-

India’s first revolutionary mutual fund portfolio evaluation and recommendation tool

-

Investors will be able to evaluate their current mutual fund portfolio, check their portfolio score and switch poor-performing funds into new recommended funds

-

#RankMFSmartSwitch

MUMBAI, 9th JULY, 2020 (GPN): RankMF, a Samco Group brand, announces the launch of a new and superior portfolio upgradation tool, ‘SmartSwitch’. RankMF’s SmartSwitch is a revolutionary mutual fund portfolio evaluation and recommendation tool that helps to analyse your existing mutual fund portfolio giving quality score on various parameters like

MUMBAI, 9th JULY, 2020 (GPN): RankMF, a Samco Group brand, announces the launch of a new and superior portfolio upgradation tool, ‘SmartSwitch’. RankMF’s SmartSwitch is a revolutionary mutual fund portfolio evaluation and recommendation tool that helps to analyse your existing mutual fund portfolio giving quality score on various parameters like

-

Quality of existing mutual funds

-

Category of mutual funds

-

Over or under exposure to specific fund or category

-

Over or under diversification

SmartSwitch uses RankMF’s proprietary research and rating engine to recommend switching of poor-performing schemes with high quality recommended schemes.

“Approximately 11 lakh crores of AUM is stuck in less than 4 stars rated funds. It is important that these investors let go of their emotions to stay invested in these poor-quality funds and shift their investments to good quality funds to avoid further losses,” highlighted Mr. Jimeet Modi, CEO, Samco Group.

“If you are someone who has invested money with great discipline and still haven’t made gains over a long period means there are great chances that you have invested your money in the wrong mutual funds. SmartSwitch will help investors get a quality score for their portfolio, get specific recommendations and then will allow them to switch poor-quality funds to better-recommended funds,” he added further.

In the past 1 year

1. 89% of AUM in Large-Cap Category has given negative returns of 5% to 22%.

2. 86% of AUM in Multi-Cap Category has given negative returns of 5% to 27%.

3. 99.5% of AUM in Small-Cap Category has given negative returns of 5% to 26%.

4. 82% of AUM in Mid-cap Category has given negative returns of 5% to 18%.

* Data as on 1st July, 2020 – Source AMFI.

The above data statistics clearly emphasize starting your new mutual fund’s investments in the right funds.

Mr. Omkeshwar Singh, Head – Rank MF, Samco Group -Photo By GPN

Mr. Omkeshwar Singh, Head – Rank MF, Samco Group commenting on the launch added that, “Choosing the right funds is the main objective when investing in Mutual Funds. The funds can in turn give negative returns after some time and that investor can end up having an over-diversified portfolio. SmartSwitch is a revolutionary solution for these investors. They can simply upload their eCAS, check their portfolio score and switch their existing investments from poor quality or non-performing funds to a recommended quality mutual fund portfolio.”

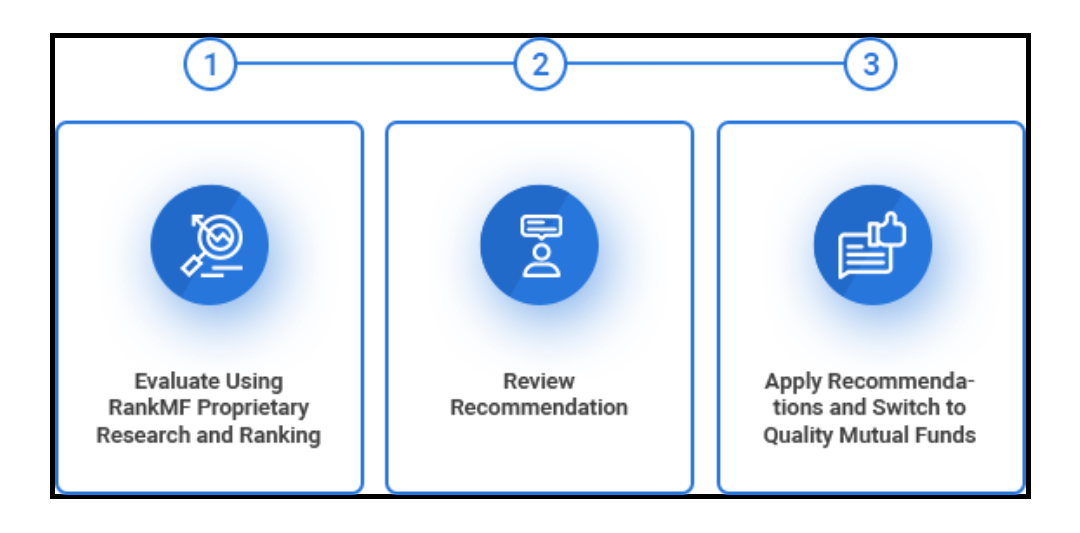

How Does SmartSwitch Work?

RankMF provides the only mutual fund research which does not rate and rank mutual funds on past performance. RankMF takes into consideration a variety of factors into consideration and over 20 million data points such as expense ratios, standard deviation, beta, market valuations, and multiples, portfolio holdings and diversification /concentration of portfolio, the cash ratio of a fund, size of the fund, the predicted yields and we can go on and on, however one of the most important factors is the actual portfolio quality of holdings since that is what is going to deliver investor returns. ENDS

RankMF provides the only mutual fund research which does not rate and rank mutual funds on past performance. RankMF takes into consideration a variety of factors into consideration and over 20 million data points such as expense ratios, standard deviation, beta, market valuations, and multiples, portfolio holdings and diversification /concentration of portfolio, the cash ratio of a fund, size of the fund, the predicted yields and we can go on and on, however one of the most important factors is the actual portfolio quality of holdings since that is what is going to deliver investor returns. ENDS

Be the first to comment on "RankMF Launches India’s First Mutual fund Portfolio Sanitization Tool: SmartSwitch"