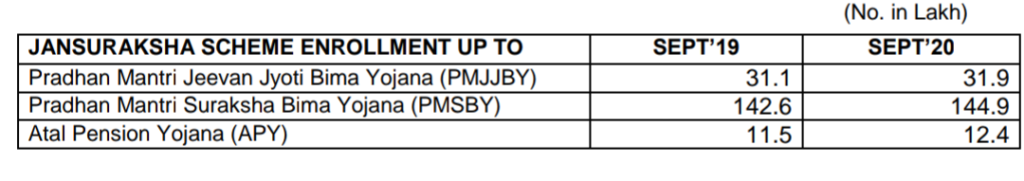

❖Enrollment under PMJJBY, PMSBY & APY:

Distribution Network

❖10930 branches (1970 Metro, 2277 Urban, 2753 Semi-Urban & 3930 Rural). 2 Overseas branches at Hong Kong and Dubai.

13878 ATMs.

12756 BCs.

New Initiatives Undertaken

- Digital Apnayen Campaign- Launched on 15th August 2020, More than 8 Lakh customers on-boarded on digital channels.

- Rs 40 Lakh Donated to PM CARES Fund on behalf of customers for Digital On-boarding since launch on 15th August 2020.

- Facility of Overdraft against FD in PNB One Mobile App.

- Facility of Insta – Demat through Internet Banking.

- Gram Sampark Abhiyan launched on 02nd Oct 2020: 1.67 Lakh customers were contacted in around 5000 camps with increased credit sanctions, digital on boarding and enrolment for social security.

Awards and Accolades

Bank secured overall 4th place under EASE 2.0 amongst all PSU Banks in different themes as under:

- Responsible Banking –2nd runner up.

- Governance and HR –2nd runner up.

- Deepening FI & Digitalisation –2nd runner up.

Social Media Presence of the Bank: (No. of Followers)

❖Facebook: 9,22,631 (https://www.facebook.com/pnbindia/)

❖Twitter: 1,61,200 (https://twitter.com/pnbindia)

❖LinkedIn: 62,565 (https://in.linkedin.com/company/pnbindia)

❖Instagram: 43,174 (https://www.instagram.com/pnbindia/)

❖Youtube: 37,213 (https://www.youtube.com/pnbindia)

ENDS

Be the first to comment on "PNB Reports Q2 FY21 Financial Results for the Quarter Ended 30th September 2020 Net Profit at Rs 621 Crore & 7.1% YoY growth in Operating Profit during Q2FY21; Gross Global Business reached Rs. 17.87 Lakh Crore. Global NIM improved to 3.21% in Q2FY21"