MUMBAI, 19 MAY, 2020 (GPN): Bajaj Finance reports quarterly consolidated profit off 948 crore post a contingency provision of Rs. 900 crore for Covid-19. Adjusted for this provision, profit was up by 38% at Rs. 1,622 crore.

MUMBAI, 19 MAY, 2020 (GPN): Bajaj Finance reports quarterly consolidated profit off 948 crore post a contingency provision of Rs. 900 crore for Covid-19. Adjusted for this provision, profit was up by 38% at Rs. 1,622 crore.

Consolidated profit for FY20 was highest ever at Rs. 5,264 crore- a growth of 32% over FY19.

A meeting of the Board of Directors of Bajaj Finance Limited (BFL) was held today to consider and approve

the audited standalone and consolidated results for the quarter and year ended 31 March 2020.

The consolidated results of BFL include the results of its wholly owned subsidiaries viz. Bajaj Housing

Finance Limited (BHFL) and Bajaj Financial Securities Limited (BFinsec).

PERFORMANCE FOR Q4 FY20 AND FY20

Consolidated assets under management

– Rs. 147,153 crore v/s Rs. 115,888 crore Up By 27%

Consolidated profit after tax for Q4 FY20- Rs. 948 crore v/s Rs. 1,176 crore, Down By 19%

Consolidated profit after tax for FY20 – Rs 5,264 crore v/s Rs. 3,995 crore Up By 32%

Due to Covid-19 pandemic and the consequent lockdown, the Company lost 10 productive days in Q4 FY20

resulting in lower acquisition of nearly 1.0 million loan accounts and lower AUM of approximately Rs. 4,500

crore. Adjusted for the impact of lockdown, AUM growth would have been 31%.

The Company is well capitalised with CRAR of 25.01% as at 31 March 2020. The Company remains one of

the most capitalised amongst large NBFCs in India.

The Company’s liquidity position remains very strong with overall liquidity surplus of approximately Rs. 15,725 crore as of 31 March 2020 on consolidated basis. The Company’s liquidity surplus as of 15 May 2020 was

approximately Rs. 20,900 crore.

In accordance with the RBI guidelines relating to ‘COVID-19 Regulatory Package’ dated 27 March 2020, the

Company has offered EMI mortarium to its customers based on requests as well as on a suo-mota basis. The

Company remains committed to help its customers navigate through this difficult time.

The Company, at this juncture, is focused on capital preservation, balance sheet protection and operating

expenses management. Given it’s healthy capital adequacy, strong liquidity position, low gross NPA and net NPA, access to retail deposits, large customer franchise, diversified portfolio mix, granular geographical

distribution and strong risk metrics, the Company is confident of successfully dealing with challenges posed

by Covid-19.

CONSOLIDATED PERFORMANCE HIGHLIGHTS- Q4 FY20

~ New loans booked during Q4 FY20 increased by 3% to 6.03 million from 5.83 million in Q4 FY19.

Adjusted for lower acquisition due to lockdown, new loans booked would have grown by 21% to approximately 7.03 million.

~ Net Interest Income for Q4 FY20 was up by 38% to Rs. 4,684 crore from Rs. 3,385 crore in Q4 FY19.

~ Total operating expenses to net interest income for Q4 FY20 was 31.0% as against 34.4% in Q4 FY19.

~ Loan losses and provisions (expected credit loss) for Q4 FY20 was’ Rs. 1,954 crore as against’ Rs. 409 crore in Q4 FY19. During the quarter, the Company has taken an accelerated charge of’ Rs. 390 crore for two identified large accounts, an additional provision of’ Rs. 129 crore on account of recalibration of its ECL model and a contingency provision of’ Rs. 900 crore for Covid-19. Adjusted for these additional provisions of’ Rs. 1 ,419 crore, loan losses and provisions for Q4 FY20 was ‘ Rs. 535 crore.

~ Profit after tax for Q4 FY20 was ‘ Rs. 948 crore as compared to’ Rs. 1,176 crore in Q4 FY19. Adjusted for

contingency provision of’ Rs. 900 crore for Covid-19, profit for the quarter was up by 38% at’ Rs. 1,622 crore.

From the current financial year, the Company and one of its subsidiary viz. BHFL has opted for reduced

rate of 25.17% for computation of income tax as per recently inserted Section 115BAA of the Income Tax

Act, 1961.

~ Gross NPA and Net NPA, recognized as per extant RBI prudential norms and provisioned as per expected credit loss (ECL) method prescribed in lnd AS, as of 31 March 2020 stood at 1.61% and 0.65% respectively. The provisioning coverage ratio was 60%. Standard assets provisioning (ECL stage 1 and

2) including contingency provision of’ Rs. 900 crorefor Covid-19 stood at 159 bps and 97 bps excluding

contingency provision under lnd AS.

