MUMBAI, 31 JULY, 2018 (GPN) :

BUSINESS HIGHLIGHTS : For the quarter ended June 30, 2018 (Q1FY19), Consolidated results as per IND AS

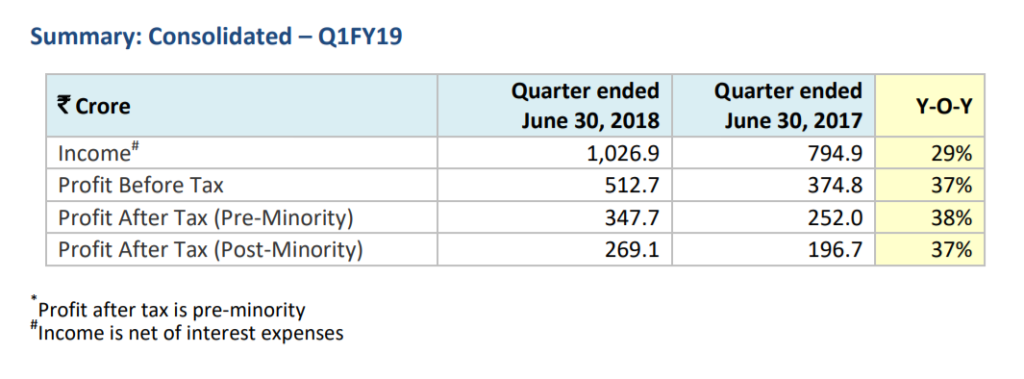

BUSINESS HIGHLIGHTS : For the quarter ended June 30, 2018 (Q1FY19), Consolidated results as per IND AS Profit after tax stood at `348 Cr for the quarter, up 38% y-o-y

Consolidated income stood at `1,027 Cr for the quarter, up 29% y-o-y

Loan assets under management in NBFC business at `33,653 Cr, up 44% y-o-y

Wealth assets at `1,40,898 Cr, up 25% y-o-y

Mr. Nirmal Jain, Chairman, IIFL Holdings Ltd., commented on the financial results: “We are pleased to report first quarter results which indicate a good start to the new financial year. Despite upward pressure on interest rates, we are seeing positive traction in credit demand and quality. We are optimistic about the

prospects of our Wealth and Capital Markets businesses for the rest of the year.”

Loans and Mortgages

The Loans and Mortgages business is carried out by a non-banking finance company and its two subsidiaries, housing finance company and micro finance company; conducted through 1,547 branches spanning the length and breadth of the country.

The profit after tax for Q1FY19 was `196 Cr, up 68% y-o-y, while total income was `583 Cr, up 47% y-o-y. NBFC’s ROE1

for Q1FY19 stood at 20.7% and ROA was 2.4%. Average borrowing costs declined

5bps y-o-y to 8.6%. Net Interest Margin was at 7.2%.

Loan assets under management (AUM), predominantly retail, showed a strong growth of 44% y-o-y to `33,653Cr, mainly driven by small-ticket home loans, SME loans and microfinance loans.

At the end of the quarter, retail home loan assets grew to `9,327 Cr, up 57% y-o-y.

IIFL contribution in PMAY-CLSS: Over 14,000 customers were benefitted with a subsidy of more than `317 Cr under the Pradhan Mantri Awas Yojana – Credit Linked Subsidy Scheme.

Microfinance – the microfinance business continued its steady growth, with the loan assets crossing a

milestone of `1,000 Crore during the quarter. Loan AUM stood at `1,111 Cr at the end of the quarter, up by 32% q-o-q. The MFI customer base increased to over 5,00,000 customers and branch network grew to 259 branches.

Commercial vehicle loans and Gold loans recorded strong growth as well.

85% of our loans are retail in nature and 43% are PSL compliant. The securitized loan book currently at`5,284 Cr is 16% of AUM. There exists significant opportunity for securitization, which will positively impact profitability and CAR.

Asset quality remains sound with GNPA of 2.0% and NNPA of 0.9% as on June 30, 2018. With implementation of Expected Credit Loss under IndAS, specific provision coverage on NPAs stands at 57%

IIFL Finance has long-term credit rating by CRISIL AA/Stable, [ICRA] AA (Stable), CARE AA (Positive).

Capital adequacy: Total CAR stood at 19.0% including Tier I capital of 15.9% as at June 30, 2018, as against statutory requirement of 15%.

