MUMBAI, 08 OCTOBER, 2020 (GPN):

Synopsis:

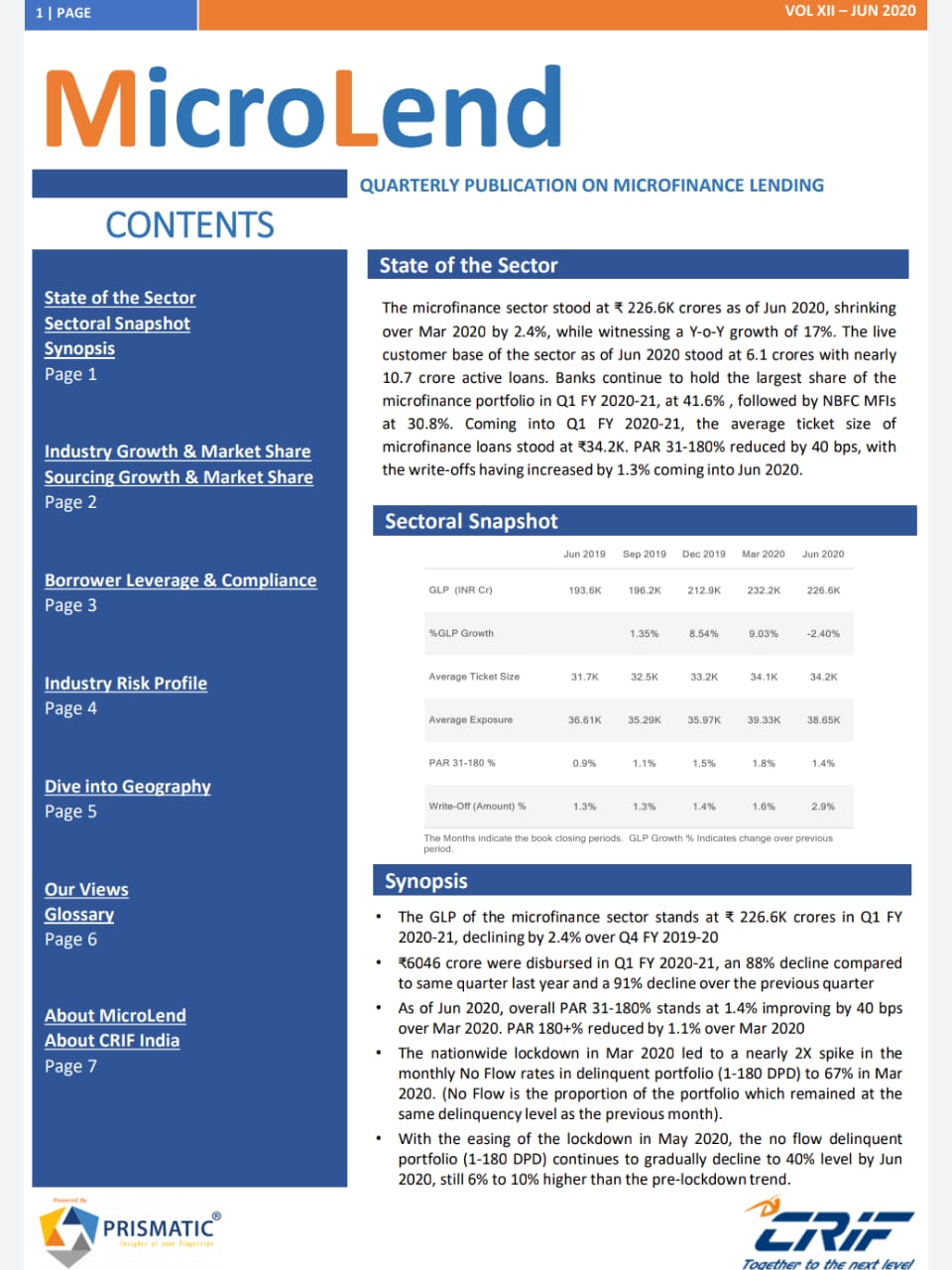

The GLP of the microfinance sector stands at ₹ 226.6K crores in Q1 FY

2020-21, declining by 2.4% over Q4 FY 2019-20

• ₹6046 crore were disbursed in Q1 FY 2020-21, an 88% decline compared

to same quarter last year and a 91% decline over the previous quarter

• As of Jun 2020, overall PAR 31-180% stands at 1.4% improving by 40 bps

over Mar 2020. PAR 180+% reduced by 1.1% over Mar 2020

