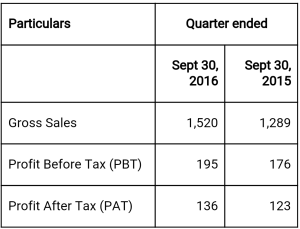

» Revenue of Rs. 1,520 crore

» PBT of Rs. 195 crore

» PAT of Rs. 136 crore

Hyderabad, India – November 7, 2016: Amara Raja Batteries Limited, India’s leading Industrial and Automotive Battery major (BSE: 500008 & NSE Code: AMARAJABAT) today reported Gross sales (excluding other income) of Rs. 1,520 crore in Q2 FY17 (Rs. 1,289 crore) a 18% growth and Profit after Tax (PAT) of Rs. 136 crore (Rs. 123 crore) a 11% growth.

For the quarter ended September 30, 2016

Rs. in crores

The Automotive battery business continued to maintain the growth trend. A double digit growth in our aftermarket brands, Amaron® and PowerZoneTM, led to further increase in market share. The impressive volume growth in two-wheeler batteries in both Amaron® and PowerZoneTM brands further added significantly to the performance of the business unit. During the quarter, OEM production grew in both four-wheeler and two Wheeler categories, thereby, aiding higher sale of batteries in the OEM sector. This helped us in further consolidating our market shares in this segment. Our key exports markets responded favourable, thereby, helping us show impressive growth in exports. All the above led us to have higher utilisation of plant capacities.

The Company’s Industrial Battery businessregistered double digit volume growth over Q2 of previous financial year, in a challenging & competitive market conditions. The industrial battery business improved the overall performance by virtue of its “preferred supplier status” with all major customers, efficient after sales service, customer relationship management, optimal product mix and consistent product performance of its flagship brands PowerStack®, Quanta® and QRS Series batteries.

Commenting on the Q2 performance, Mr. Jayadev Galla, Vice Chairman & Managing Director, Amara Raja Batteries Limited said, “ As the market place is beginning to become more exciting owing to both domestic and international developments, we are fully geared up to ensure all round improvements to bring about continuous betterment in operations and in the marketing activities. The automotive and industrial businesses are appropriately poised and the capacities are at optimum level of utilization with adequate capacities available to meet the growing demand in different sectors. The four and two wheeler battery expansion projects are progressing on expected lines.”

Commenting on the Q2 performance, Mr. S V Raghavendra, Chief Financial Officer, said, “Operational efficiencies have further improved during the quarter and we are continuing to increase focus on costs optimization in all areas to become cost competitive. Income tax incentives announced recently for Chittoor district, where our capacity expansions are in progress, will result in cash accruals. The Company continues to have healthy liquidity position and the expansion projects are progressing as planned.”