Nine-point agenda prepared based on analysis of stimulus measures in 10 prominent countries.

MUMBAI, 19th APRIL, 2020 (GPN): MVIRDC World Trade Center Mumbai proposes nine-point agenda to revitalize Indian economy by providing immediate liquidity support to micro, small and medium enterprises (MSMEs) who are the mainstay of employment and exports.

This nine-point agenda includes freezing all statutory payments, offering wage subsidy, waiving property tax and stamp duty, providing direct grants, extending bridge financing, credit guarantee, interest subsidy, reducing corporate income tax and allowing one-time restructuring of loans. The detailed list of the nine-point agenda is provided in appendix I.

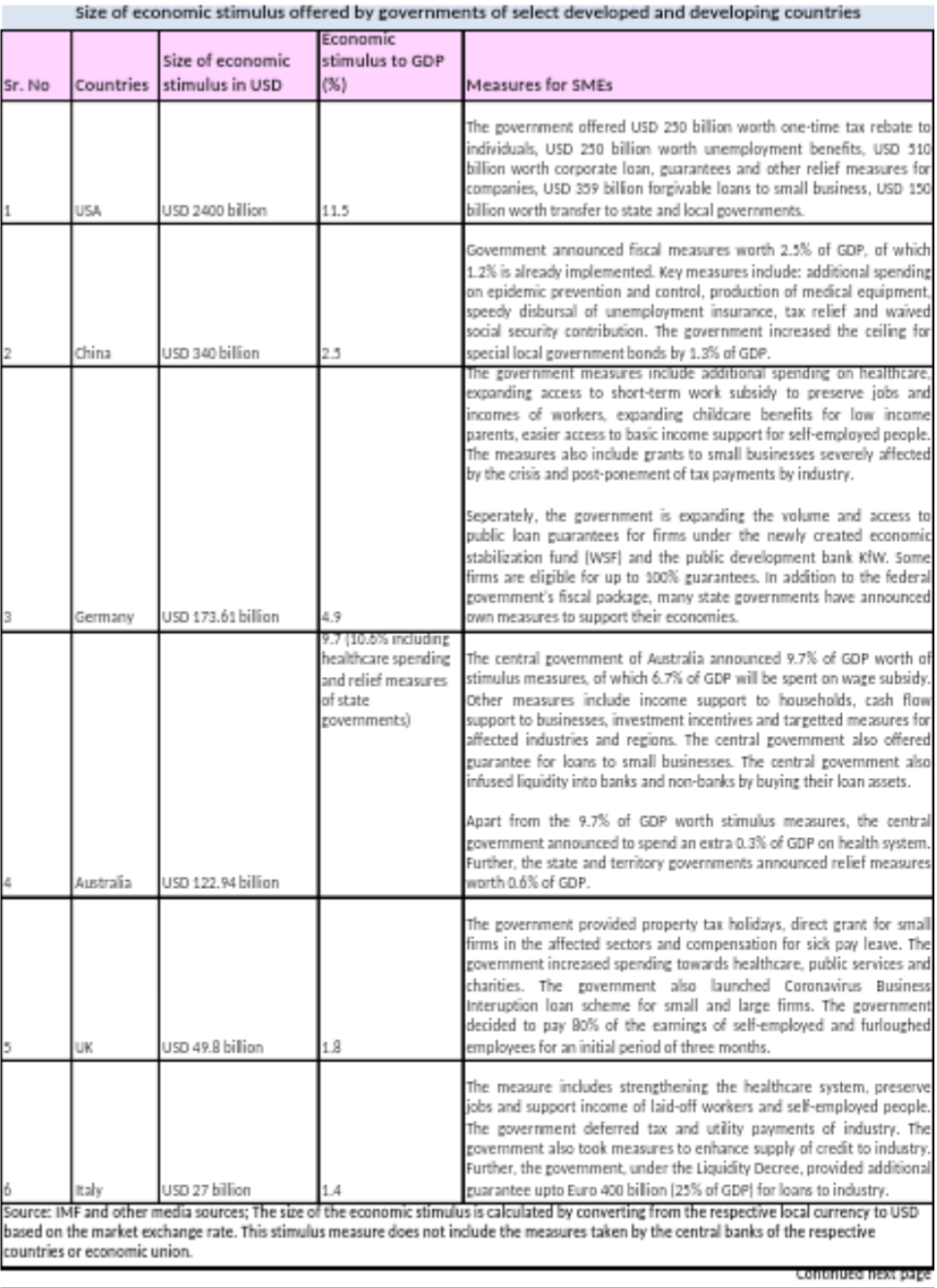

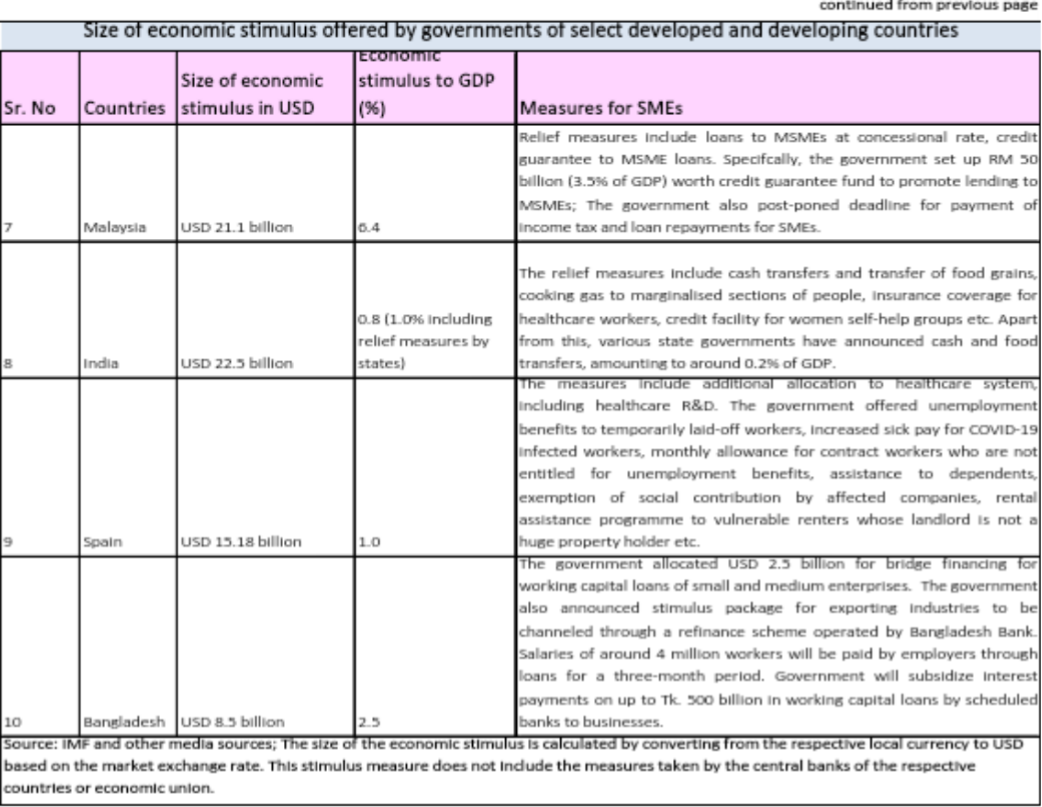

This nine-point agenda is prepared based on an analysis of the relief/stimulus measures provided by 10 prominent countries from the developing and developed world. These countries include Bangladesh, China, UK, USA, Malaysia, Spain, Italy, among others. The comparative chart of the relief measures provided by these countries is provided in appendix II.

Government of India has so far offered Rs. 1.7 lakh crore worth relief measure representing0.8% of our GDP. India needs a much larger relief measure to address the economic fallout of this pandemic. Even a least developed country such as Bangladesh has provided relief measures worth more than 2.5% of its GDP, while Malaysia has offered relief measures worth 6.4% of its GDP.

