Mumbai, 14 May, 2019 (GPN) : BoardDirectors of Union Bank of India, today, approved the accounts of the Bank for

Mumbai, 14 May, 2019 (GPN) : BoardDirectors of Union Bank of India, today, approved the accounts of the Bank for

the quarter and Financial Year ended March 3 (1, 2019.

Key Highlights 2018-19

Cash Recovery & Upgradation 188.5% YoY

PCR 66.24% (up 908 bps YoY) Domestic Advances 7.8% YoY

CRAR 11.78% Net Interest Income 9.8% YoY

Business:

Global Business grew by 2.6 per cent to `741307 crore as on March 31, 2019 from

`722362 crore as on March 31, 2018. Domestic business grew by 4.7 per cent to `724031

crore as on March 31, 2019 from `691533 crore as on March 31, 2018.

Total deposit of the bank grew from `408502 crore as on March 31, 2018 to `415915

crore as on March 31, 2019 showing growth of 1.8 per cent.

CASA deposits increased by 7.8 per cent to `150141 crore as on March 31, 2019 from

`139241 crore as on March 31, 2018.

CASA share in total deposits increased to 36.1 per cent as on March 31, 2019 compared

to 34.1 per cent as on March 31, 2018.

Bank’s Global Advances grew by 3.7 per cent to `325392 crore as on March 31, 2019

from `313860 crore as on March 31, 2018.

Domestic Advances increased by 7.8 per cent to `310932 crore as on March 31, 2019

from `288336 crore as on March 31, 2018.

Financial Performance for the quarter ended March 2019:

Net Interest Income for January-March 2019 increased by 18.6 per cent to `2602 crore

from `2193 crore for January-March 2018.

Non Interest Income for January-March 2019 was sequentially up by 16.2 per cent to

`1272 crore from `1095 crore in October-December 2018.

Operating profit stood at `1730 crore for January-March 2019 as against `1810 crore for

October-December 2018.

Net loss for January-March 2019 stood at `3370 crore on account of higher provisioning.

Global NIM for January-March 2019 stood at 2.27 per cent as against 2.23 per cent for

October-December 2018. Domestic Net Interest Margin (NIM) stood at 2.38 per cent for

January-March 2019 as against 2.23 per cent for October-December 2018.

Return on average assets (annualised) stood at -2.71 per cent for January-March 2019.

Yield on funds improved to 6.72 per cent for January-March 2019 as against 6.43 per

cent for January-March 2018.

Cost of funds declined to 4.63 per cent for January-March 2019 as against 4.69 per cent

for January-March 2018.

Financial Performance for Financial Year ended March 2019:

Net Interest Income for FY 2018-19 up by 9.8 per cent on YoY basis to `10215 crore from

`9305 crore for FY 2017-18.

Non Interest Income stood at `4474 crore for FY 2018-19 as against `4990 crore for FY

2017-18.

Operating profit stood at `7521 crore for FY 2018-19 as against `7640 crore for FY 2017-

18.

Net loss for FY 2018-19 stood at `2948 crore as against net loss of `5247 crore for FY

2017-18.

Global NIM for FY 2018-19 improved to 2.23 per cent as against 2.07 per cent for FY

2017-18. Domestic Net Interest Margin (NIM) improved to 2.28 per cent for FY 2018-19

compared to 2.17 per cent for FY 2017-18.

Return on average assets (annualised) stood at -0.59 per cent for FY 2018-19 as against

-1.07 for FY 2017-18.

Return on equity (annualised) stood at -15.57 per cent in FY 2018-19.

Yield on funds improved to 6.85 per cent for FY 2018-19 as against 6.71 per cent for FY

2017-18.

Earnings per share (annualised) stood at `-25.08 for FY 2018-19.

Asset Quality:

Cash Recovery & Upgradation during FY 2018-19 increased by 188.5 per cent to `6447

crore as against `2235 crore during FY 2017-18.

Gross NPAs stood at 14.98 per cent as on March 31, 2019 as against 15.66 per cent as on

December 31, 2018 and 15.73 per cent as on March 31, 2018.

Net NPA ratio stood at 6.85 per cent as on March 31, 2019 as against 8.27 per cent as on

December 31, 2018 and 8.42 per cent as on March 31, 2018.

Provision Coverage Ratio improved to 66.24 per cent as on March 31, 2019 as against

57.16 per cent as on March 31, 2018. It was 58.84 per cent as on December 31, 2018.

Capital Adequacy:

Capital Adequacy Ratio of the Bank under Basel III improved to 11.78 per cent as on

March 31, 2019 as against 11.43 per cent as on December 31, 2018 compared to

minimum regulatory requirement of 10.875 per cent.

The Tier I ratio as of March 31, 2019 is 9.48 per cent, within which Common Equity Tier

1 ratio is 8.02 per cent compared to regulatory minimum of 7.375 per cent.

Digital Initiatives:

The Bank has launched a variety of new products in its 100th foundation year to enhance

the customer convenience and comfort. Following are some of the key products launched

during the FY 2018-19:

New Version of mobile Banking Application (U-Mobile): Bank has launched its new

version of Mobile Banking Application with enhanced features and functionalities. It is

all in one application through which the customer can avail a series of facilities

including opening/closure of Term and Recurring Deposit Accounts, balance inquiry,

mini statement, fund transfer, UPI, bill payment etc.

Combo Card: Combo Card is a 2-in-1 card that allows card holder to enjoy the

convenience, flexibility and freedom to choose in a single physical card for debit and

credit facility and the card holder need not to carry two cards.