CONSOLIDATED PERFORMANCE HIGHLIGHTS- FY20

~ New loans booked during FY20 increased by 17% to 27.44 million from 23.50 million in FY19. Adjusted

for lower acquisition due to lockdown, new loans acquisition would have grown by 21% to approximately

28.44 million.

~ Customer franchise increased by 24% to 42.60 million as of 31 March 2020 from 34.48 million as of 31

March 2019.

~ Assets under management (AUM) grew by 27% to’ Rs. 147,153 crore as of 31 March 2020 from ‘ Rs. 115,888 crore as of 31 March 2019. Adjusted for lower acquisition due to lockdown, AUM would have grown by 31% to approximately’! 151,700 crore.

~ Net Interest Income for FY20 was up by 42% to ‘ Rs. 16,913 crore from ‘ Rs. 11 ,877 crore in FY19.

~ Total operating expenses to net interest income for FY20 was 33.5% as against 35.3% in FY19.

~ Loan losses and provisions (expected credit loss) for FY20 were ‘ Rs. 3,929 crore as against’ Rs. 1,501 crore in FY19. During the year, the Company has taken an accelerated charge of’ Rs. 483 crore for two identified large accounts, an additional provision of’ Rs. 129 crore on account of recalibration of its ECL

model and a contingency provision of’ Rs. 900 crore for Covid-19. Adjusted for these additional provisions

of’ Rs. 1,512 crore, loan losses and provisions for FY20 was’ Rs. 2,417 crore.

~ Profit after tax for FY20 grew by 32% to ‘ Rs. 5,264 crore from ‘Rs. 3,995 crore in FY19.

~ Capital adequacy ratio (including Tier-II capital) as of 31 March 2020 stood at 25.01%. The Tier-I capital

stood at 21.27%. During the year, the Company raised equity capital of approximately’ Rs. 8,500 crore

through QIP route.

~ The Board of Directors has not recommended any final dividend. The interim dividend of~ 10 per equity

share of the face value of~ 2 (500%) declared by Board of Directors, at its meeting held on 21 February 2020, shall be considered as the final dividend for the FY20. Thus, the total dividend for FY20 remains ~ 10 per equity share (previous year~ 6 per equity share).

