Mr. Anuj Kumar, CEO, CAMS -Photo By GPN

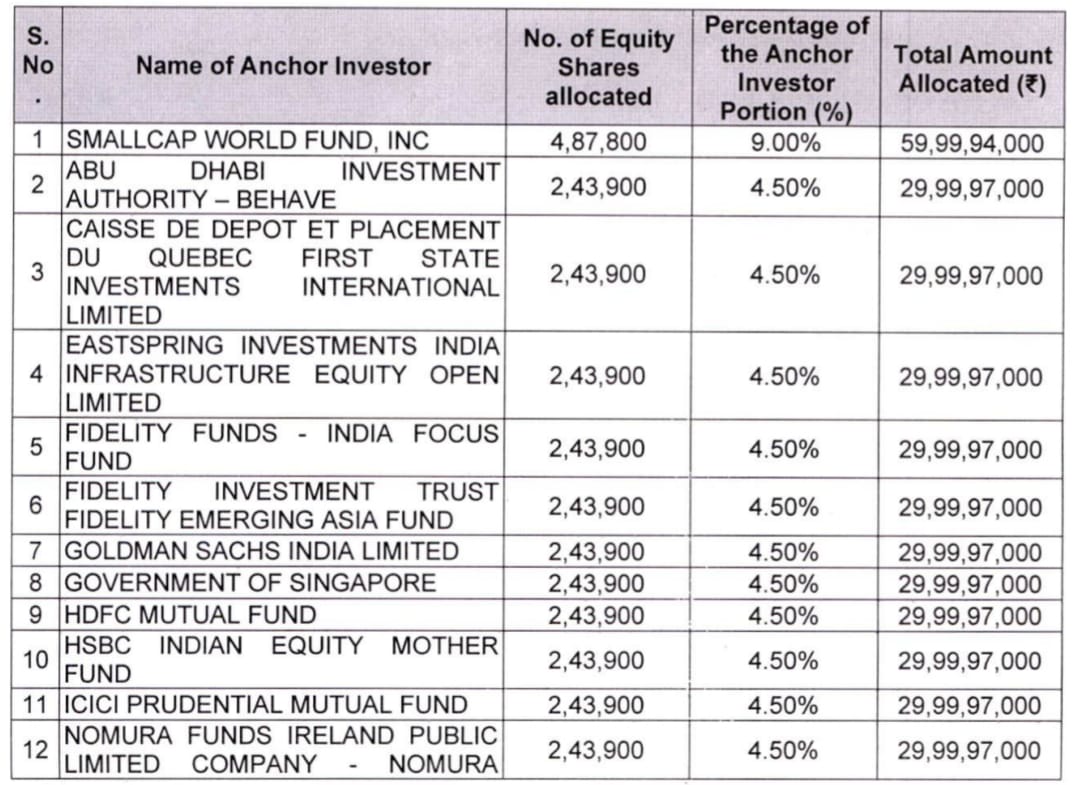

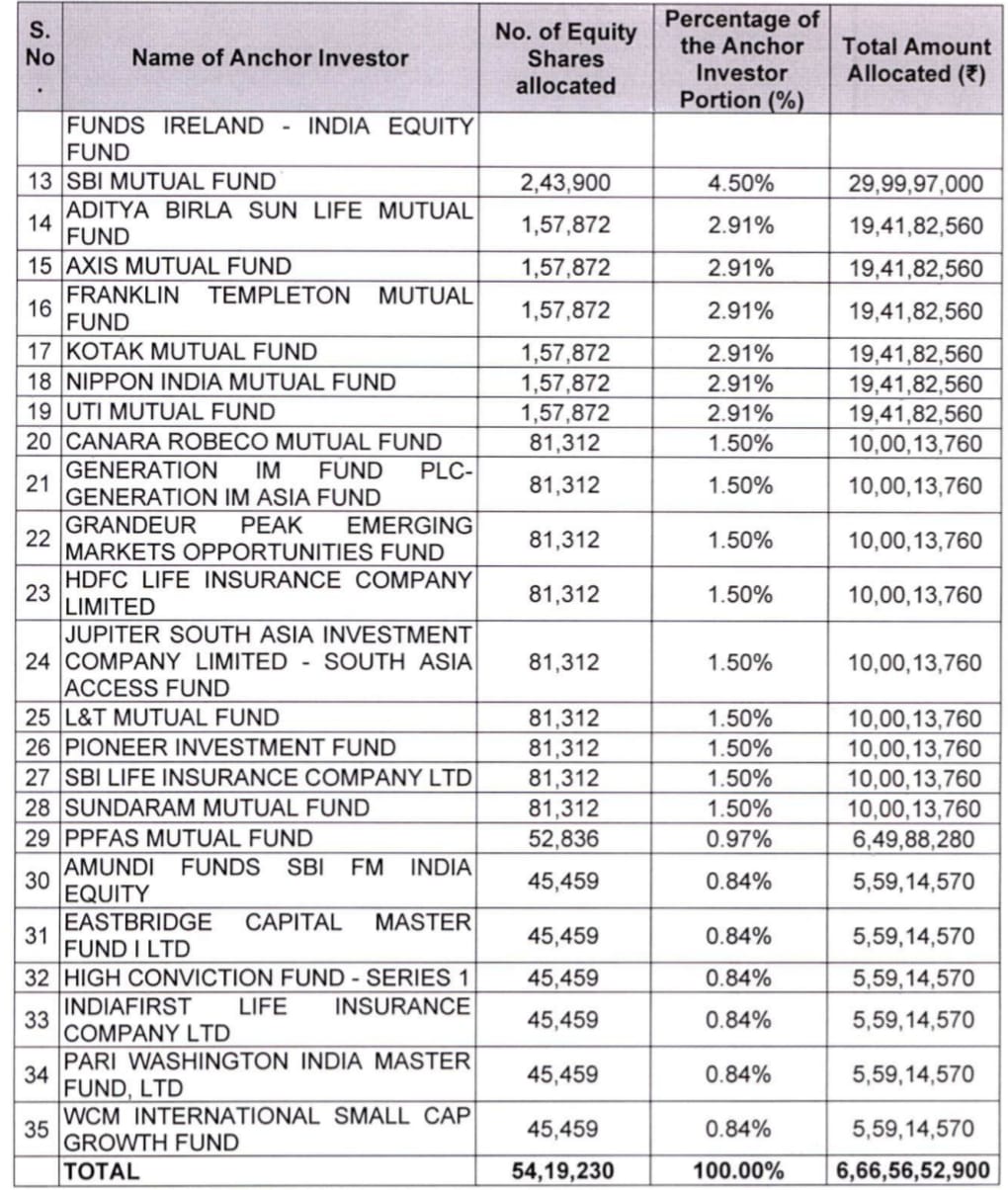

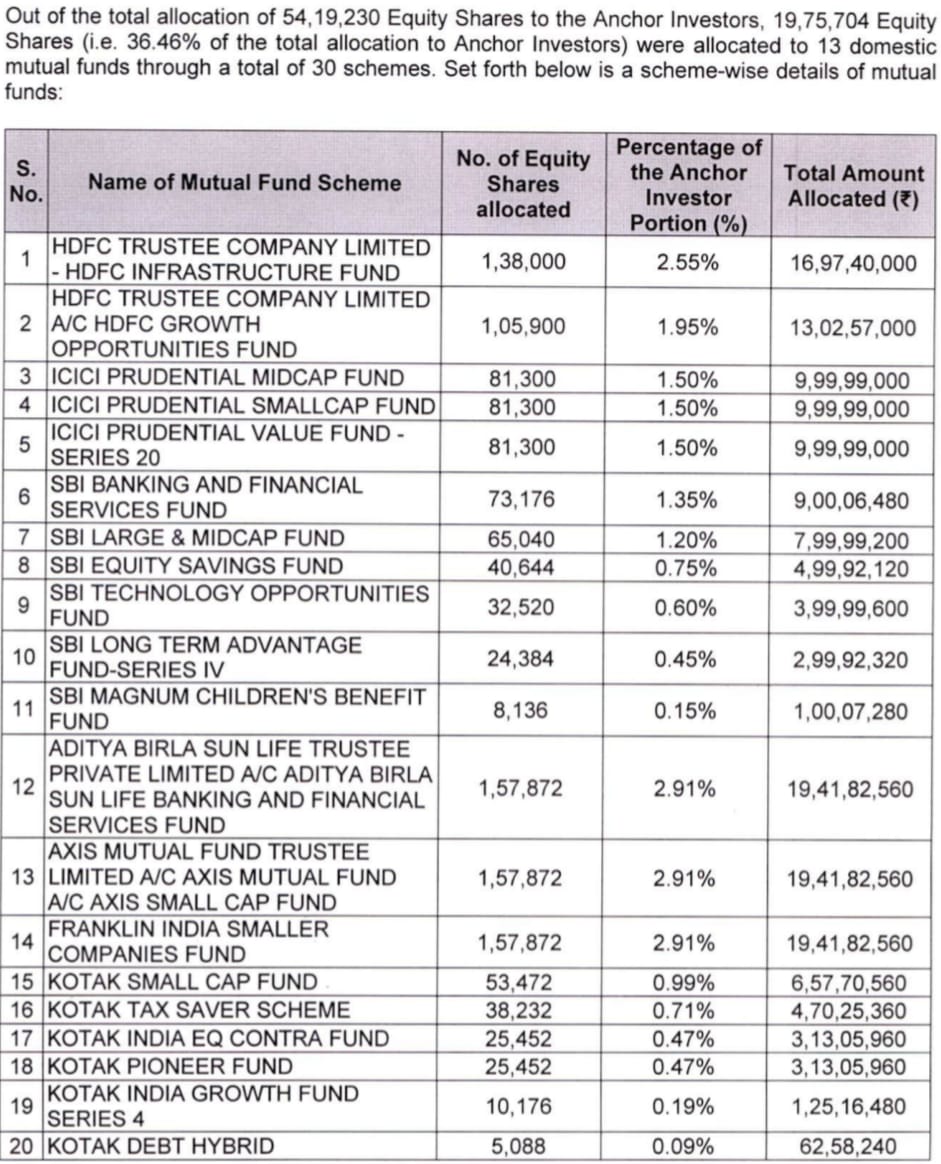

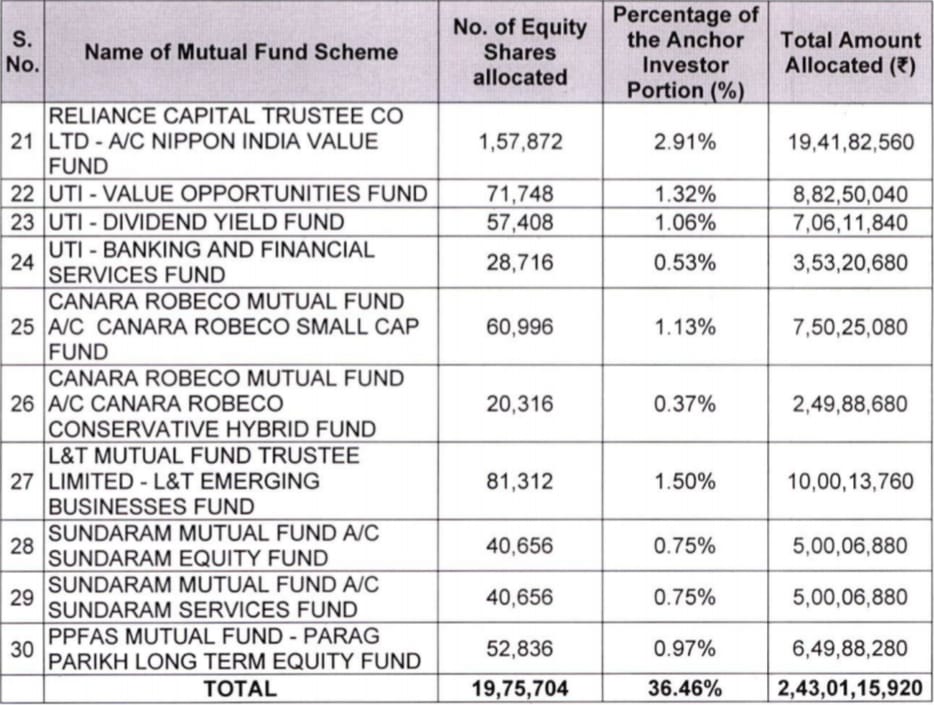

Mumbai, September 19, 2020 (GPN): Warburg Pincus backed, Leading business services partner of the BFSI Industry, CAMS has announced in a regulatory filing on Sept 18 that it has finalized the allocation of 54,19,230 shares at Rs 1230 piece to 35 anchor investors. A total of 13 Mutual funds have applied through 30 schemes.

The company found interest from well-known FPIs across the globe such as SmallCap World Fund, HSBC, Abu Dhabi Investment Authority, Caisse de Depot et Placement First State Investments, Eastspring Investments, Fidelity Investment Trust, Goldman Sachs, Govt. of Singapore, Nomura Funds Ireland Public Ltd Company, Amundi, Generation IM Fund, Grandeur Peak Emerging Markets Opportunities Fund, Jupiter South Asia Investment Company, Pari Washington India and WCM International

