MUMBAI, 22 JULY, 2020 (GPN):

MUMBAI, 22 JULY, 2020 (GPN):

A meeting of the Board of Directors of Bajaj Finance Limited (BFL) was held today to consider and approve

the unaudited standalone and consolidated results for the quarter ended 30 June 2020.

The consolidated results of BFL include the results of its wholly owned subsidiaries viz. Bajaj Housing

Finance Limited (BHFL) and Bajaj Financial Securities Limited (BFinsec).

CONSOLIDATED PERFORMANCE HIGHLIGHTS

Consolidated assets under management

Consolidated profit after tax

– f 138,055 crore v/s f 128,898 crore 1′ 7% -f 962crore v/s f 1,195crore .J, 19%

Q1 FY21 was a pandemic quarter. During the quarter, the Company focused on employee safety, capital

preservation, liquidity management, business scenario planning, operating expenses management, collections capacity augmentation, customer propositions, business transformation framework and lastly but most importantly calibrated restart of business as the country started to reopen.

The Company’s business operations in Q1 FY21 were considerably impacted due to COVID-19 pandemic and the consequent lockdowns which remained for most of Q1 FY21. It has resulted in significantly lower business acquisition and constraints on recovery of overdues from customers.

The Company restarted its urban B2B, rural B2B, auto finance, gold loans and loan against securities businesses from 1 O May 2020 with stringent loan to value (LTV) and underwriting norms and focus on existing customers. The Company restarted its home loans and credit card distribution businesses from June 2020.

The Company deferred restart of other businesses viz. loan against property, SME, urban B2C, rural B2C and commercial businesses to July 2020 due to extension of moratorium.

Consolidated moratorium book has reduced to f 21,705 crore (or 15.7% of AUM) from f 38,599 crore (or 27% of AUM) as of 30 April 2020 owing to reduction in bounce rate coupled with better collection efficiency.

During the quarter, the Company made an additional contingency provision for COVID-19 off 1,450 crore taking the overall contingency provision for COVID-19 to f 2,350 crore as of 30 June 2020. The contingency provision for COVID-19 is now at 10.8% of consolidated moratorium book. This contingency provision together with existing expected credit loss provision off 623 crore provides an overall provisioning coverage of 13.7% on the consolidated moratorium book.

Addltionally, as a matter of prudence, the Company has also reversed f 220 crore of interest income from the interest capitalised during moratorium period.

The Company continues to remain very well capitalised with CRAR of 26.40% as at 30 June 2020. It remains one of the best capitalised large NBFCs in India.

The Company’s liquidity position remains very strong with overall liquidity surplus of approximately f 17,700 crore as of 30 June 2020 on consolidated basis. The Company’s liquidity surplus as of 20 July 2020 was

approximately f 20,590 crore.

CONSOLIDATED PERFORMANCE HIGHLIGHTS- Q1 FY21

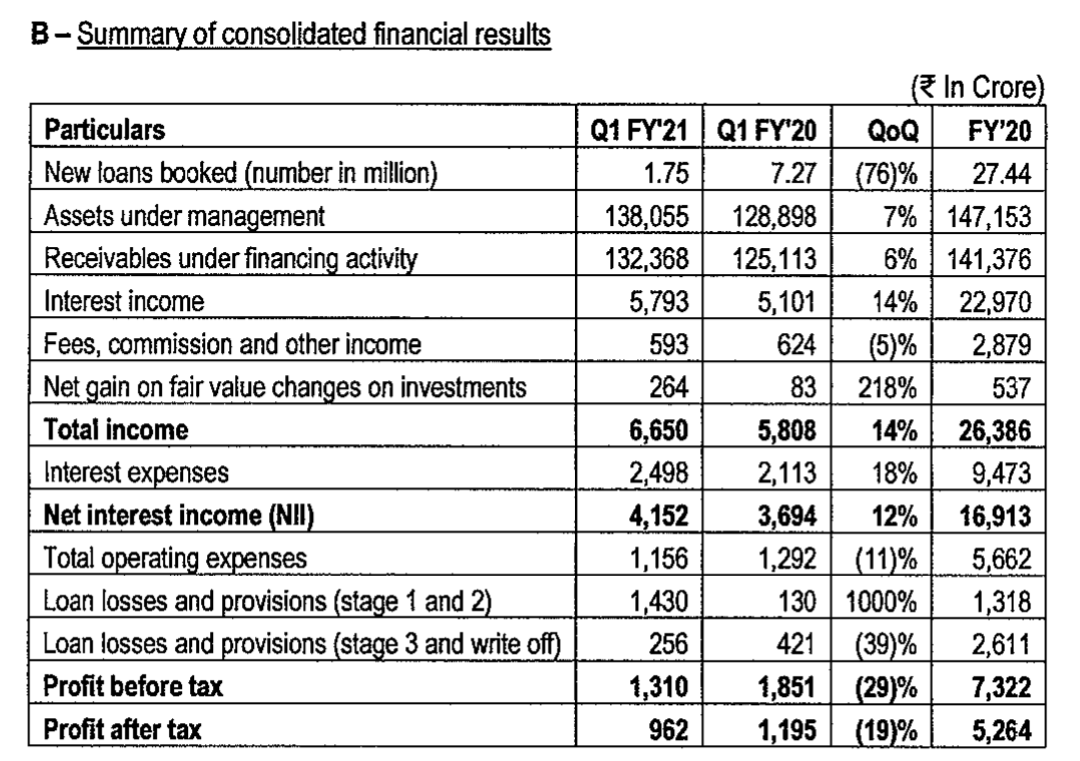

» New loans booked during Q1 FY21 declined by 76% to 1.75 million from 7.27 million in Q1 FY20.