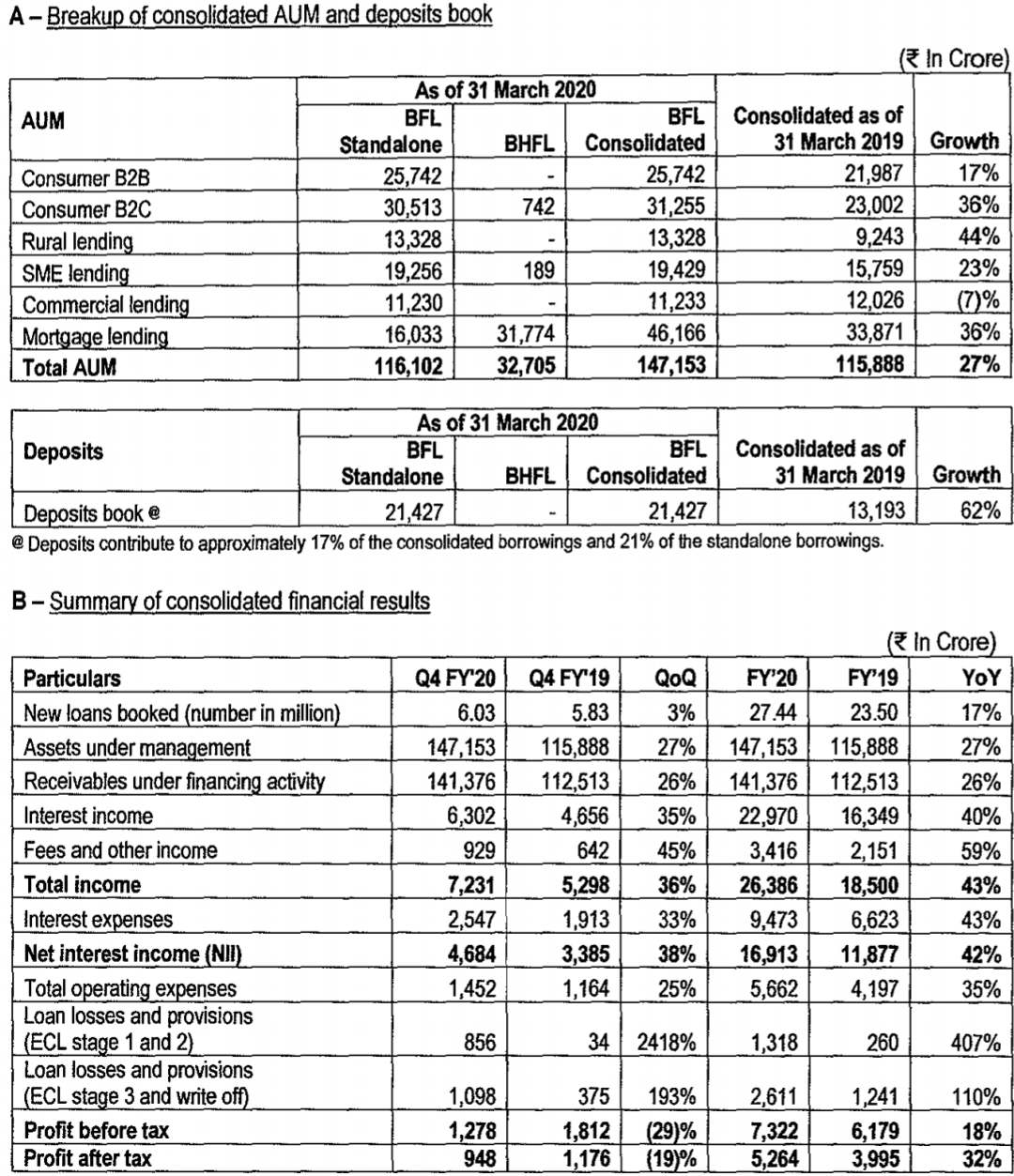

A- Breakup of consolidated AUM and deposits book -Refer Chart

B – Summary of consolidated financial results -Refer Chart

During the quarter, the Company has invested an amount of~ 1 ,500 crore in BHFL by subscribing to 133.33 crore equity shares of face value of ~ 10 for cash at ~ 11.25 (including premium of ~ 1.25), offered on rights basis.

During the quarter, the Company has invested an amount of~ 1 ,500 crore in BHFL by subscribing to 133.33 crore equity shares of face value of ~ 10 for cash at ~ 11.25 (including premium of ~ 1.25), offered on rights basis.

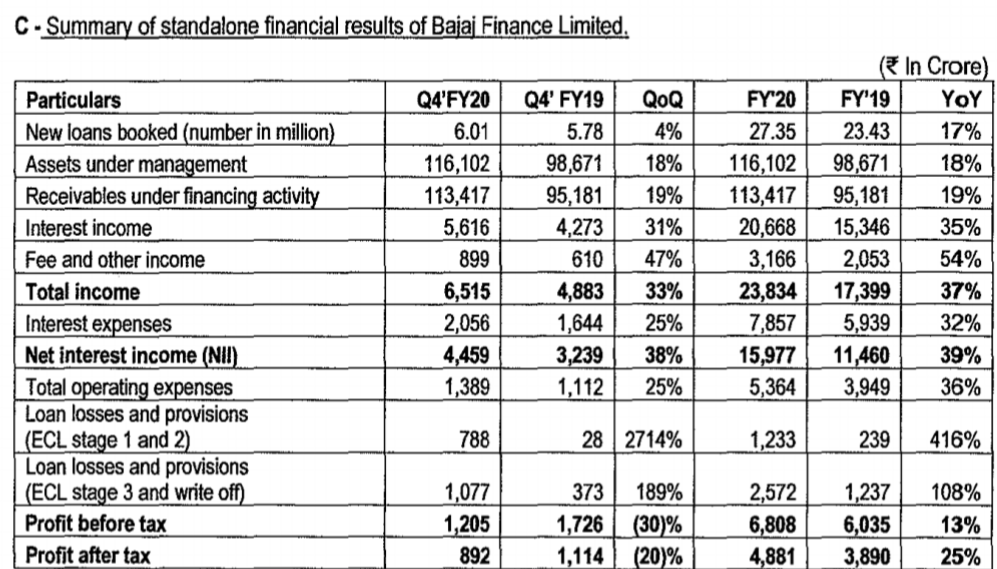

STANDALONE PERFORMANCE HIGHLIGHTS

Bajaj Finance Limited – Q4 FY20

Net Interest Income for Q4 FY20 was up by 38% to~ 4,459 crore from~ 3,239 crore in Q4 FY19.

Loan losses and provisions (expected credit loss) for Q4 FY20 was~ 1,865 crore as against~ 401 crore in Q4 FY19. During the quarter, the Company has taken an accelerated charge of~ 390 crore for two identified large accounts, an additional provision of~ 123 crore on account of recalibration of its ECL

model and a contingency provision of~ 850 crore for Covid-19. Adjusted for these additional provisions of ~ 1,363 crore, loan losses and provisions for Q4 FY20 was~ 502 crore.