Even though Reserve Bank of India (RBI) has been infusing massive amount of liquidity into the banking system since March 27, 2020, banks are not transmitting this to the distressed sections of the industry. We hope that the second monetary easing measure undertaken by RBI on April 17, 2020 will improve flow of liquidity to MSMEs, real estate, micro finance and small & medium NBFCs.

In the coming days, Government should play an important role in providing credit guarantee to MSME loans so that banks will shed their risk aversion while lending to MSMEs.

Speaking on the imperative of an immediate stimulus package, Ms. Rupa Naik, Senior Director, MVIRDC World Trade Center Mumbai said, “MSMEs need immediate liquidity support to operate as a going concern and prevent becoming insolvent. We cannot afford to let our MSMEs fail as they account for more than 20% or 11 crore jobs in the country andmore than 40% of our exports.”

MSMEs contribute 29% to the country’s GDP and produce more than 5,000 varieties of products that are labour intensive. Therefore, reviving MSMEs is the most important way to revitalize the economy. Global institutions and experts have warned that this crisis is far worse than the 2008 Global Financial Crisis and can also be worse than the 1930s Great Depression, if policymakers do not act in time to support industry and consumers. International Monetary Fund (IMF) expects the global economy to contract 3% in 2020 and it has slashed India’s GDP growth forecast by a whopping 3.9% to 1.9% for the ongoing financial year.