» Customer franchise as of 30 June 2020 increased by 16% to 42.95 million from 36.94 million as of 30 June 2019.

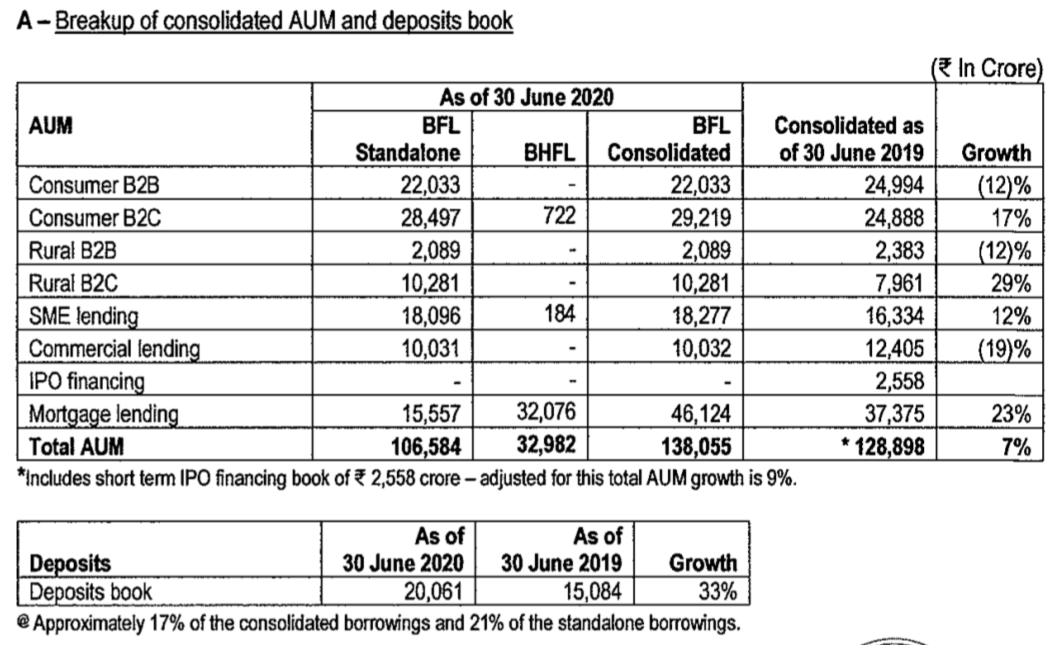

» Assets under management (AUM) as of 30 June 2020 grew by 7% to~ 138,055 crore from ~ 128,898 crore as of 30 June 2019.

» Net Interest Income for Q1 FY21 was up by 12% to ~ 4, 152 crore from ~ 3,694 crore in Q1 FY20.

» Total operating expenses to net interest income for Q1 FY21was27.9% against 35.0% in Q1 FY20.

» Loan losses and provisions for Q1 FY21was~1,686 crore as against~ 551 crore in Q1 FY20. During the quarter, the Company made an additional contingency provision of~ 1,450 crorefor COVID-19 taking the overall contingency provision for COVID-19 to~ 2,350 crore as of 30 June 2020.

» Profit after tax for Q1 FY21 declined by 19% to~ 962 crore from~ 1,195 crore in Q1 FY20.

» Gross NPA and Net NPA as of 30 June 2020 stood at 1.40% and 0.50% respectively, as against 1.60% and 0.64% as of30 June 2019. The provisioning coverage ratio as of30 June 2020 was 65%. Standard assets provisioning (ECL stage 1 and 2) stood at 273 bps including contingency provision for COVID-19 and 101 bps excluding contingency provision.

» Capital adequacy ratio (including Tier-II capital) as of 30 June 2020 stood at 26.40%. The Tier-I capital stood at 22.56%.

A — Breakup of consolidated AUM and deposits book

~In Crore

B- Summary of consolidated financial results~In Crore

» The Company is ranked 5 amongst “Best Companies to Work for” in India by Great Place to Work (GPTW) Institute.

STANDALONE PERFORMANCE HIGHLIGHTS

» Assets under management (AUM) as of 30 June 2020 declined by 1% to ‘ 106,584 crore from ‘107,949 crore as of30June 2019.

» Net Interest Income for Q1 FY21 was up by 12% to’ 3,917 crore from’ 3,507 crore in Q1 FY20.

» Loan losses and provisions for Q1 FY21 was ‘ 1,641 crore as against ‘ 542 crore in Q1 FY20. During the quarter, the Company made contingency provision of’ 1,406 crore for COVID-19 taking the overall contingency provision for COVID-19 to ‘ 2,256 crore as of 30 June 2020.

» Profit after tax for Q1 FY21 declined by 23% to ‘ 870 crore from ‘ 1, 125 crore in Q1 FY20. ENDS

Be the first to comment on "Bajaj Finance reports quarterly consolidated profit after tax of Rs. 962 crore for the quarter ended 30 June 2020 despite contingency provision of Rs. 1,450 crore for COVID·19"