Profit aftertax for Q4 FY20 was~ 892 crore compared to~ 1,114 crore in Q4 FY19.

Bajaj Finance Limited – FY20

Assets under management (AUM) grew by 18% to~ 116,102 crore as of 31 March 2020 from ~ 98,671 crore as of31 March 2019. Adjusted for lower acquisition due to lockdown, AUM would have

grown by 21% to approximately~ 119,400 crore.

Net Interest Income for FY20 was up by 39% to~ 15,977 crore from ~ 11,460 crore in FY19.

Loan losses and provisions (expected credit loss) for FY20 was ~ 3,805 crore as against~ 1,476 crore in FY19. During the year, the Company has taken an accelerated charge of~ 483 crore for two identified large accounts, an additional provision of ~ 123 crore on account of recalibration of its ECL

model and a contingency provision of~ 850 crore for Covid-19. Adjusted for these additional provisions of ~ 1,456 crore, loan losses and provisions for FY20 was ~ 2,349 crore.

Profit after tax for FY20 grew by 25% to~ 4,881 crore from ~ 3,890 crore in FY19.

C ·Summary of standalone financial results of Bajaj Finance Limited. – Refer Chart

PERFORMANCE HIGHLIGHT OF SUBSIDIARIES

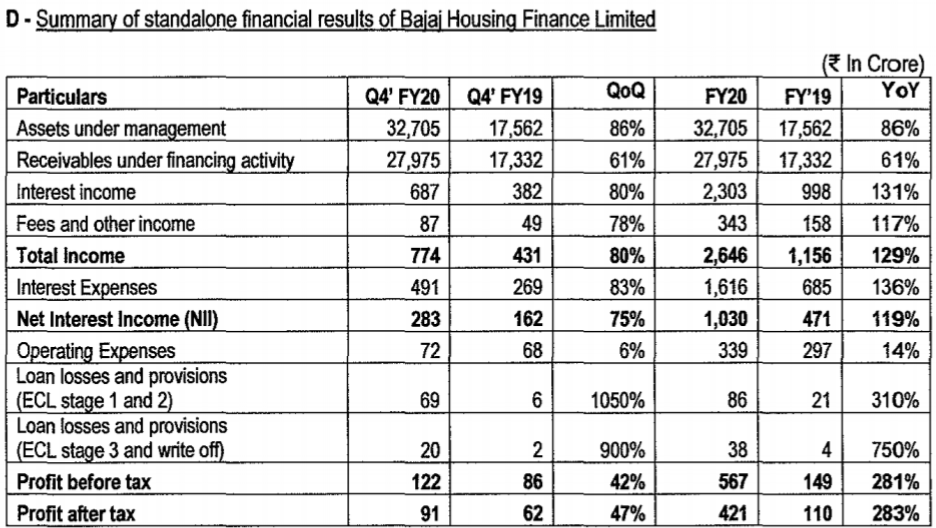

Bajaj Housing Finance Limited • Q4 FY’20

~ Net Interest Income for Q4 FY20 was up by 75% to’ Rs. 283 crore from’ Rs. 162 crore in Q4 FY19.

~ Profit after tax for Q4 FY20 was up by 47% to’ Rs. 91 crore from’ Rs. 62 crore in Q4 FY19.

Bajaj Housing Finance Limited • FY’20

~Assets under management (AUM) grew by 86% to ‘Rs. 32,705 crore as of 31 March 2020 from YoY ‘Rs. 17,562 crore as of 31 March 2019. Adjusted for lower acquisition due to lockdown, AUM would have grown by 93% to approximately ‘Rs. 33,900.

~ Net Interest Income for FY20 was up by 119% to’ Rs. 1,030 crore from ‘ Rs. 471 crore in FY19.

~ Profit after tax for FY20 was up by 283% to’ Rs. 421 crore from’ Rs. 110 crore in FY19.

~ Capital adequacy ratio (including Tier-11 capital) as of 31 March 2020 stood at 25.15%

D • Summary of standalone financial results of Bajaj Housing Finance Limited -Refer Chart

Bajaj Financial Securities Limited • FY’20

Bajaj Financial Securities Limited • FY’20

Bajaj Financial Securities Limited has become operational from August 2019. Total Income for FY20 was Rs. 11 crore and Profit after tax for FY20 was Rs. 2 crore. ENDS

Be the first to comment on "Bajaj Finance Announces Financial results for Q4 FY20 and Full Year FY20"