National Common Mobility Card: This newly launched card variant is based on RuPay

qSPARC (Quick Specification for Payment Application of Rupay Chip) debit card

specifications to give shape to the Government’s initiative of National Common Mobility

Card (NCMC).

Contactless Visa Signature Debit Card: To offer Debit Card to privileged customers,

Visa Signature Contactless Debit card has been issued by the Bank wherein the customer

can use the card for contactless payment upto ` 2,000 per transaction per card.

Financial Inclusion:

Under the Pradhan Manrti Jan Dhan Yojana (PMJDY), the Bank has more than 98 lakh

accounts having a balance of `2404 crore as on March 31, 2019.

Total enrollment under Pradhan Mantri Suraksha Bima Yojana (PMSBY), Pradhan Mantri

Jeevan Jyoti Bima Yojana (PMJJBY) and Atal Pension Yojana (APY) increased to 38.6

lakh, 14.8 lakh and 4.9 lakh respectively.

The Bank financed `4402 crore in 195996 accounts under Pradhan Mantri Mudra Yojana

with an outstanding balance of `3550 crore.

Network:

The Bank has 4291 branches as of March 31, 2019 including 3 overseas branches at Hong

Kong, DIFC (Dubai) and Sydney (Australia). In addition, the Bank has representative

office at Abu Dhabi. The Bank also operates in United Kingdom through its wholly owned

subsidiary, Union Bank of India (UK) Ltd.

Total number of ATMs stood at 12236 including 5586 micro ATMs & 4483 talking ATMs as

of March 31, 2019. ATM to branch ratio stood at 2.9.

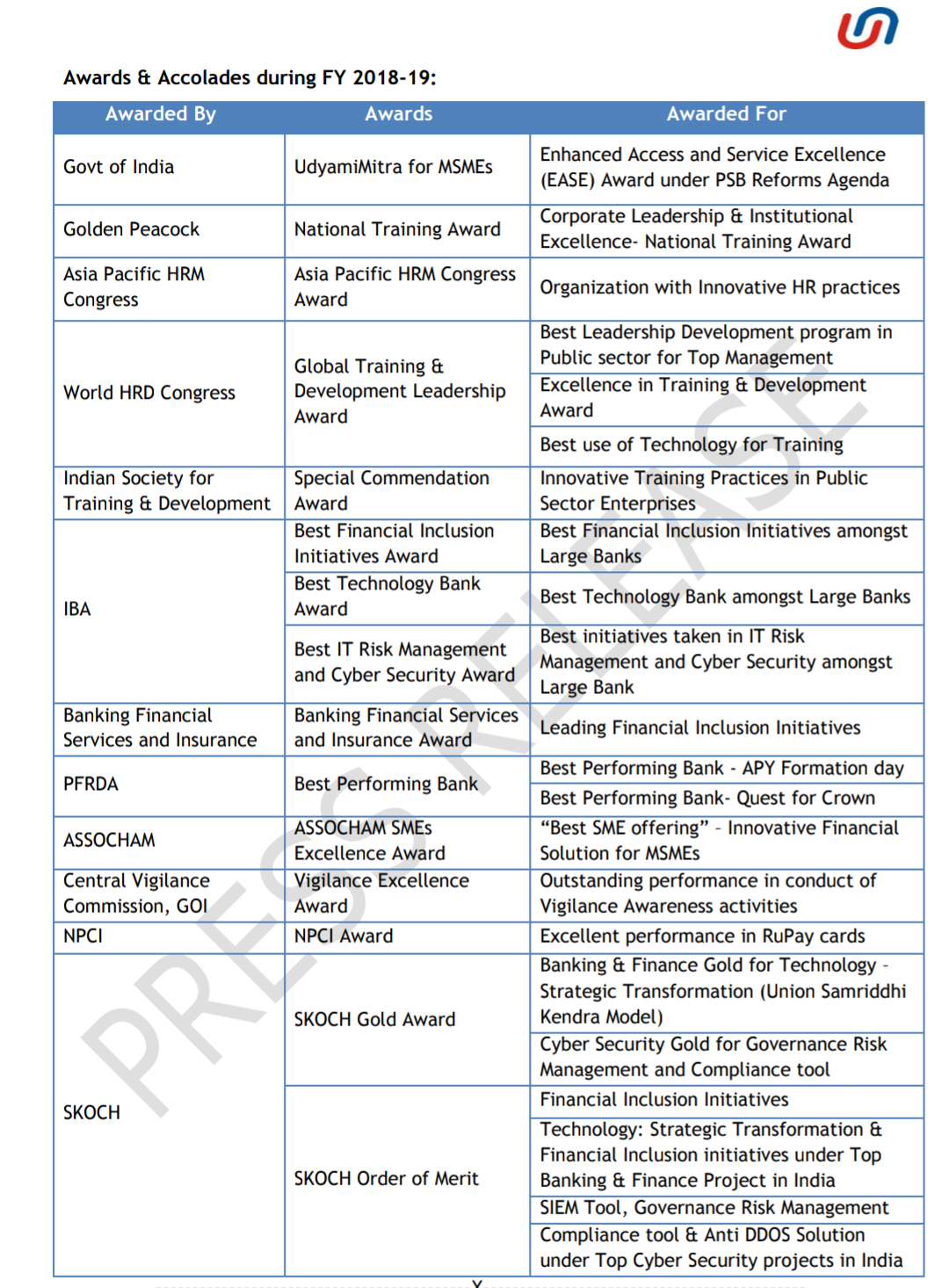

Awards & Accolades during FY 2018-19:

——————————————-X——————————————–

Date: 14

th May, 2019

Place: Mumbai