Wealth and Asset Management operations

IIFL Wealth Management is the leading wealth management company in India. The company has catapulted itself to become the largest private wealth management firm in India in less than a decade since its inception. Headquartered in Mumbai, IIFL Wealth has close to 900 employees and presence in 9 major global financial hubs spread across 23 locations in India and around the world.

The company’s total assets under management, distribution and advice witnessed 25% y-o-y growth to

reach `1, 40,898Cr in Q1FY19. The PAT was at `110 Cr, up 26% y-o-y.

IIFL Wealth Finance, a wholly-owned

NBFC subsidiary of IIFL Wealth focused on providing loan against securities to wealth clients had a loan book of `5,611 Cr as at June 2018, up 31% y-o-y.

Capital Market and others.

IIFL is a key player in both retail and institutional segments of the capital market, and category I merchant banker. We have close to 1,300 service locations comprising a wide branch and sub-broker network and providing unparalleled research coverage on over 500 companies.

IIFL Capital Markets net profits for the quarter grew by 11% y-o-y to Rs53 Cr. During the quarter, the average daily market turnover for the broking business was `16,677 Cr, up 51% y-o-y with the cash market turnover at `1,215 Cr, up 9% y-o-y.

Our mobile trading app, ‘IIFL Markets’ continues to be the highest rated amongst peers (4.3) with over

19 lakh downloads. Mobile brokerage constituted about 34% of the total.

IIFL’s Mutual Fund App crossed 3.6 lakh downloads with a 4.3 star rating, and is steadily building on its customer base. The Mutual Fund app and website recorded 150% growth in new mutual fund customer acquisition.

Investment Banking: During the year, IIFL has completed 6 transactions across various products-IPO/QIP/Private Equity/Public issue of NCD; and continues to have a substantial pipeline of transactions which are at various stages of execution.

IIFL Finance issue of Masala Bonds to CDC Group

During the quarter, the Company’s subsidiary India Infoline Finance Ltd (‘IIFL Finance’) raised Rs 325 Cr

from CDC Group Plc (“CDC”), the United Kingdom’s Government-owned Development Finance Institution.

CDC, which has a minority equity stake in IIFL Finance, invested in the Rupee Denominated Tier – II qualifying subordinated bonds having a tenor of 10 years. CDC’s investment is aimed at helping IIFL Finance grow its loan book and address capital needs of the low income, under-served and largely self-employed segments of the society.

Appointment of CEO & Executive Director in IIFL Finance

India Infoline Finance Ltd appointed, with effect from June 25, 2018, Mr Sumit Bali as the Executive Director and Chief Executive Officer of the company.

Mr Bali holds a B.A (Hon) from St. Stephen’s college, New Delhi and has completed his PGDM from IIM Ahmedabad. Prior to his current role, Mr Bali spent 24 years with Kotak Group, with his last position at Kotak Mahindra Bank being Senior Executive Vice President overseeing consumer banking retailassets.

IIFL Wealth raises `746 Cr by way of equity issuance to institutional investors

IIFL Wealth Management Limited approved the issue of 5.1% equity to marquee financial investors:

Amansa, General Atlantic, HDFC Standard Life Insurance, Rimco, Steadview and Ward Ferry for a

consideration of `746 Cr. The transaction will provide IIFL Wealth with additional capital for its business

operations and for growth and expansion of business.

Group reorganization

The Board of Directors of the Company at its meeting held on 31 January 2018, had approved the Composite Scheme of Arrangement amongst the Company, India Infoline Media and Research Services

Limited (“IIFL M&R”), IIFL Securities Limited (“Formerly India Infoline Limited”), IIFL Wealth Management

Limited (“IIFL Wealth”), India Infoline Finance Limited (“IIFL Finance”), IIFL Distribution Services Limited

(“IIFL Distribution”), and their respective shareholders, under Sections 230 – 232 and other applicable provisions of the Companies Act, 2013.

The scheme has been filed with the exchanges, SEBI and other regulators for their approval. The regulatory approval process is under progress.

Awards and Accolades received in Q1FY19:

IIFL received “Best Customer Services Excellence in Financial Services” for the Category-Customer Service and Loyalty at the World Quality Congress and Awards 2018

IIFL Group co-promoter and Managing Director Mr R Venkataraman featured as the Best CEO in Business World listing for large category firms.

IIFL Home Finance awarded as the 2nd best performing Primary Lending Institution under Credit Linked Subsidy Scheme for EWS/LIG by Ministry of Housing and Urban Affairs

IIFL Wealth received the ‘World’s Best Private Banks 2018’ research award by Global Finance Magazine.

ENDS.