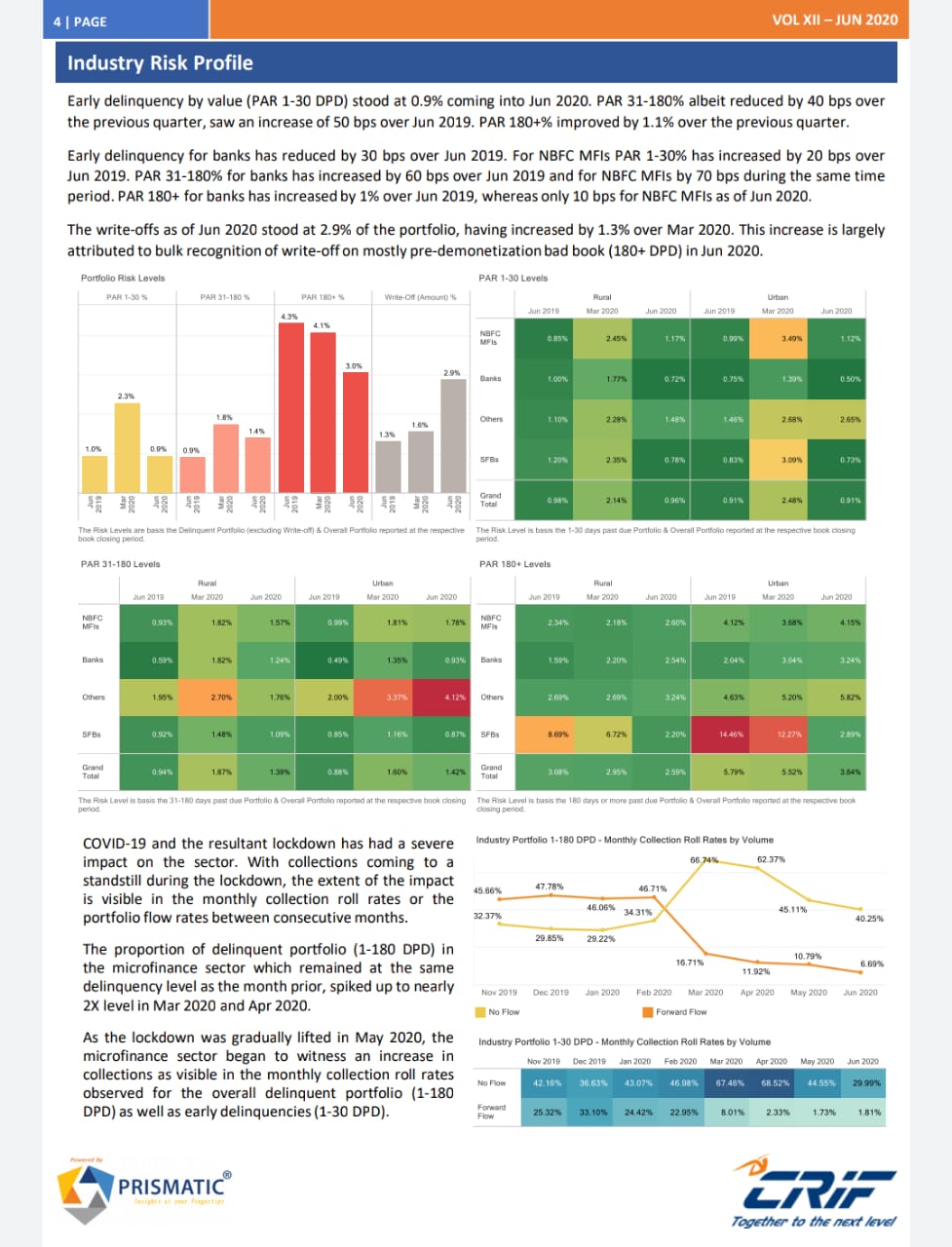

• The nationwide lockdown in Mar 2020 led to a nearly 2X spike in the

monthly No Flow rates in delinquent portfolio (1-180 DPD) to 67% in Mar

2020. (No Flow is the proportion of the portfolio which remained at the

same delinquency level as the previous month).

• With the easing of the lockdown in May 2020, the no flow delinquent

portfolio (1-180 DPD) continues to gradually decline to 40% level by Jun

2020, still 6% to 10% higher than the pre-lockdown trend.