The nation-wide lockdown caused many MSMEs to lose their local and overseas clients, and most of them are sitting on unsold inventories. In the absence of adequate relief measures from the government, the plight of our MSMEs may precipitate into huge job losses.

Appendix I

Nine-point Agenda

- Freeze all statutory payments: At a time when industries are facing loss of revenue from disruption to their business, the government should freeze all tax and non-tax dues such as electricity and telephone bills. Companies in the travel & hospitality, retail, real estate, entertainment and hotels may face low demand in the next one year because of the expected change in the lifestyle of the people post-COVID. Therefore, the government should freeze statutory dues for these sectors for a period of one year. Many countries, from the developing and developed world have resorted to this measure to provide relief to the industry.

- Provide wage subsidy: Small businesses are struggling to pay salaries of their workers amidst the dwindling revenue stream and cancellation of orders from clients. In order to prevent mass layoff of workers, the government should partially share the wage burden of the industry by providing subsidy or grants towards this expenditure. Australia has supported its employers by providing wage subsidy.

- Waive stamp duty and property tax: The government should waive stamp duty and property tax for the current financial year for small businesses. Egypt has waived stamp duty on transactions, while Georgia has suspended property tax for tourism sector till November 2020. Countries such as UK and Uzbekistan have also provided relaxation in payment of property tax for affected sectors.

- Government guarantee for loans to MSMEs: In order to encourage banks to lend to the MSME sector, which is perceived as risky, government should provide either complete or partial guarantee on bank credit to the sector. The government already gives guarantee under the CGTMSE scheme for MSMEs to avail collateral-free loans upto Rs. 2 crore. The corpus of this scheme can be enhanced so that it benefits a wide spectrum of MSMEs.Separately, the government can guarantee initial loss of say 20% of fresh loans extended by banks to the MSME sector. Government guarantee will encourage banks who shy away from lending to the industry in this circumstance. Banks are sitting on excess liquidity of Rs. 6.92 lakh crore, which is equal to more than 3.4% of India’s GDP. This liquidity should flow to the industry to kickstart economic activity post lockdown.

- Provide direct grant for MSMEs: Government should provide direct grants to MSMEs in the manufacturing and services sector. The lockdown has increased the financial hardships of companies because of increase in freight rates amidst sub-normal functioning of transport operators and scarcity of truck drivers. Companies are also suffering from their inability to convert their inventories into cash because of closure of market. In this situation, companies are struggling for liquidity to meet their immediate expenses. The government should provide liquidity in the hands of the MSMEs to meet their immediate expenses such as rent, commissions, daily wages etc.

- Provide bridge financing for MSMEs: Countries such as Thailand have provided bridge financing for companies whose bonds or loans are maturing in the current financial year. Such a bridge financing will help companies repay their loans that fall due in the immediate future. Even Iceland has offered bridge financing to distressed enterprises in this circumstance. Government of India may provide such bridge financing to MSMEs whose loan amount is due for repaying in the current financial year.

- Reduce corporate income tax: In September last year, the government reduced corporate income tax for manufacturing companies set up after October 2019 to 15%. Considering the hardships faced by the industry today, this reduced corporate tax should be made applicable for all companies. This will significantly relieve the tax burden on industry and to that extent reduce the impact on their liquidity.

- Subsidize interest payment for MSMEs: Government of India should partially bear the interest cost on the working capital and term loans availed by MSMEs. Even though Reserve Bank of India reduced repo rate to 4.4% on March 27, 2020, even a AAA-rate corporate entity (company with sound credit rating) is not able to raise bank loans at interest rate below 8%. The interest rate paid by MSMEs is even higher than the 8% as they are perceived as high risk borrowers. In order to reduce the interest cost burden on MSMEs, the government should subsidize the interest payment of MSMEs. Government of Bangladesh has provided subsidy on working capital loans availed by MSMEs.

- One –time restructuring of loans: These are extraordinary times that require extraordinary government measures to support the distressed industry. We cannot expect quick recovery in economic activity immediately after the lockdown as it may take a few months for migrant labourers to return from their hometown and consumer demand to pick up gradually. Therefore, the operation of MSMEs may not attain the full scale that was witnessed before the lockdown. This will cripple the ability of these enterprises to repay their loan even after the moratorium period of three months, given by Reserve Bank of India (RBI). Therefore, the government and RBI should provide a one-time restructuring of loans extended to MSMEs and other distressed companies.

Small enterprises need immediate relief to stay afloat in this challenging time and prevent their liquidity crisis from becoming an insolvency crisis. We are confident that these measures will cushion the fallout of the COVID-19 crisis on small businesses, prevent massive layoff of workers and facilitate quick recovery of the economy. ENDS

Appendix II

Be the first to comment on "Government should adopt 9-point agenda to provide relief to small businesses"