MUMBAI, 21 JANUARY, 2020 (GPN): Federal Bank announced the Unaudited Financial Results for the quarter ended 31st December 2019.

The major highlights of the results on a Y-o-Y basis are as follows:

Net profit records a growth of 32.07%

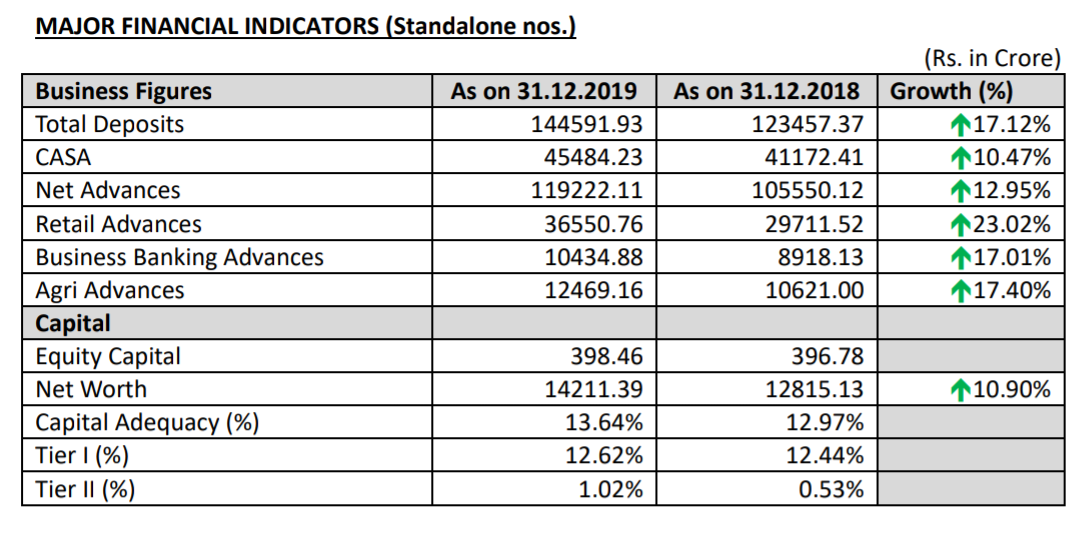

Retail Advances grow by 23.02%

Business Banking Advances register a growth 17.01%

Other income grows by 18.03%

The Bank continues to grow its retail franchise with strong momentum in personal loans, home loans and auto loans. The gold loan segment has also shown significant growth. Business Banking segment, part of the SME book, continues to show a steady growth. The Bank adopted a cautious approach in

wholesale lending owing to the volatile environment prevailing in the market. The liability growth remains intact and continues to tread the path of growth. The quarter also saw the Bank achieving the landmark figure of 1 Crore customers. The asset quality of the Bank continues to improve under

a strong focus for the segment with retail slippage trending at a multi-quarter low.

Q3FY19 Vs Q3FY20

Retail Advances registered a growth of 23.02% to reach Rs. 36550.76 Cr

Business Banking Advances grew 17.01% to reach Rs. 10434.88 Cr

Agri Advances grew by 17.40% to reach Rs.12469.16 Cr

CASA increased to Rs. 45484.23 Cr

NRE Deposits grew by 11.80% to reach Rs.53586.77 Cr

The Net worth of the Bank reached Rs.14211.39 Cr

Book Value per share increased to Rs. 71.33 from Rs. 64.60

Balance Sheet

The Total Business of the Bank grew 15.20% Y-o-Y from Rs.229007.49 Cr as on 31st December 2018 to Rs.263814.04 Cr as on 31st December 2019. While Total Deposits reached Rs.144591.93 Cr from Rs.123457.37 Cr, Net Advances reached the figure of Rs. 119222.11 Cr as on 31st December 2019.

Operating Profit & Net Profit

The Bank recorded Operating Profit of Rs.743.82 Cr during the quarter and Net Profit increased by 32.07% to reach Rs.440.64 Cr.

Margins

The Bank earned a Net Interest Income of Rs.1154.93 Cr for the quarter. The Net Interest Margin of the Bank during quarter ended 31st December 2019 stood at 3.00%.

Asset Quality

The Gross NPA and Net NPA of the Bank as at the end of the Quarter stood at Rs.3618.69 Cr and Rs. 1941.01 Cr respectively. Gross NPA as a percentage improved from 3.14% to 2.99% while Net NPA improved from 1.72% to 1.63% on a YoY basis. The Provision Coverage Ratio (including technical write-offs) also improved from 64.2% to 66.38%. Stressed asset book as a percentage of total average assets came to multi quarter lows. Also, 98% of the slippages from the corporate business came from the already identified watch listed cases.

NET-WORTH & CAPITAL ADEQUACY

The Net worth of the bank increased from Rs.12815.13 Cr as on 31st December 2018 to Rs.14211.39

Cr as on 31st December 2019. The Capital Adequacy Ratio (CRAR) of the Bank, computed as per Basel III guidelines stood at 13.64% as at the end of the quarter.

FOOTPRINT

The Bank has 1255 branches and 1965 ATM/ Recycler as on 31st December 2019.

ENDS

Be the first to comment on "Federal Bank Profit surges 32% to Rs. 441 Crore backed by strong growth in Retail Franchise"