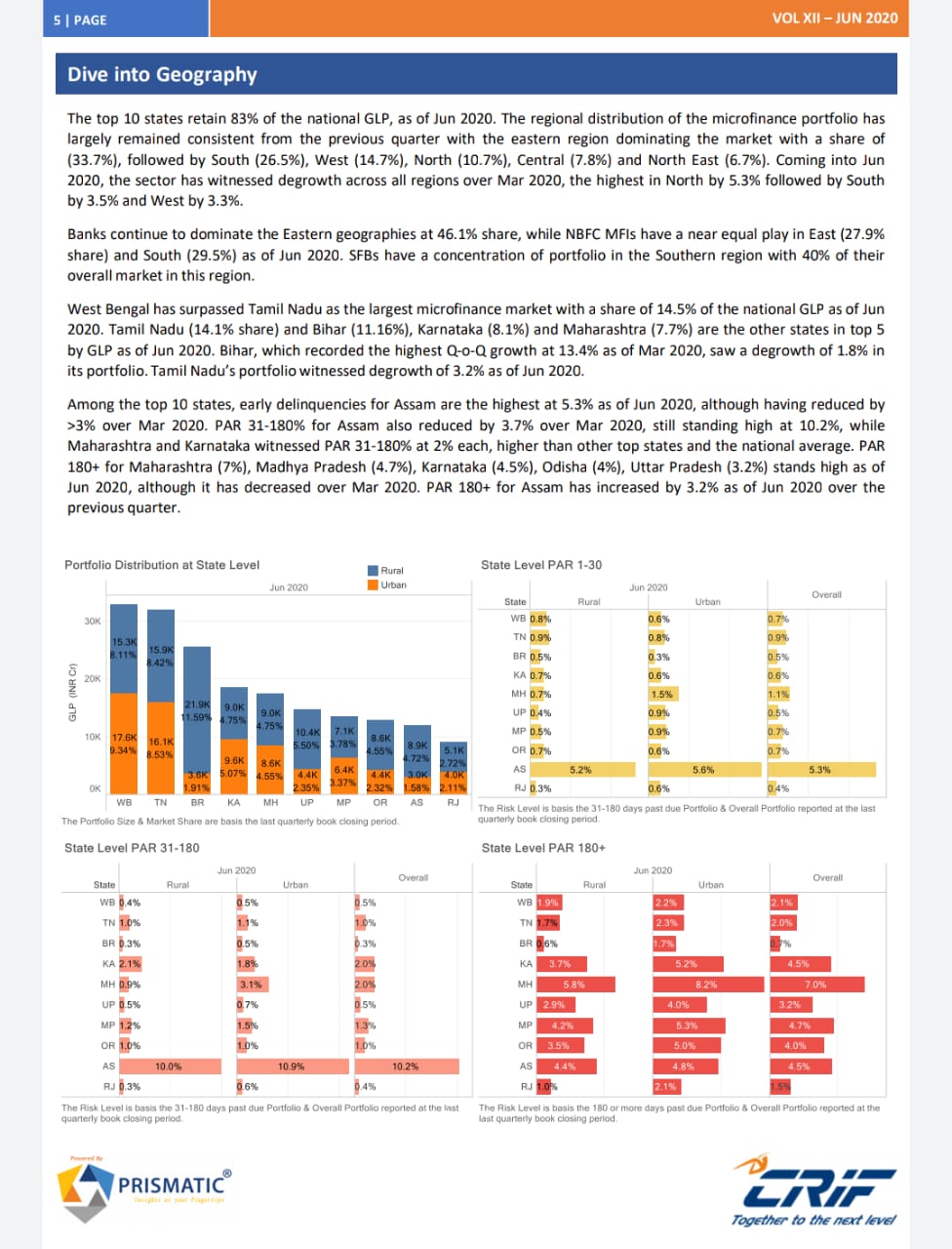

CRIF’s Views:

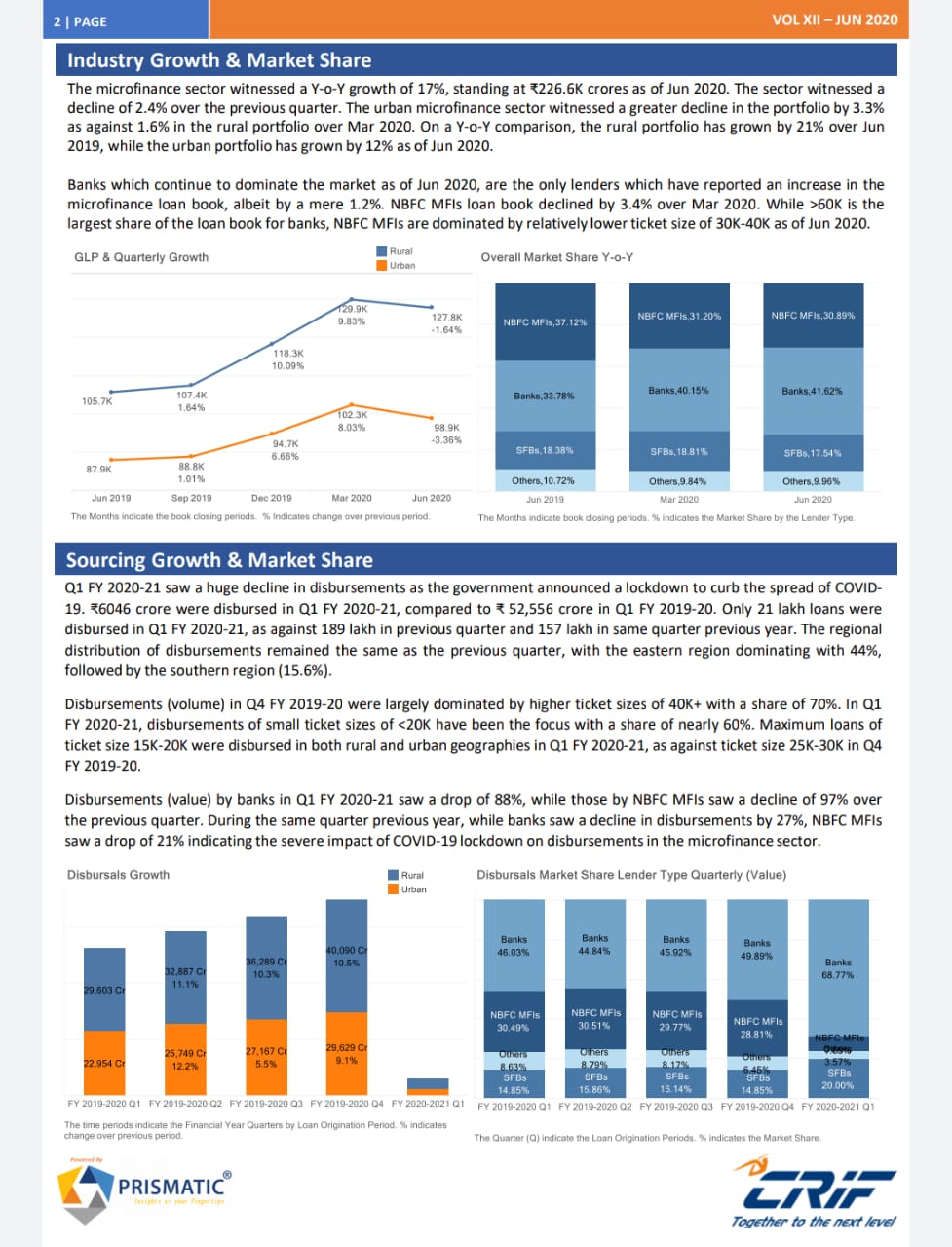

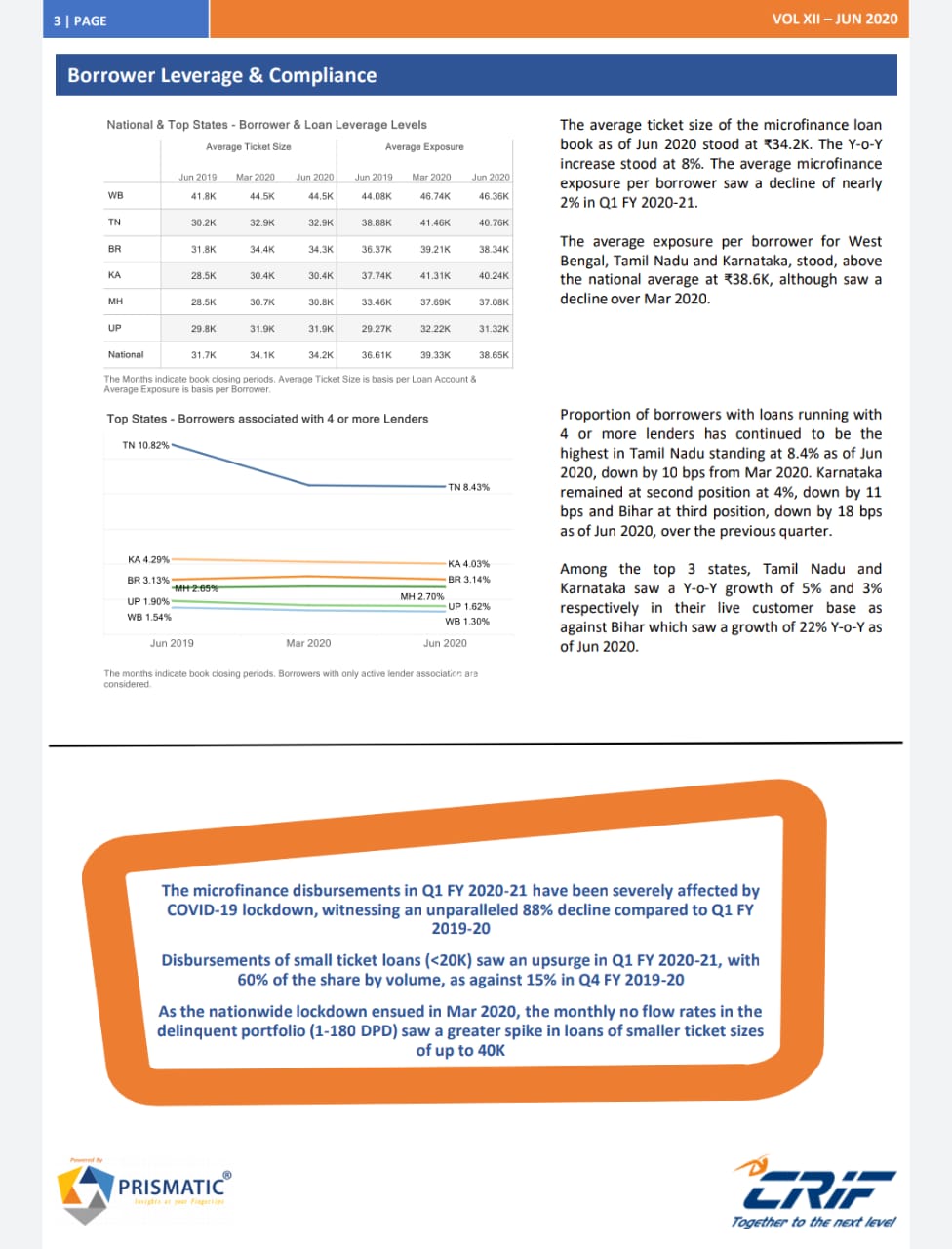

The Coronavirus pandemic has left an unprecedented impact across the world. The microfinance sector as well in India has borne the brunt of the pandemic. Unlike demonetization, the COVID-19 pandemic is a black swan event for the sector with not only collections BUT new business acquisition also getting impacted during the lockdown and as a result of the support and relief measures announced for the borrowers. The GLP of the sector stood at ₹226.6K crore, a 2.4% decline over the previous quarter, a phenomenon never observed since the 2012 crisis in the sector. Disbursements in Q1 FY 2020-21 declined by 88% by value compared to same quarter last year. Maximum disbursements (by volume) have been in the smaller ticket size segments of loans <20K as mostly emergency loans. The share of the larger ticket size of >20K loans has reduced from 84% in Mar 2020 to 41% in Jun 2020. West Bengal has once again emerged as the top state with the highest portfolio outstanding after 3 consecutive quarters, with a share of 41.5% in the national GLP, as of Jun 2020.

Delinquencies (PAR 31-180%) in the sector have remained more or less at the same levels as prior to the implementation of the lockdown and it remains to be seen as to what the level of non-repayment stress on the sector will be as the lockdown restrictions ease and the moratorium period ends. Collections in the microfinance sector are still largely cash dependent and came to a standstill in the lockdown, as visible in the monthly collection roll rates for the portfolio. By May 2020, as economic activity resumed in several non-containment areas across the country, and by and large in the rest of the country as well by Jun 2020, physical collection in the microfinance sector is reported to have picked up momentum. While the sector has witnessed transformation over the last few years in terms of digital adoption in practices as well as processes such as contact less sourcing and disbursal, it remains to be seen as to how policy, regulation and the industry will work collectively to enable and promote digital adoption in the collections cycle of microfinance. ENDS

ENDS

Be the first to comment on "12th Edition of CRIF MicroLend – Quarterly publication with an overview of the Micro-lending industry in India."