The Company is proposing to raise upto Rs. ₹2,242 cr through its Initial Public Offering via an OFS of 18,246,600 equity shares. The issue will open on September 21, 2020 and close on September 23, 2020, with a price band of ₹ 1229– ₹ 1230 per Equity Share of face value of ₹ 10 each. The company will not receive any funds from the Net Proceeds.

From just being a registry and a transfer agent to Mutual Funds and facilitating 328mn transactions in FY20, CAMS has grown into becoming a leading business services partner to the BFSI industry to create an end to end value chain of services such as transaction origination interface, transaction execution payment, settlement and reconciliation, dividend processing, investor interface, record keeping, report generation, intermediary empanelment and brokerage computation and compliance related services electronically and through its pan india network of 271 service centres across 25 states and 5 union territories supported by call centres and back offices in Mumbai, New Delhi, Chennai and Kolkata having real-time connectivity, continuous availability and data replication and redundancy. As on July 2020, the technology driven financial infrastructure services provider has approximate 70 % market share amongst mutual funds based on the assets under management.

From just being a registry and a transfer agent to Mutual Funds and facilitating 328mn transactions in FY20, CAMS has grown into becoming a leading business services partner to the BFSI industry to create an end to end value chain of services such as transaction origination interface, transaction execution payment, settlement and reconciliation, dividend processing, investor interface, record keeping, report generation, intermediary empanelment and brokerage computation and compliance related services electronically and through its pan india network of 271 service centres across 25 states and 5 union territories supported by call centres and back offices in Mumbai, New Delhi, Chennai and Kolkata having real-time connectivity, continuous availability and data replication and redundancy. As on July 2020, the technology driven financial infrastructure services provider has approximate 70 % market share amongst mutual funds based on the assets under management.

Kotak Mahindra Capital Company Limited, HDFC Bank Limited, ICICI Securities Limited and Nomura Financial Advisory and Securities (India) Private Limited are the BRLMs to the issue. ENDS

Kotak Mahindra Capital Company Limited, HDFC Bank Limited, ICICI Securities Limited and Nomura Financial Advisory and Securities (India) Private Limited are the BRLMs to the issue. ENDS

Be the first to comment on "Strong Demand: CAMS garners 666.56 crs from 35 Anchors"